A tiny artificial intelligence (AI) startup out of China is causing all-out chaos for American AI stocks – but Nvidia’s (NVDA) story is far from over.

DeepSeek, previously unknown to most investors, released its R1 large-language model (LLM) last week, claiming it achieved advanced AI performance using 2,048 H800 GPUs over 57 days at a cost of under $6 million – reportedly 95% cheaper than OpenAI’s models.

The market’s reaction was swift and painful as Wall Street considered the implications for big tech companies: Why are Microsoft (MSFT), Meta Platforms (META), and other U.S. mega caps shelling out billions for top-of-the-line AI chips when DeepSeek managed similar performance at a significantly lower cost?

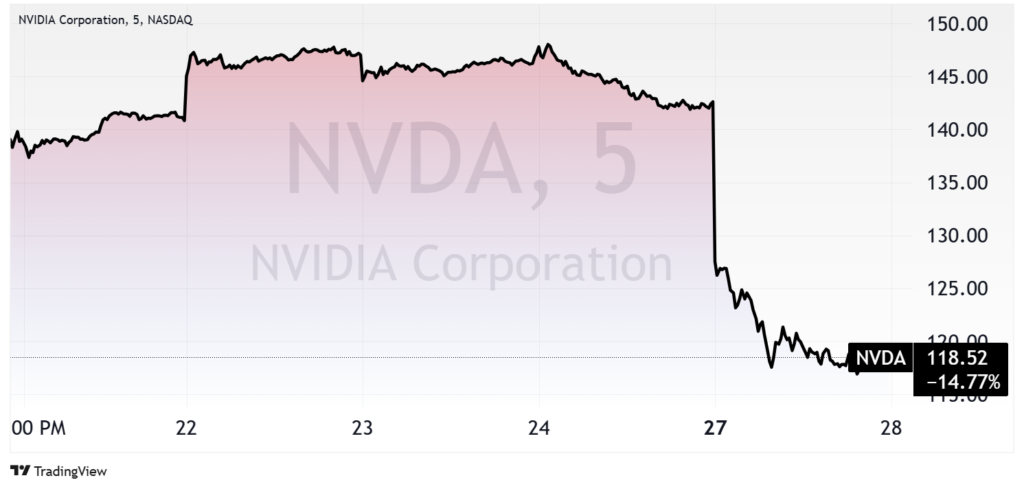

NVDA shares plummeted more than 14% on Monday while the Nasdaq 100 fell 4%.

But here’s the thing: We believe the market’s knee-jerk reaction to this announcement is overblown – and misses the broader picture.

While DeepSeek’s narrative suggests significant disruption ahead for the AI market, we see equally significant opportunities for Nvidia as well as for the smaller players in this space.

Here’s what investors need to know as this story unfolds…

The Broader Implications of DeepSeek’s Claims

While DeepSeek emphasized its low-cost innovation, reports from industry insiders suggest the story may be more complex. Evidence points to DeepSeek potentially using tens of thousands of Nvidia H100 GPUs rather than relying solely on 2,048 H800s.

If accurate, this would confirm that Nvidia’s most advanced chips were critical to DeepSeek’s achievements. Moreover, the approximate $6 million cost cited by DeepSeek likely excludes operational expenses such as energy, cooling, and storage, which are necessary for training large-scale AI models.

This does not diminish the importance of DeepSeek’s breakthrough.

Instead, it highlights how reduced costs – whether from optimized software, improved hardware efficiency, or a combination of both – can pave the way for smaller companies to enter the AI space.

For investors, this is a game-changer.

Low-cost innovation could bring AI development within reach for startups and small-cap firms, making them increasingly attractive to investors looking for growth opportunities in a rapidly expanding market.

Nvidia’s Role in a Democratized AI Market

DeepSeek’s success, whether through engineering optimizations or leveraging Nvidia’s GPUs, signals a larger shift in the AI landscape.

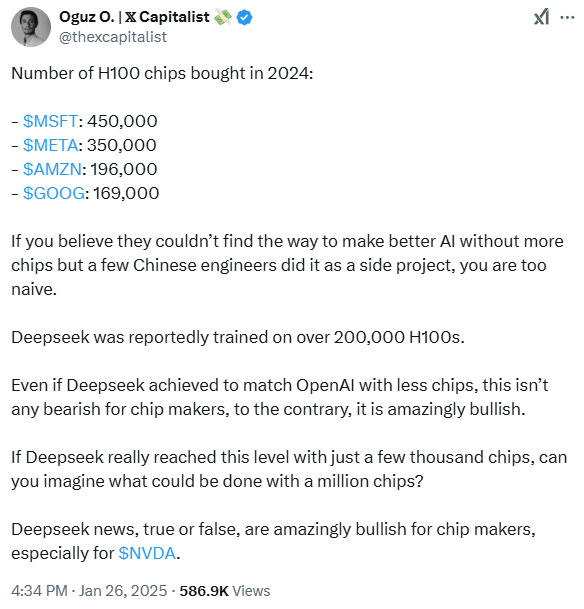

While major players like Microsoft, Meta, Amazon.com (AMZN), and Alphabet (GOOGL) continue to dominate GPU demand – collectively purchasing over 1.1 million H100 GPUs in 2024 – smaller companies now have a clearer path to competing in the AI market.

This democratization of AI development could spark a new wave of innovation driven by startups and mid-sized firms, all of which could tap into Nvidia’s hardware, cloud services, and development tools to scale their efforts.

By offering solutions that address the needs of both established giants and emerging firms, Nvidia is well-positioned to capitalize on this shift.

For smaller companies, Nvidia’s mid-tier GPUs like the H800, along with its cloud-based AI infrastructure, provide accessible options for building and deploying AI systems without the need for massive upfront investments.

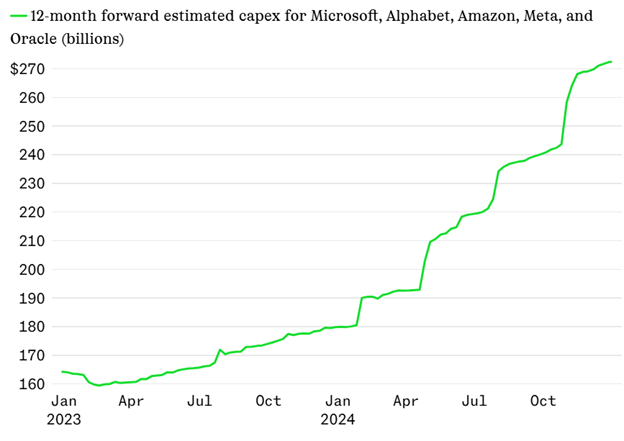

For larger companies, Nvidia’s high-end GPUs remain essential for staying ahead in the AI race. Capex (capital expenditure) spend on AI infrastructure has already been growing at a blistering pace…

And Nvidia stands to gain from both ends of the market.

Opening up New Opportunities for Investors

The possibility of cost-efficient AI development could drive interest in smaller AI firms, making small-cap stocks a compelling option for investors. (MegaTrends members are already way ahead of this curve, receiving our top small-cap AI picks in this month’s issue, along with a buy alert on a sub-$2 AI player with the potential to triple under Trump’s deregulation efforts.)

With the ability to leverage advancements like those seen with DeepSeek, these smaller, more agile companies could create a broader ecosystem of innovation – and the opportunity for explosive returns.

In addition, as barriers to entry in AI lower, Nvidia’s customer base could expand significantly, creating long-term growth opportunities.

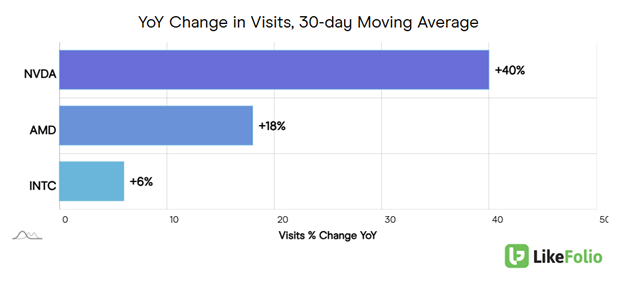

We see substantially increased demand for chip technology across the board, with Nvidia leading the way. LikeFolio is logging a 40% year-over-year surge in NVDA interest, well outperforming competitors such as Advanced Micro Devices (AMD) and Intel (INTC):

Investors should also consider the ripple effect on major tech firms: DeepSeek’s advancements could spur increased investments in AI infrastructure as companies race to improve their models, driving even greater demand for Nvidia’s GPUs.

Bottom line: This dual trend – AI democratization opening doors for smaller firms and established players ramping up investments – positions Nvidia as a key enabler across the entire AI market.

Until next time,

Andy Swan

Founder, LikeFolio

Something Far More Disruptive Than AI Is Coming

While the rest of the market falls for the fearmongering headlines, the real story lies in an invention far more disruptive than even today’s most advanced AI technologies. Bill Gates has called it “The most transformative technology any of us will see in our lifetimes.” The New York Times says this technology will “split history into before and after.” Those who prepare now will be on the right side of that history – while the rest fall behind.

You have a rare window to profit before this invention goes live, but it’s closing fast. Here are the three steps you can take today to prepare.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

DoorDash Delivers Two Powerful New Partners (Just in Time for Earnings)

These new collabs promise to strengthen advertising and customer engagement…

Wall Street Wake-Up Call: The Tesla Cultural Shift Is Real

Five analyst upgrades in a month tell you all you need to know: The pullback isn’t a warning sign – it’s an opportunity…