Tariffs on Mexican imports are about to rock the beer industry.

With President Donald Trump’s 25% tariff on Mexican imports set to take effect yesterday, and upwards of 80% of U.S. beer imports coming from our neighbor to the south, alcohol industry giants are now grappling with a stark reality:

Rising production costs and stunted demand.

That’s bad news for Constellation Brands (STZ), whose Mexican-brewed Modelo brand rose to the top of the rankings in 2023 to become the best-selling beer in America.

It’s not just Modelo that’s about to become more expensive, either. About 99% of Constellation’s beers are brewed in Mexico.

The beverage giant spent north of $900 million on Mexico manufacturing in fiscal year 2024 to build out its Veracruz facility. The company has another $3 billion in spending planned through FY 2028.

The takeaway: Constellation faces a dire situation. Another brewer, however, finds itself in prime position to capitalize on its competitor’s woes…

TAP: A Home-Brewed Profit Opportunity

Molson Coors Beverage Company (TAP) has made all the right moves to prepare for this moment.

The company is aggressively expanding its above-premium portfolio to align itself with increasing consumer demand for higher quality beverages.

Its diversified beer lineup consists of core “power brands” like Coors Light, Miller Lite, and Molson Canadian, premium brands such as Blue Moon and Leinenkugel’s, and value brands like Keystone.

And its November 2024 buyout of Cruz Blanca, the Mexican-inspired craft beer brand based out of Chicago, now looks like a huge opportunity in light of the 25% tariff on Mexican imports that went into effect yesterday.

With American-made Cruz Blanca under its belt, Coors is well prepared to steal market share from rival Constellation Brands’ popular Modelo, Pacifico, and Corona brands at just the right time.

The American-Made Advantage

Molson Coors has been busy expanding its North American footprint to support long-term growth.

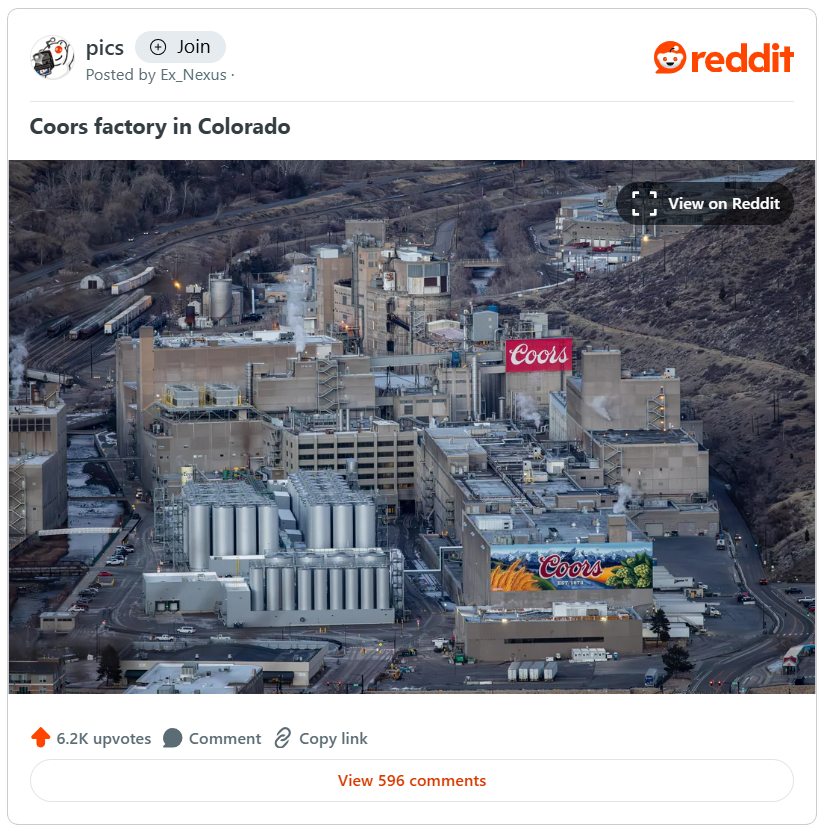

It recently completed a multi-hundred-million-dollar “G150” project to modernize its iconic Golden, Colorado brewery – the largest in the nation – adding a new brew house, vertical tanks, and a packaging line in a facility that’s nearly three football fields long.

Because TAP operates breweries in the U.S. and Canada and sources ingredients from North America, it’s more insulated from tariff pressures than its big international competitors like Constellation, Belgium-based Anheuser-Busch InBev (BUD), Brazil-based Ambev (ABEV), and Netherlands-based Heineken.

Plus, Coors’ newfound edge comes as the company TAPs into a lucrative $40 billion trend…

TAPping Into the Non-Alcoholic Beer Boom

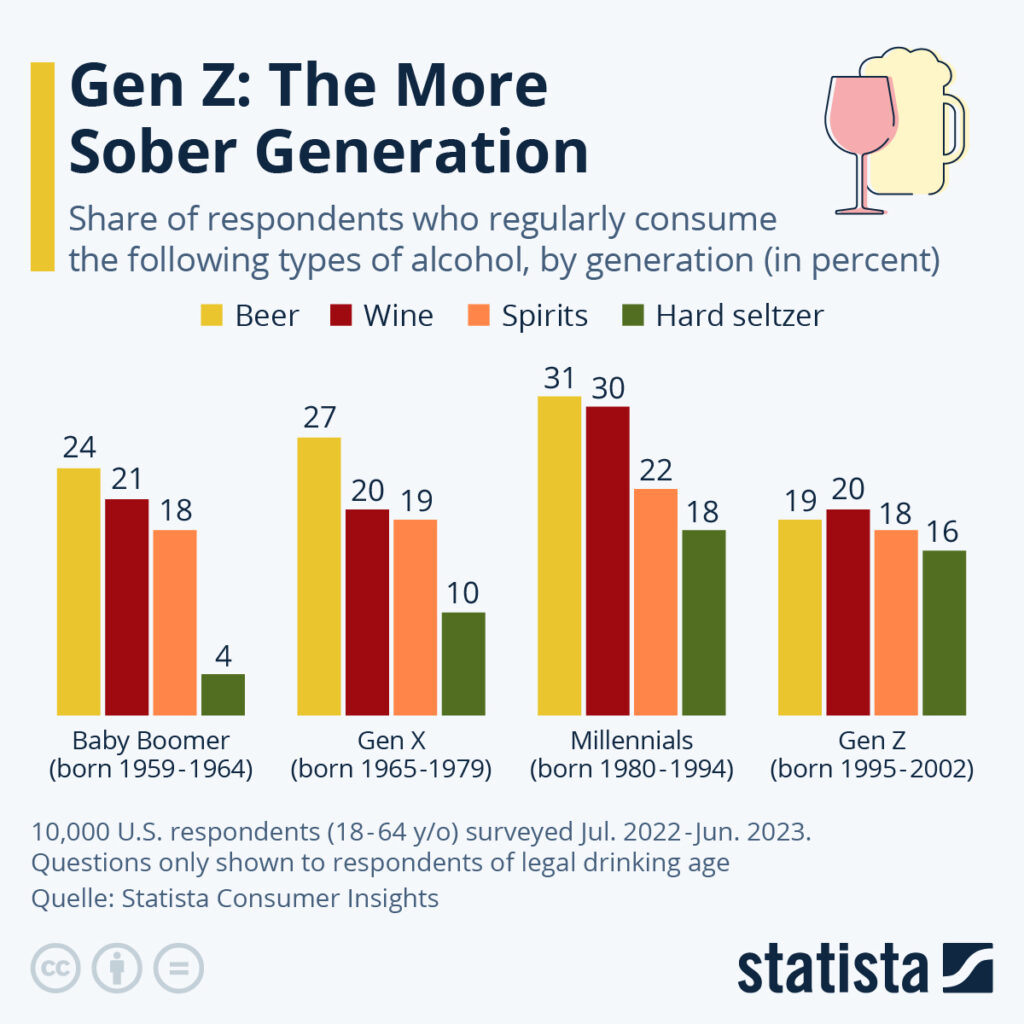

We started tracking the rising popularity of non-alcoholic beer in 2023 as increased awareness around the risks of alcohol use influenced younger generations to drink less booze than their predecessors.

It proved to be much more than a fleeting trend. The rate of imbibing among adults aged 18 to 34 is down 10% over the last two decades, according to a 2023 Gallup poll, with Gen Z leading the charge.

Brewers like Coors are rapidly adapting to this new reality by rolling out innovative and flavorful NA beer options.

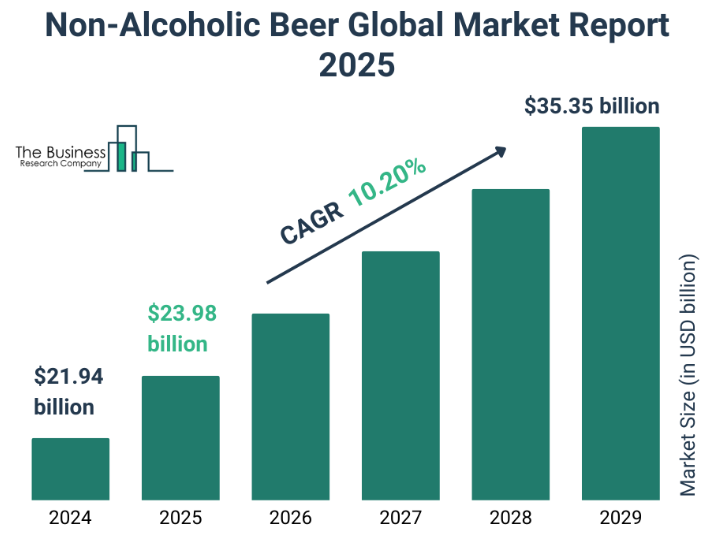

And consumers are drinking them up: Non-alcoholic beer sales in the U.S. exploded 30% year over year through the first 10 months of 2024.

This segment is now on track to double the size of the craft beer market by 2032, with estimates suggesting the NA beer industry could soar to a whopping $40 billion.

Molson Coors’ non-alcoholic beer offerings include Coors Edge, Blue Moon Non-Alcoholic, and Peroni 0.0.

Today, the company is expanding its “Beyond Beer” portfolio with strategic partnerships, including:

- Naked Life, Australia’s top-selling non-alcoholic ready-to-drink (RTD) cocktail, with plans to launch options like Mojito and Negroni Spritz in the U.S. starting this month.

- Fever-Tree, the world’s leading supplier of premium carbonated mixers for alcoholic spirits, acquiring an 8.5% stake and exclusive U.S. marketing rights.

- ZOA Energy, the better-for-you energy drink brand from WWE icon-turned-actor Dwayne “The Rock” Johnson, taking a majority ownership stake.

TAP Web Visits Are Bubbling Higher

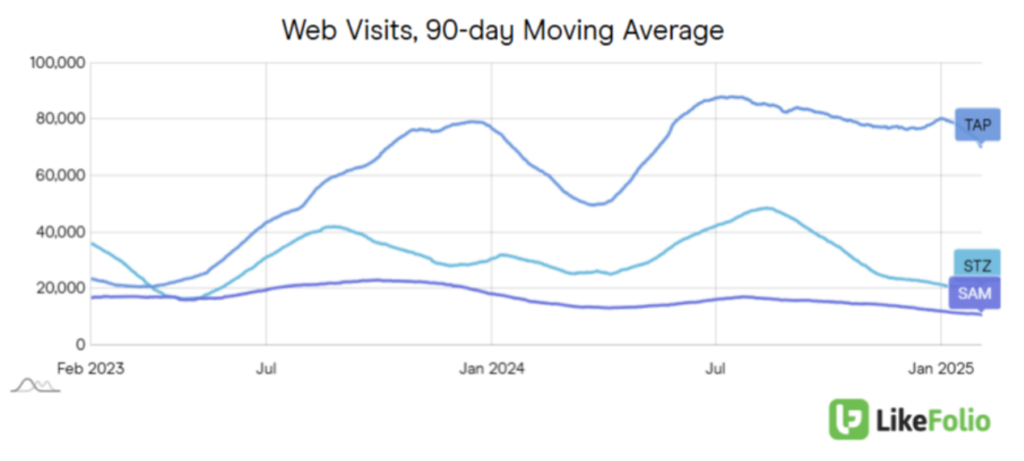

LikeFolio’s social media insights reveal consumers are discovering – and loving – Coors’ expanding lineup of differentiated beer brands and non-beer beverages.

TAP web traffic has tripled over the past two years, while visits to rivals Constellation Brands and Samuel Adams (SAM) websites have declined…

…signaling that a major uplift in the Coors brand following the infamous Bud Light controversy is persisting.

Bottom line: While Trump tariffs create uncertainty in the market at large, there are always opportunities to be found in individual stocks assets. And with Constellation’s Mexican-made beer brands in trouble, LikeFolio’s insights reveal there’s a new opening for TAP to rise to the top.

I’ll cheers to that!

For more insights and opportunities to help you get through this messy market, check out yesterday’s issue of Derby City Daily for another top tariff-proof portfolio pick, and our special report from Friday highlighting three accumulation opportunities in this volatile market.

While we dig into LikeFolio’s consumer insights, our friends over at TradeSmith are digging into their own cutting-edge tools to help TradeSmith Daily readers navigate the chaos.

In this morning’s (free) digest issue, editor Michael Salvatore breaks down why mid-cap names are a great value right now, shares 10 picks that recently triggered an entry signal based on TradeSmith’s Trade360 stock screener, and highlights an earnings opportunity straight from LikeFolio’s own Data Engine.

Check it out here to see for yourself the kind of quality content you’ll get access to as LikeFolio joins forces with TradeSmith Daily.

And if you haven’t done so yet, make sure you go here now to sign up to receive TradeSmith Daily in your inbox every morning. After Friday, that’s where you’ll find me.

Until next time,

Andy Swan

Founder, LikeFolio

Please Read: Important Changes Coming for Derby City Daily Readers

This week marks the end of an era – and an exciting new beginning. On Friday, March 7, you’ll receive our last issue of Derby City Daily. But don’t worry. We’re not going anywhere.

Effective immediately, LikeFolio has teamed up with our good friends at TradeSmith to bring you our same profit-packed consumer insights with a more streamlined delivery. Instead of receiving LikeFolio coverage here, you’ll now see our free insights – and much more – in TradeSmith’s free daily e-letter, TradeSmith Daily.

Click here now to register to receive tomorrow’s issue of TradeSmith Daily and grab their newest free report while you’re at it. (Because, why wait?)

In TradeSmith Daily, CEO Keith Kaplan, along with a powerhouse team of analysts, including Andy and Landon Swan, editor Michael Salvatore, Quantum-based investing expert Jason Bodner, Alpha Signals specialist Lucas Downey, and more – use TradeSmith’s best-in-class tools to find the top market opportunities the pundits miss.

Once you make sure you’re on the list (remember, it’s free), you’ll start receiving TradeSmith Daily all seven days a week at 8:15 a.m. ET.

If you’re already a TradeSmith Daily subscriber, there’s nothing you need to do but look for Andy and Landon Swan’s insights (and a whole lot more) in TradeSmith Daily every week.

If you’re not yet a subscriber, click here to join the list now. Then, add [email protected] to your contact list to ensure nothing gets caught in those pesky spam filters.

Thank you for being a loyal LikeFolio follower. The best is yet to come – and we look forward to keeping you informed through TradeSmith Daily!

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Tariff-Proof Your Portfolio with This Top Pick

While tariff uncertainty rocks the markets, investors can still find opportunities in more insulated names like this one…

Opportunity Over Fear: 3 Picks to Harness the Market Chaos

This was another tough week for investors. But there’s opportunity in the chaos, if you know where to find it…