Donald Trump’s return to office unleashed the bulls – but the post-election euphoria was short-lived as tariffs introduced an unwelcome wild card into the markets.

Deregulation promises made on the campaign trail and pro-business policies sent cryptocurrencies, tech stocks like Tesla (TSLA), and financial players soaring in December.

Now, tariffs are threatening to drive up the cost of goods and services, disrupt supply chains, undercut demand and revenues for companies relying on foreign products or materials, and unleash global economic uncertainty.

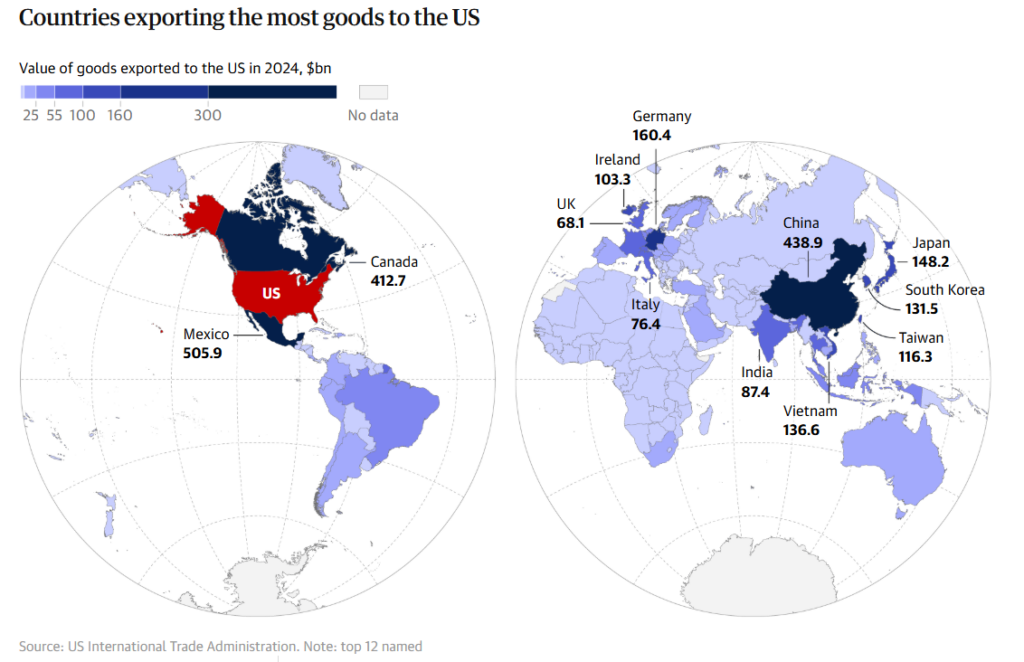

Already, February and March have seen a flurry of tariff announcements aimed at the U.S.’s three largest trade partners – Canada, Mexico, and China. Together, these three countries made up 43% of the $3.1 trillion in U.S.-imported goods in 2023.

Everyday Americans Are Bracing for Impact

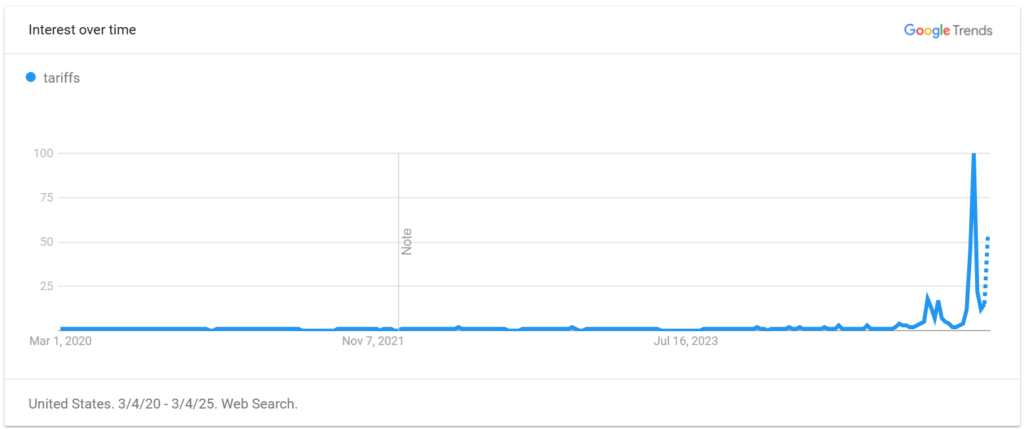

Last month, consumer sentiment took its largest hit in four years, tumbling 10% to a seven-month low. Meanwhile, Main Street interest in tariffs and their potential impact on the economy and price of goods is trending at five-year highs.

Investors are scared, too. TradeSmith’s Fear & Greed Index has plummeted into fear territory – a sharp reversal from the Extreme Greed experienced this time last year.

Major retailers riding high on strong holiday sales are now readjusting their profit outlooks for 2025, with Walmart (WMT), Target (TGT), and Best Buy (BBY), among the latest to issue tariff warnings.

“While Best Buy only directly imports 2% to 3% of our overall assortment, we expect our vendors across our entire assortment will pass along some level of tariff costs to retailers, making price increases for American consumers highly likely,” CEO Corie Barry noted on Best Buy’s earnings call this morning.

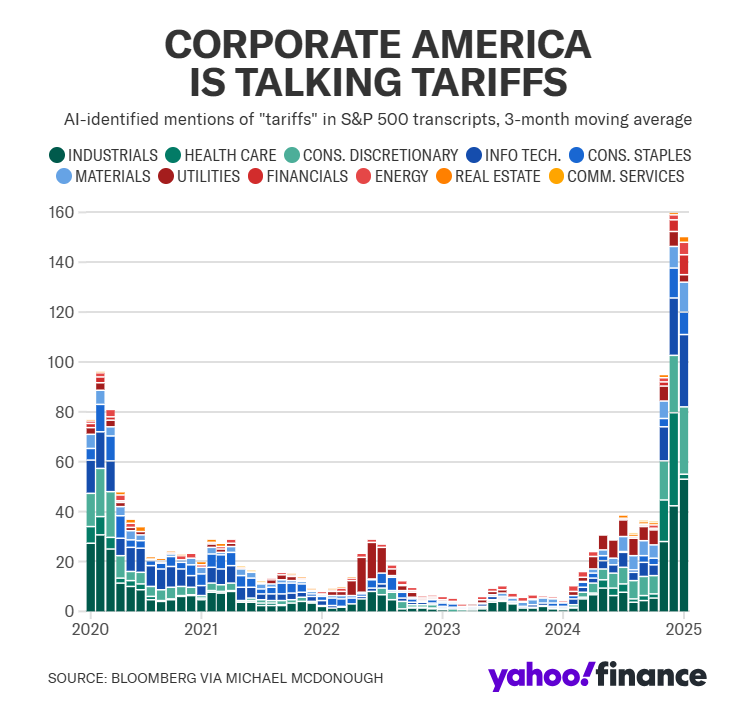

And they’re not the only ones voicing concerns. Tariffs have been a dominant talking point on S&P 500 earnings calls over the last three months.

Tariff Turmoil: What We Know – and What We Don’t

While many tariff plans are now public, the full impact on the economy remains to be seen. Here’s what we know so far.

A 25% tariff on imports from Canada and Mexico went into effect today. The previously announced 10% tariff on Chinese goods, set for April, escalated overnight as Trump doubled down with another 10%.

Retaliatory measures have been swift and painful. Canadian Prime Minister Justin Trudeau snapped back with a 25% tariff on $100 billion worth of imported U.S. goods, targeting American-made alcohol, clothing, and household appliances, among others. Mexico promised to announce its own reciprocal tariffs this coming Sunday.

China responded with a 15% tariff on U.S. coal and liquified natural gas and a 10% tariff on crude oil and agricultural machinery. Now, it too is doubling down with another round of tariffs on U.S. agricultural staples including chicken, wheat, corn, and dairy, targeted trade restrictions on U.S. defense companies such as drone makers Leidos (LDOS) and AeroVironment (AVAV), and blacklisting U.S. brands like PVH Corp. (PVH), known for consumer favorite brands like Tommy Hilfiger and Calvin Klein.

Consumers will be among the first in line to feel the effects. The Tax Foundation projects Trump’s tariffs could cost American households an extra $1,000 this year.

While uncertainty looms over tariff implementation, investors can still find opportunities in more insulated names.

Today, we’ll show you one “tariff-proof” stock that could help your portfolio weather the storm…

A Top “Tariff-Proof” Portfolio Pick

Despite the macroeconomic pressures on household budgets, consumers proved they’re willing to pay a premium for convenient, quality at-home entertainment.

Streaming subscription prices rose nearly 13% in 2024, outpacing general inflation by 3.5x.

Yet Netflix (NFLX) had its best year yet.

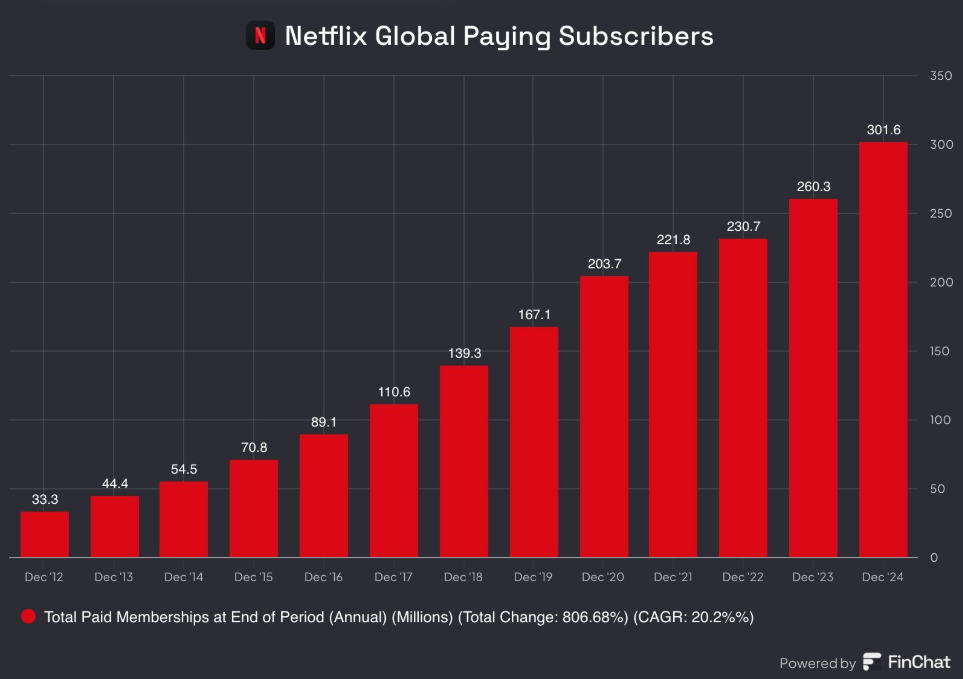

The undisputed streaming king added 41.3 million paid subscribers to bolster its lead over Amazon Prime Video’s (AMZN) 180 million subscribers and Disney+ (DIS), which lost subscribers last quarter.

Its lower-priced ad plan won over budget-minded consumers, accounting for 55% of new sign-ups, driving global paid subscribers beyond 300 million.

How’d Netflix do it? With a bold bet on live sports – and focus on top-notch content.

Consumers Pony Up for Quality Content

Netflix’s $150 million deal to broadcast two Christmas Day NFL games paid off, boosting subscription growth 19% in December. It aired the most streamed sporting event in history with the mega-hyped Tyson-Paul boxing match, which drew in the most signups in three years.

Netflix will go after more blockbuster sporting events in 2025, with WWE Raw debuting in January and Christmas NFL games set to make a comeback in December.

Digital advertising dollars are likely to shift toward Netflix as live events including sports become a bigger part of the expansion strategy.

The company is also flexing its muscles with award-winning content, proving it can go toe-to-toe with major industry players like Universal Studios and Walt Disney.

Netflix topped all film studios with 16 Academy Awards nominations, 13 of which went to musical drama Emilia Pérez, including one for Best Picture. On Sunday, the platform took home three Oscars wins: Emilia Pérez secured Best Actress in a Leading Role and Best Music (Original Song) and The Only Girl in the Orchestra earned Best Documentary Short Film.

A Safe Bet in an Uncertain Market

With discretionary spending pressures building, 2025 may see a greater emphasis on streaming video value.

Media companies like Netflix that offer a range of price points, bundling services, and loyalty rewards may be best positioned to achieve above-industry subscriber gains and revenue growth.

Netflix makes an especially attractive bet as tariff fears take hold.

Since it primarily delivers digital content, the company has a reduced dependence on physical goods and international supply chains. Its film and TV studio does have some international projects, but content production is largely U.S.-based, keeping NFLX relatively insulated.

Bottom line: Investors looking to navigate macroeconomic uncertainty should consider adding NFLX to their roster for 2025.

Until next time,

Andy Swan

Founder, LikeFolio

Publisher’s Note: Important Changes Coming for Derby City Daily Readers

This week marks the end of an era – and an exciting new beginning. On Friday, March 7, you’ll receive our last issue of Derby City Daily. But don’t worry. We’re not going anywhere. LikeFolio is officially teaming up with our good friends at TradeSmith to bring you the same profit-packed consumer insights, but with a more streamlined delivery. Instead of receiving LikeFolio coverage here, you’ll now see our free insights – and much more – in a comprehensive, seven-day-a-week (and then some) investor e-letter called TradeSmith Daily.

No need to wait – you can start getting TradeSmith Daily delivered to your inbox immediately by clicking here now.

Many of you know TradeSmith CEO Keith Kaplan well already. He’s a champion of the retail investor – a family man who, like many of us, set out on his investing journey 25 years ago to create a better life for himself and his family… and like many of us, suffered through the inevitable highs, lows, and extreme volatility of the market. Unsatisfied with the frustrating lack of tools available at the time, he joined TradeSmith to create cutting-edge software for the everyday investor.

In TradeSmith Daily, Keith – along with his editor, Michael Salvatore, and a powerhouse team of analysts (Swans included) – use TradeSmith’s best-in-class tools to find the top market opportunities the pundits miss. Once you’re on the list (click here to join), you’ll get a new issue every single day – seven days a week – at 8:15 a.m. ET.

If you’re already a TradeSmith Daily subscriber, there’s nothing you need to do – you’ll start seeing LikeFolio’s insights from the same Andy Swan you know and love in TradeSmith Daily every week.

If you’re not yet a subscriber, click here to join the list now – it’s completely free – and add [email protected] to your contact list so every email comes straight to your inbox.

We appreciate your readership and look forward to keeping you informed through TradeSmith Daily!

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Opportunity Over Fear: 3 Picks to Harness the Market Chaos

This was another tough week for investors. But there’s opportunity in the chaos, if you know where to find it…

How to Play Rising Volatility in the Fast-Casual Sector

Fast-casual stocks are on a wild ride in 2025. Here are two picks that let you play along for profits…