Up, Up, Down, Down, Left, Right, Left, Right, B, A, Start…

To most people, that’s nothing more than a random string of words. But to us ‘80s kids, that series of commands was the cheat code to winning “Contra,” one of the coolest video games of our childhood.

Contra (video game) 1987

byu/LIGHTNING-SUPERHERO innostalgia

This cheat code was a gamechanger for two boys between the ages of 8 to 12-ish, like Landon and I were back then.

It unlocked 30 lives instead of three – extending game play and giving you a leg up on your noob friends.

But the concept of a cheat code is also a great way to understand LikeFolio insights.

By leveraging consumer mentions on social media and actions on the web, LikeFolio can craft custom “cheat codes” for companies in our coverage universe.

These cheat codes – aka insights – give investors a major leg up on the market.

And during earnings season, these codes are our Earnings Scores.

The LikeFolio Earnings Score

The LikeFolio Earnings Score is a simple -100 to +100 metric that lets us know how bullish, bearish, or neutral we should be on a company’s earnings event.

It’s calculated from an ever-evolving equation that leverages artificial intelligence (AI) to factor in millions of individual data points, pulling from demand mentions, sentiment, web visits, macro trends, investor expectations, and more.

Negative scores are a bearish indication while positive scores are a bullish indication. The larger the number, the stronger the indication.

Inside the “Cheat Code” That Predicted Chewy’s Earnings Win

Take an example from last week’s Earnings Season Pass Scorecard: Chewy (CHWY).

This e-commerce pet supply go-to offers convenience and a unique customer experience. But it struggled to sustain high growth levels from a pandemic-era boom.

However, going into its August 28 earnings report, CHWY’s +71 Earnings Score was decidedly bullish – and informed by the cumulation of LikeFolio’s consumer-facing data points.

ChewyHealth.com Web Visits: Up 🔼

One key factor informing our bullish call was Chewy’s expansion into pet health care – which, according to LikeFolio consumer metrics, was driving fresh demand for the company.

With our x-ray view into company website data, we could see visits to ChewyHealth.com at record highs… and likely to deliver an earnings boost:

Chewy Overall Web Demand: Up 🔼

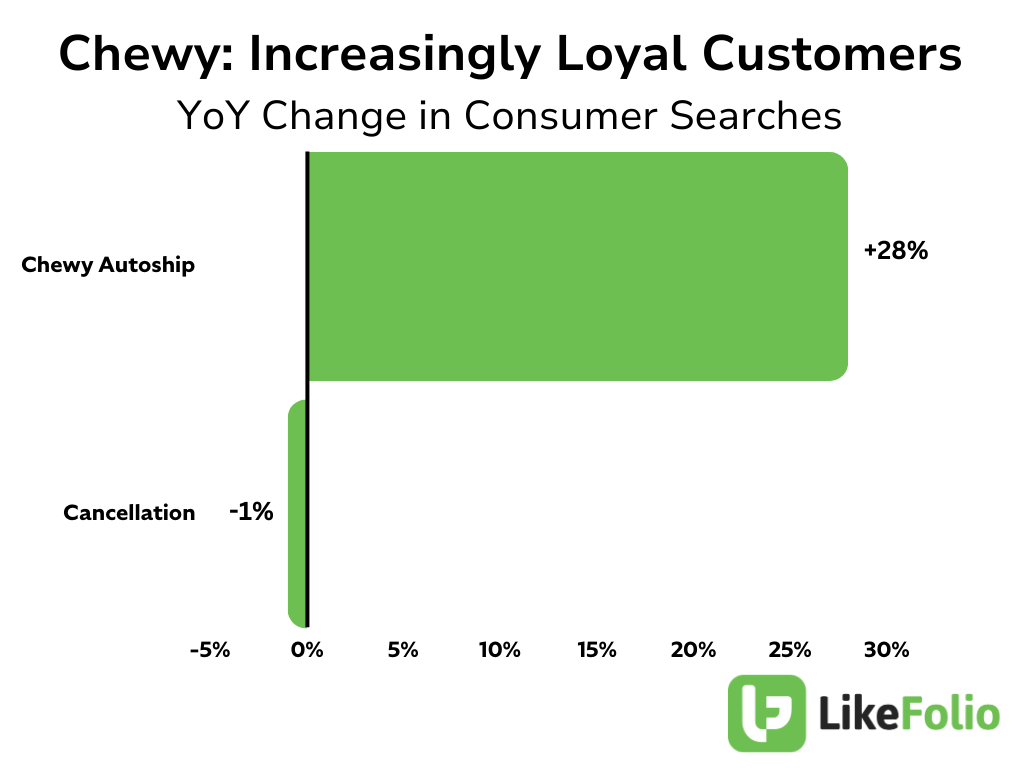

It wasn’t just Chewy Health gaining traction, either. With a bird’s-eye view into Chewy.com metrics, we knew Chewy was back in action after its post-pandemic slump. Overall web visits had pushed higher for five consecutive months, aided by the expansion of affordable health services for man’s best friend(s).

CHWY Consumer Happiness: Up ⏫⭐

At the same time our Data Engine is figuring out consumer demand, it’s also measuring sentiment – and whether social media posts from Chewy customers are positive or negative in nature. We call this Consumer Happiness. And for Chewy, this metric has proven particularly predictive of past earnings moves – as indicated by the star in CHWY’s “Happiness Growth” column on the Earnings Scorecard.

Our social data revealed increasingly positive sentiment from Chewy customers, even as overall mention volume increased, which is a rare feat in the LikeFolio Universe.

CHWY Short Interest: High 🔼

Heading into Chewy’s August 28 earnings report, we saw the stock garnering interest from meme-stock traders after the infamous Roaring Kitty revealed a stake in July. With short interest still elevated, and a new stock buyback plan potentially limiting CHWY’s near-term downside, we expected these market factors to keep the stock buoyed.

Our calculations on the backend carefully weigh each metric to expected revenue – a formula custom created for each company at hand.

The result was clear: Chewy was winning back customers who missed its convenience and superior service – and the company was poised to surpass Wall Street’s expectations.

We were right.

Chewy shares soared 7% on a great earnings report: Net sales per active customer grew to $565 from $532, driven by premium product lines and adoption of Chewy Health, which was a pillar of our bullish earnings call.

LikeFolio’s Earnings Score was the “cheat code” that secured us this win – and a perfect example of how we give investors an edge during earnings season.

This summer alone, our earnings “cheat codes” helped our members unlock dozens of winning trades, including:

- 104% on On Holding (ONON)

- 112% on CrowdStrike (CRWD)

- 113% on United Airlines (UAL)

- 115% on Whirlpool (WHR)

- And 288% on RH (RH)

…all of which had Earnings Season Pass subscribers cashing out their profits in five days or less.

Our childhood selves would be proud.

You can find out how to access our AI-powered earnings “cheat codes” for yourself right here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Add This Compelling “Value” Play to Your Watchlist

Here are five reasons why BJ is a top stock to watch right now…

What’s Next for NVDA After Its Earnings Stumble?

Here’s our new long-term outlook on the “most important stock in the world.”