Click here to jump straight to today’s video.

No matter how healthy you try to be, at some point or another, we’ve all found ourselves in the drive-thru line at McDonald’s (MCD), Wendy’s (WEN), Taco Bell (YUM), or another of the American fast-food staples.

It’s one of those unavoidable experiences: having an empty fridge with zero energy and motivation in place to go grocery shopping or at 4:00 a.m. on the first leg of a family road trip, desperately looking for food when nothing seems open – until you round the corner and see those big golden arches glowing ahead like an oasis in the desert.

We’ve all been there.

And no matter which of those restaurants you end up at, you can pretty much guarantee they’re offering some sort of splashy new junk food for a limited time only – like at the McDonald’s in my hometown of Louisville, where you can grab a Krispy Kreme donut with your Big Mac.

That’s no coincidence: Fast-food companies are in a never-ending rivalry to put out the most enticing menu items they can think of to get Americans lining up at their drive thru instead of the one across the street.

Just last week, I noticed breakfast tacos on the Dunkin’ menu board.

McDonald’s recently upped its spring menu with ice-cold lemonade. And not to be outdone, Wendy’s launched blueberry pomegranate lemonade along with a new grilled chicken ranch wrap.

Fast food is already a go-to option for many Americans but especially now in this “trade-down” economy, where consumers faced with sky-high food prices and persistent inflation are forced to make strategic purchasing decisions that often mean “trading down” to more affordable menu items or brands.

LikeFolio Social Media Buzz 💬

Consumer mentions expressing concern about food prices or the inability to afford groceries are up +41% YoY.

Consumer mentions expressing fear, uncertainty, and concern about inflation are up +29% YoY.

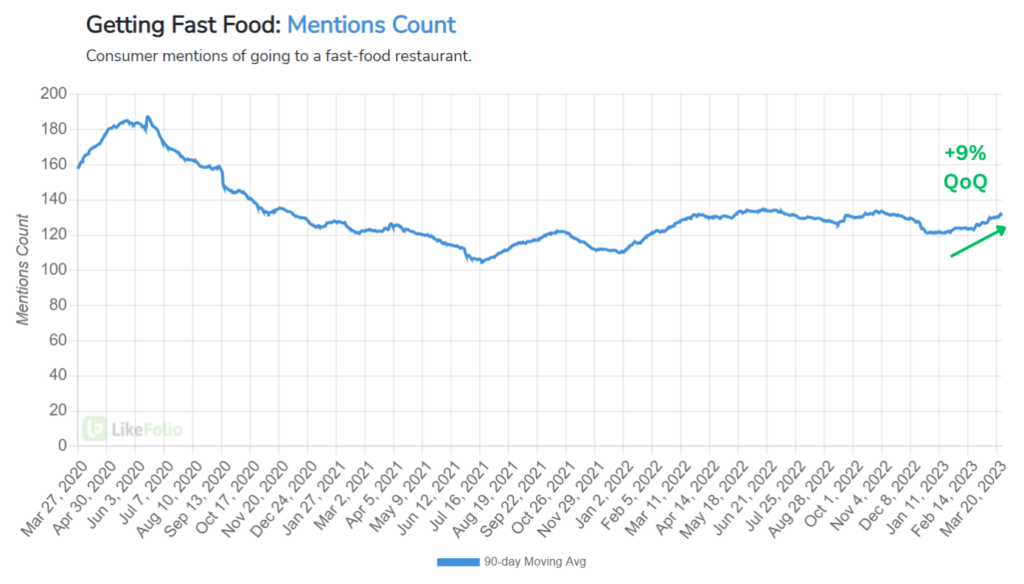

And with a reputation for cheap eats, quick service, and consistency above all else, our data shows consumer mentions of grabbing a bite at a fast-food restaurant trending 9% higher this quarter:

But while consumers have hundreds of drive thru options to choose from, when it comes to investment opportunities, there’s one fast-food icon that stands above the rest.

It’s a burger-slinging joint that saw 10% sales growth in 2022, thanks in part to its mobile app being downloaded 40 million times. In fact, our social media machine has picked up a 20% year-over-year (YoY) increase in mentions of using this iconic brand’s app to take advantage of loyalty rewards.

So to talk about the opportunity for investors we see with this fast-food icon, I recently joined my good friends over at TD Ameritrade for a live segment. (As a TD Ameritrade alum, you’ll often see me joining their crew to share the latest LikeFolio consumer insights.)

And with this fast-food joint’s next earnings report slated for April, I wanted to make sure all our Derby City Daily readers were able to access this six-minute video report today – before the trading opportunities kick off in earnest.

Because this is one fast-food name you’ll want to have on your moneymaking watchlist.

Watch now:

The next earnings season kicks off in a matter of weeks, at which time you’ll have a 10-week window that’s open season on making money.

Tomorrow, I’ll have a way that you can get in on the profit party. Stay tuned.

Until then,

Andy Swan

Co-Founder