You’re invited! Access your special invitation to join Andy and Landon on Tuesday (April 4) for their live earnings season kickoff event, where they’ll dish their most profitable trading secrets. Click here to RSVP today.

I know it’s officially “spring break” when the traffic around Muhammad Ali International Airport here in Louisville, Kentucky becomes unbearable.

This year, we’re bracing for a record-breaking week of travel – and we’re not alone.

Across the U.S., record numbers of folks are itching to visit their families, go on holiday, fly somewhere warm – anything to take advantage of the 2023 spring break season and make up for the years stuck at home during the pandemic.

We’re talking 2.6 million passengers making their way to fresh scenery this year, a number exceeding even the pre-COVID levels of 2019.

But the solace in dealing with all that traffic is a connected investable opportunity, which I’ll share in just a minute…

Consumers prioritizing travel is a persistent trend we’ve been tracking in Derby City Daily. And this travel boost has created a ripple effect throughout other sectors that are now seeing a boost.

Because before they head out, travelers need clothes to wear, purses to carry, and beauty products to look and feel their best.

I’m not speaking anecdotally: I know that because our social media machine doesn’t just crunch the numbers – it tells me in real time when chatter around specific brands and/or companies starts to spike so we can act fast when we see an opportunity.

And when these three companies triggered our high-volume detector this week, they caught our eye as potential “surprise” opportunities that the market may not even see coming…

Spring Break Surprise No. 1: American Eagle Outfitters (AEO)

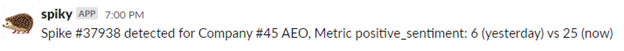

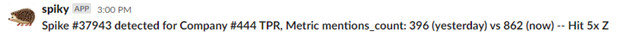

Whenever our database picks up a significant spike in social media mentions for a specific company or brand, our app named “spiky” alerts us instantly.

And this week, it let us know that positive sentiment mentions around apparel retailer American Eagle Outfitters (AEO) popped 5% higher on a year-over-year (YoY) basis.

(Talk about an “edge,” right? And we’ll put it to good use during earnings season to make the kind of get in, get out, get paid trades that we’ll brief you on this Tuesday during our live kickoff event. But you have to let us know you’re coming so we can reserve your seat… RSVP here.)

Consumers are raving about a new beauty collaboration with Elf Beauty (ELF) that launched this week, geared toward a Gen Z consumer base that made turned “washed denim” into a viral beauty craze on TikTok:

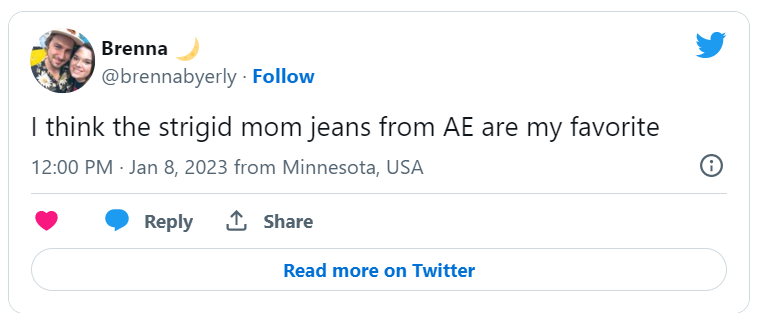

American Eagle’s top product mention on social media is denim, so this creative collab certainly taps into what consumers love most about the retailer.

Its on-trend denim style – most recently its “Strigid” mom jeans – are keeping consumers engaged.

Our Consumer Happiness metric tends to be the most forward-looking indicator of future demand, so from here, we’ll be monitoring AEO for a Purchase Intent boost.

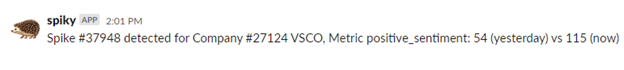

Spring Break Surprise No. 2: Victoria’s Secret (VSCO)

Often found directly across from each other at your local mall, it makes sense that Victoria’s Secret (VSCO) would get a boost right alongside American Eagle.

Spiky picked up a notable 5% positive sentiment boost for the fashion retailer this week, too.

The company knows its audience well and timed a digital sale just as Spring Break travel takes off.

And since our data give us an x-ray view into web traffic, we can confirm this sale IS gaining traction among consumers – enough to register a 13% bump in web visits to victoriassecret.com:

Between this increase in digital traffic and its rising Consumer Happiness levels, we’re seeing positive signs from a brand undergoing a major rebirth.

Spring Break Surprise No. 3: Tapestry (TPR)

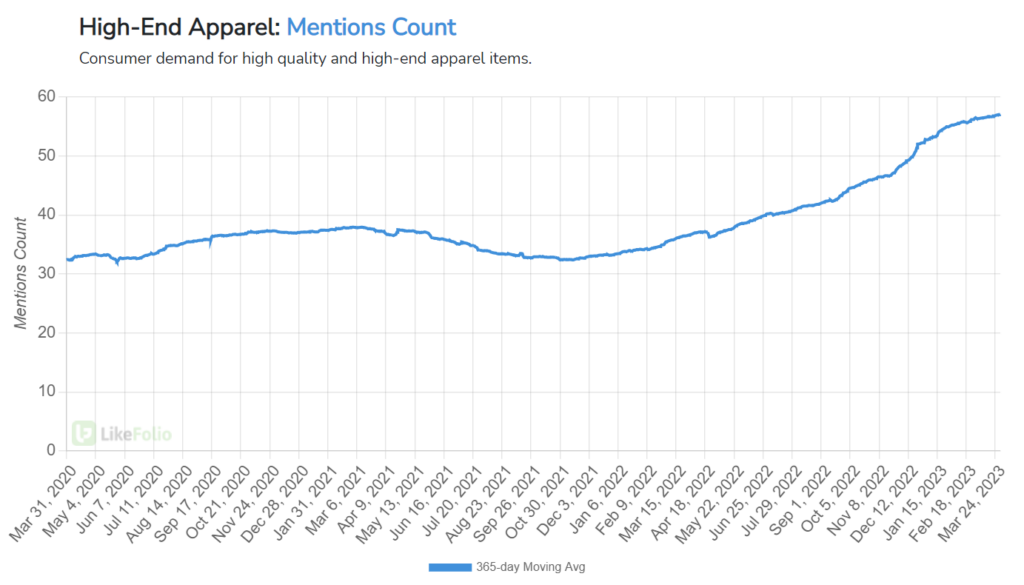

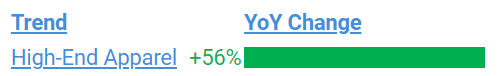

But the most significant boost we saw this week came from Tapestry (TPR), the parent company of well-known luxury brands Kate Spade and Coach – which actually makes sense considering the macro trends we’ve been tracking.

Of the three names triggering spiky, Tapestry is the only luxury retailer of the bunch. And as we know, demand for high-end apparel is proving extremely resilient under inflationary economic conditions:

Tapestry’s recent buzz bump is driven by Coach’s strategic alignment with a rising star in the hip-hop world, Doechii:

Along with engaging a young, hip audience through social media influencers, Coach is also rolling out nostalgic items for millennial consumers who have only gained spending power with age.

Key Takeaways on These “Spring Break Surprises”

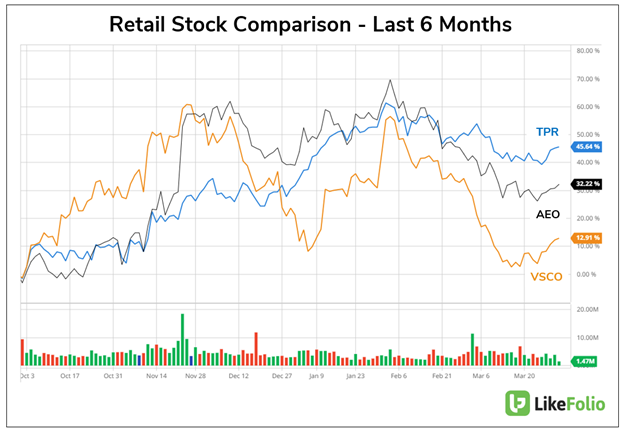

Digging into the numbers, we can see shares for each of these three retailers gaining ground over the last six months:

Our data supports continued outperformance from TPR thanks to Tapestry’s high-end status and positive consumer traction.

But we’ll also be watching for a continued spark for AEO and VSCO, with both brands potentially presenting a longer-term opportunity – if these Consumer Happiness improvements can translate to improved demand.

Until next time,

Andy Swan

Co-Founder