At LikeFolio, we understand the singular power of the consumer better than most.

We know that consumer spending drives nearly 70% of everything that happens in our economy.

And when the majority of American consumers say they’re willing to pay up for a certain type of product, we don’t just listen – we dig into the data to uncover investment opportunities.

In the current consumer market, sustainability has become a top priority for younger generations when it comes to purchasing decisions.

Six in 10 folks belonging to the younger Gen Z and millennial generations are willing to pay a premium for sustainable products, according to Deloitte’s 2023 global survey.

Before you discount the spending power of 20-somethings, consider this: A 2021 Bloomberg report put Gen Z’s spending power at $360 billion. That number will only grow as more and more of them enter the workforce; in fact, this is the only slice of the workforce that is growing, with Gen Zers now surpassing Baby Boomers in the labor market.

Their eco-conscious shopping habits are rubbing off on us “older” generations, too. Compared to two years ago, Gen X’s willingness to shell out for sustainable products has increased by 42%.

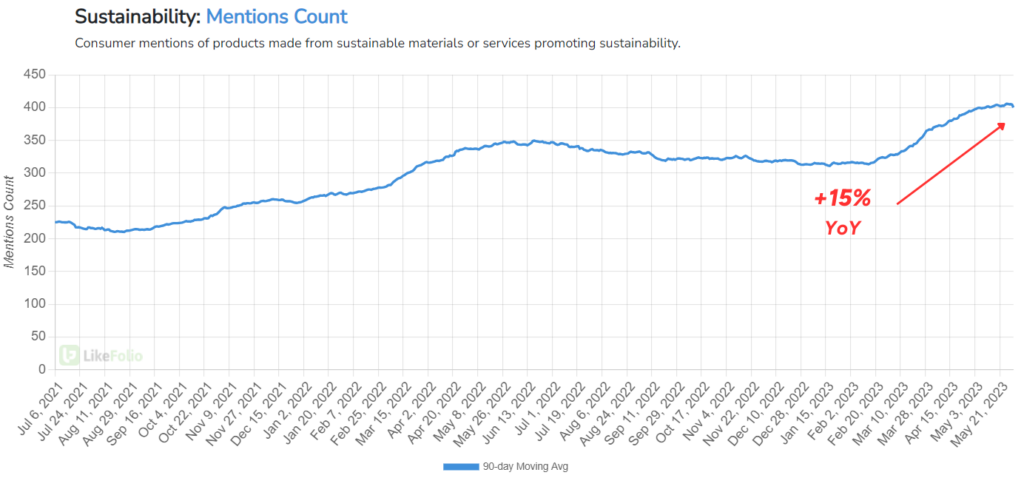

Thanks to our cutting-edge consumer trend algorithms, we were able to identify this sustainability wave well in advance.

As our database was logging consistent growth in social media chatter around sustainably-made products, we were scouring the market for “under-the-radar” consumer-facing stocks poised to benefit.

And that led us to the golden opportunity we’re bringing you here today…

Sustainability = Big Profits for ONON

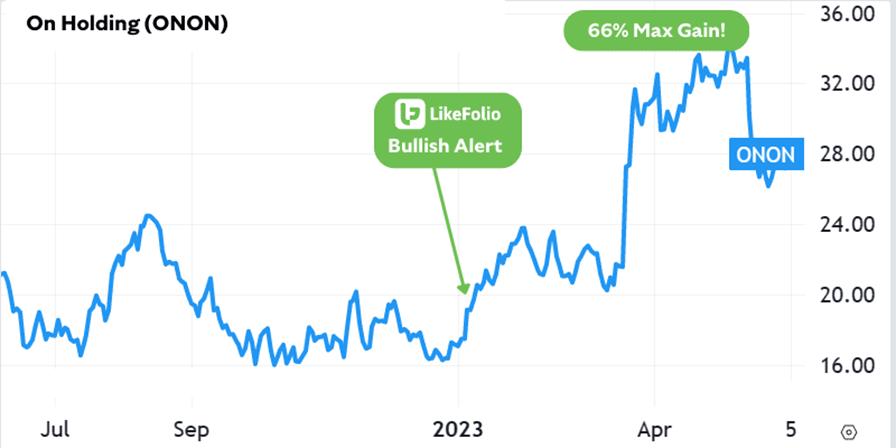

With real-time insight into the brands consumers love, we’ve watched Swiss running shoemaker On Holding (ONON) go from under-the-radar opportunity to explosive moneymaker with a front-row seat.

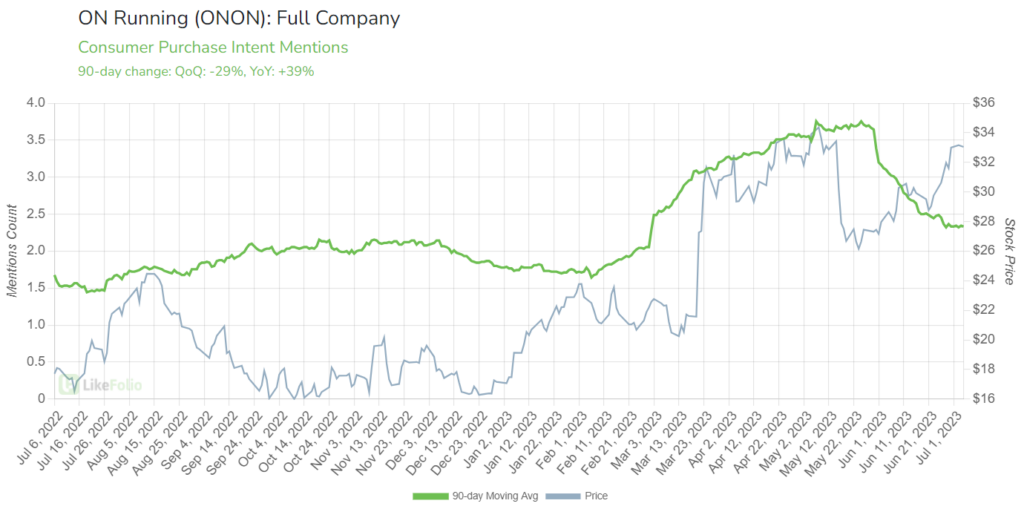

We alerted LikeFolio Investor subscribers to this opportunity when the stock was priced at a modest $20.70 on January 13, 2023.

In the months that followed, ONON’s stock price skyrocketed to a peak of $34.37 on May 8, representing a staggering 66% profit in a short period.

That position is still up by 60%. (And we believe there’s plenty more where that came from.)

With an x-ray view into the brands consumers love, we could see ONON massively outperforming larger industry players like Nike (NKE) in demand and satisfaction.

Purchase Intent mentions were up by 265% year-over-year when we sent that initial January alert, while NKE and Adidas demand mentions were sliding.

And that was in large part thanks to On’s remarkable alignment with sustainability trends.

On differentiated itself from the rest of the market by crafting its lightweight running shoes from recyclable materials like castor beans.

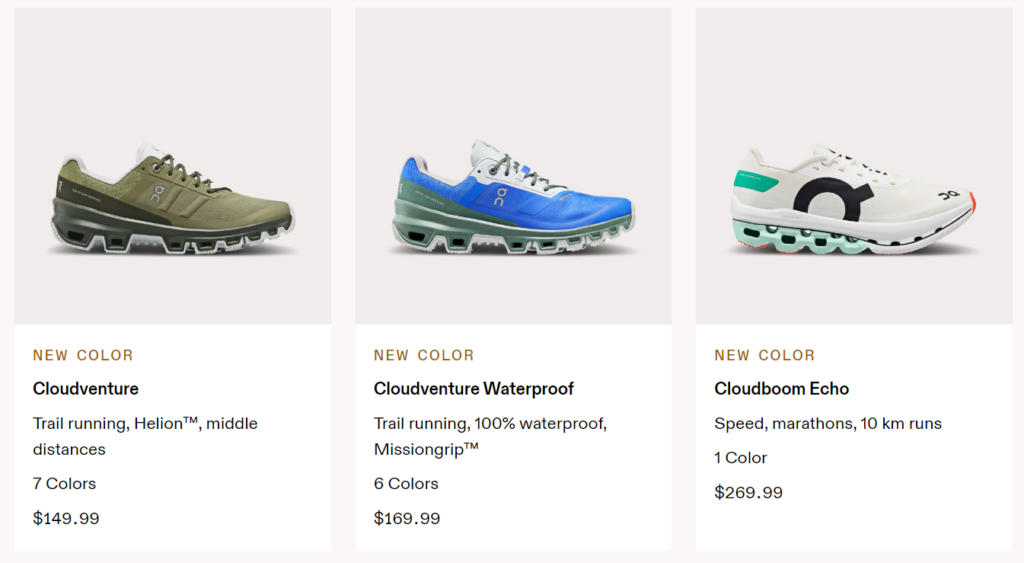

But make no mistake: these shoes aren’t cheap.

Remember how I said some consumers are willing to pay up for sustainability? Most pairs of On shoes will set you back between $129.99 and $169.99. The higher-end Cloudboom Echo model goes for as much as $269.99.

For the really-eco-conscious runners, there’s the fully-recyclable Cloudneos at just $29.99… plus $29.99 per month to swap out your old kicks for a new pair every six months.

That’s with On’s unique subscription service called Cyclon, another offer differentiating it in a crowded shoe market.

An avid runner herself, LikeFolio data guru Megan Brantley swears by her pair of Cloudneos and takes full advantage of the subscription service. (She’ll even show you how it works in this video – around the 1:30 mark.)

And she’s far from the only one.

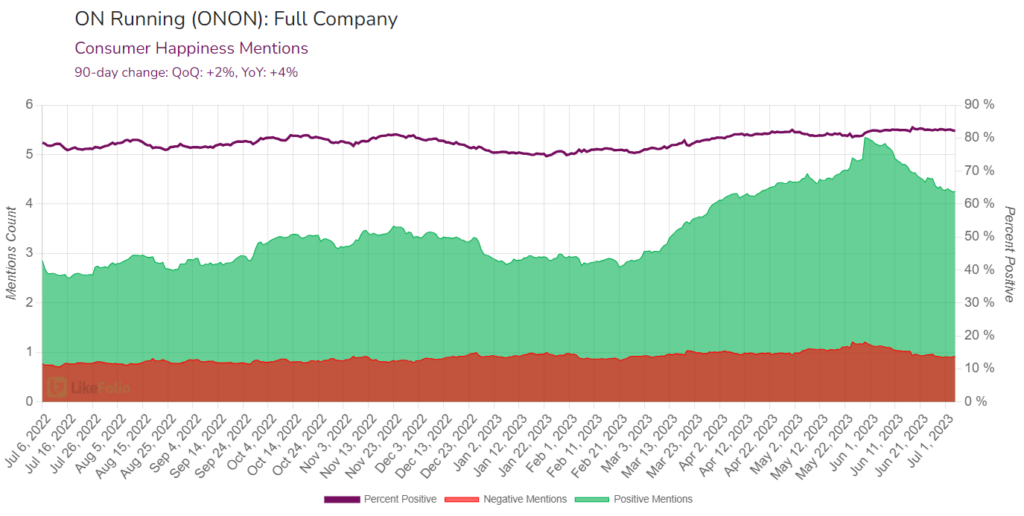

On maintains one of the highest Consumer Happiness scores in the LikeFolio universe, surpassing 82% after gaining a significant 4% year-over-year.

That’s an incredibly positive long-term indicator of success.

And while Purchase Intent mentions have slowed down from their all-time highs, the latest LikeFolio data shows they’re up by 39% on a year-over-year basis.

What’s Next for ONON

In the first quarter of 2023, On grew sales by 78.3% year-over-year to $420.2 million – enough to raise guidance for 2023.

The “tiny” Zurich-based company now expects to bring in $1.74 billion in net sales by the end of the year.

ONON has emerged as a footwear disruptor with a cult-like following of affluent athletes who value the brand’s aesthetics, comfort, and durability – with elite brand ambassadors to boot.

In fact, tennis legend Roger Federer teamed with ONON to create The Roger, a line of women’s and men’s footwear tailored specifically for different terrains.

And the company is still benefitting from several “popping” trends that could serve as tailwinds for the foreseeable future.

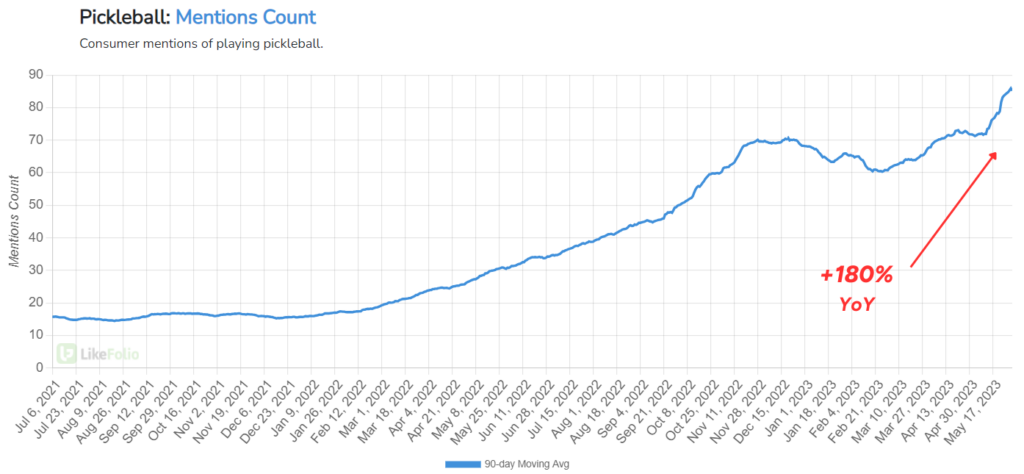

For example: For many people, pickleball has been the “gateway” sport in their tennis-playing journey.

Consumer mentions around the “retro” sports trend are up by 180% year-over-year…

And ONON has been one of the companies to capitalize on the craze.

Bottom line: We tapped ONON earlier this year as one of our top three must-own stocks of 2023. Since that call, the stock has gained 55.09%… with plenty of room left to run.

Until next time,

Andy Swan

Founder, LikeFolio