We know Americans want electric vehicles (EVs): EV demand is currently up 44% from last year, according to LikeFolio data.

And Tesla (TSLA) is doing just about everything in its power to make sure its EVs are the top choice – including slashing its prices to make its luxury vehicles available to the masses.

The company kicked off 2023 with a massive 20% price cut on its EVs and has rolled out four additional price reductions since then.

CEO Elon Musk has made affordability his priority. And along with a robust team of 17 company leaders, outlined plans to make Tesla’s vehicles more affordable during the company’s Investor Day presentation last week, which will involve operational efficiencies that fundamentally change how vehicles are assembled and batteries are put together.

Musk explained a critical driver of these strategic decisions: “The desire for people to own a Tesla is extremely high. The limiting factor is their ability to pay for a Tesla. Not, do they want a Tesla.”

Folks want to drive a Tesla. And soon, they’ll be able to afford to.

The most recent price cuts came last week on two of its top-end models, the Model S and Model X.

Those models accounted for about 4% of Tesla’s deliveries in 2022, and execs believe this latest move could nudge buyers on the edge.

Still, Tesla’s share price is down 5% since its Investor Day announcement.

But while Wall Street may not be happy with the focus on affordability, we’re seeing another story form on Main Street – and it’s one that will keep you ahead of the investing curve…

Social Media Is Buzzing Over Tesla

LikeFolio’s special relationship with Twitter feeds us thousands of tweets per minute, so we can see in real-time just how big of an impact these cuts are having on Tesla’s social media buzz.

That’s how we know that on Main Street, Tesla’s affordability campaign is actually working.

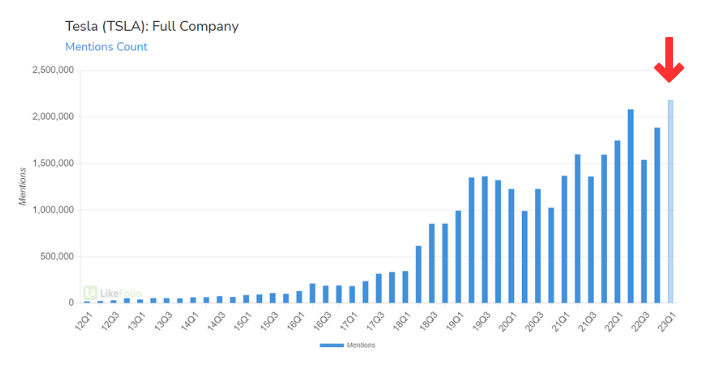

The sheer volume of Tesla social media mentions this quarter is on pace to reach its highest level ever recorded:

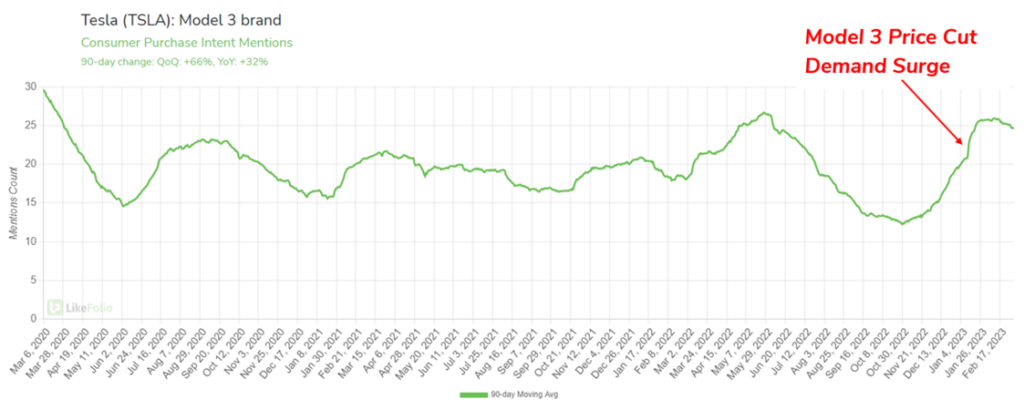

And we know Tesla’s previous price cuts worked like a charm in fanning the flames of consumer demand.

Purchase Intent (PI) Mentions surged for Model 3 sedans immediately after the January announcement that shaved 20% off the price:

Of course, the consensus you’ll hear from Wall Street is that more affordable prices will hurt Tesla’s bottom line.

But they don’t know what we do.

They can’t see the chatter on Main Street.

And that’s where you have an edge.

The Bottom Line 💰

The consumer demand metric we showed you, Purchase Intent, is predictive of real company sales – and that means the uptick we’re currently witnessing could be reflected in real dollars in Tesla’s next earnings report.

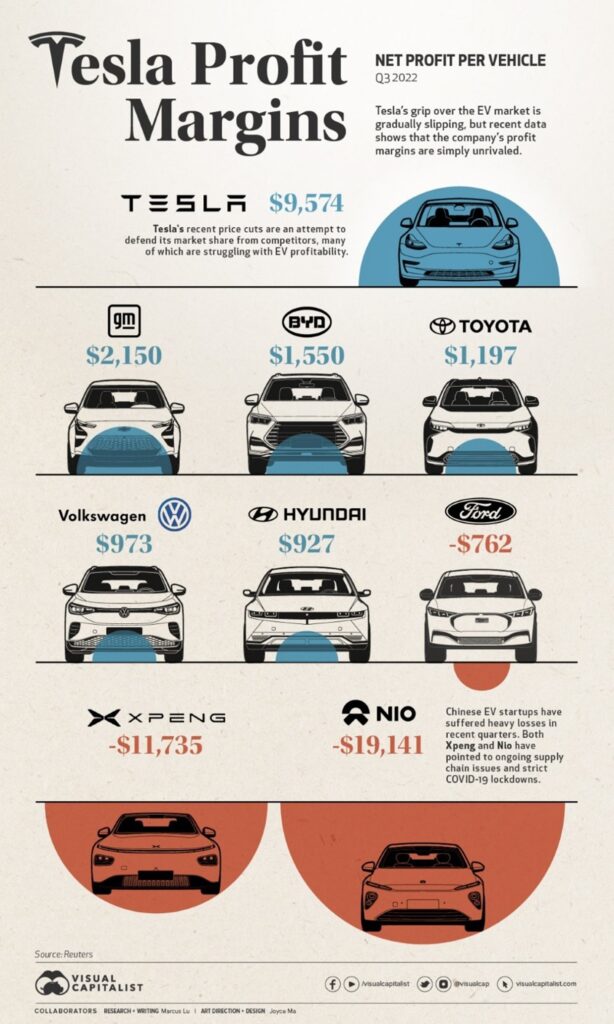

Tesla’s margins might drop, sure. But check out the chart below from Visual Capitalist, which shows just how significant of a leg up Tesla already had on its competitors when it comes to profit margins:

The increase in sales Tesla will get by making its vehicles more affordable should more than compensate in terms of its bottom line.

And if that wasn’t enough, there’s another big advantage keeping Tesla ahead of its competitors: Infrastructure.

We know Americans want electric vehicles. Remember LikeFolio data currently shows EV demand rising 44% year-over-year (YoY).

But with gas stations outnumbering charging stations three to one, that perceived lack of charging infrastructure has kept many of those folks from purchasing.

That’s why Tesla has made sure its Supercharger network is the largest in the world.

Its Superchargers currently account for roughly 60% of the fast-charging stations in America – and Musk has been a leading voice in the White House’s push toward EV adoption.

Looking ahead, we’ll be monitoring demand traction among consumers to see if it keeps up its current clip.

But early analysis suggests the move toward affordability will only boost consumer happiness and the likelihood of initial (and repeat) Tesla purchases.

Now that’s bullish.

Enjoy,

Andy Swan

Co-Founder, Derby City Daily