In the bustling streets of 17th-century London, a unique marketplace began to boom.

Merchants known as “costermongers” would gather, selling their off-price goods from carts and stalls.

These early entrepreneurs offered the thrill of a treasure hunt, where quality products could be found at discounted prices.

Samuel Pepys, the famous diarist, once wrote of his joy in discovering a bargain in one of these markets: “To Paul’s Churchyard, and there bought me a pair of gloves, cost me 5s., and so to see the steeple, which is a brave place.”

I love that quote. Because there’s actually a scientific reason Pepys was so pumped about those cheap gloves… something built into humans by evolution.

When something good happens, our brains release a chemical called dopamine to make us feel good, so we’re more likely to do it again.

Off-price retailers like Marshalls and Ross are like the modern-day versions of those old London costermongers: treasure troves filled with overstocked merchandise from premium brands at a steep discount.

For consumers, these bargain retailers offer a borderline-addictive shopping experience of discovery, excitement, and value… like one giant dopamine hit that keeps you coming back for more.

For investors, these stocks can make great “inevitable” plays because you’re betting on human nature: the universal love of finding a great deal.

But not all of them are going to be winners that make you money…

And that’s where LikeFolio’s consumer insights give us an “edge.”

We can see which brands consumers on Main Street are buzzing about in real time.

It’s how we were able to spot this winner ahead of Wall Street – and add it to your moneymaking watchlist today…

Mastering the Art of Treasure Hunting

The joy of finding a hidden gem at a bargain price is universal, and TJX (TJX) has mastered the art of delivering this experience.

Its stores, which include T.J. Maxx, Marshalls, and HomeGoods, are designed to mimic a treasure hunt: Ever-changing inventories mean there’s always something new to discover, and accepting overstock from premium retailers means those goods will be high quality… for a fraction of the price.

With our predictive analytics, we tipped off our Earnings Season Pass subscribers to a bullish opportunity on TJX in this week’s Earnings Scorecard.

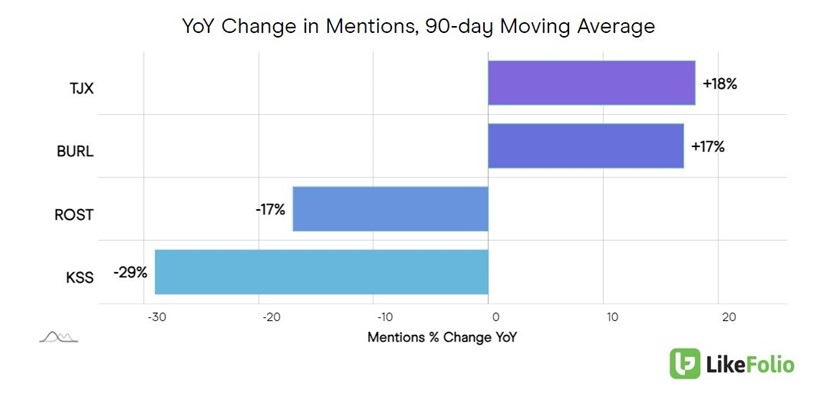

We could see the company outperforming rivals in social media buzz, with mentions pacing 18% higher year-over-year:

And just as we predicted, TJX’s stock price popped 5% today on one heck of an earnings report.

Because shoppers aren’t just chatting about TJX – they’re raving about the amazing deals they’re finding at its stores.

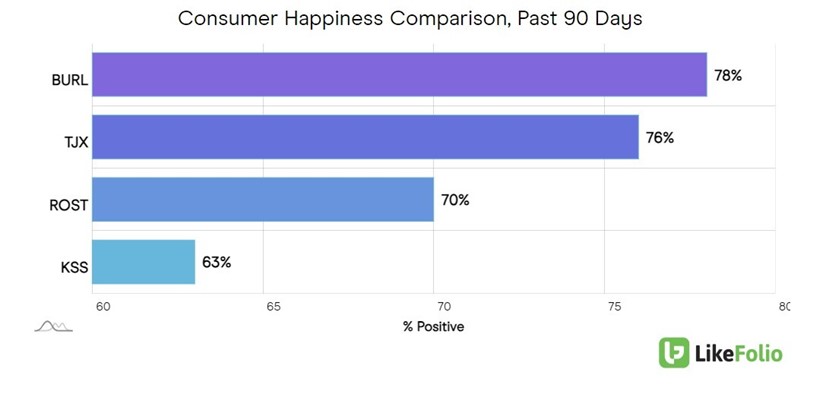

That puts TJX near the top of the pack when it comes to Consumer Happiness at 76%, trailing only Burlington (BURL).

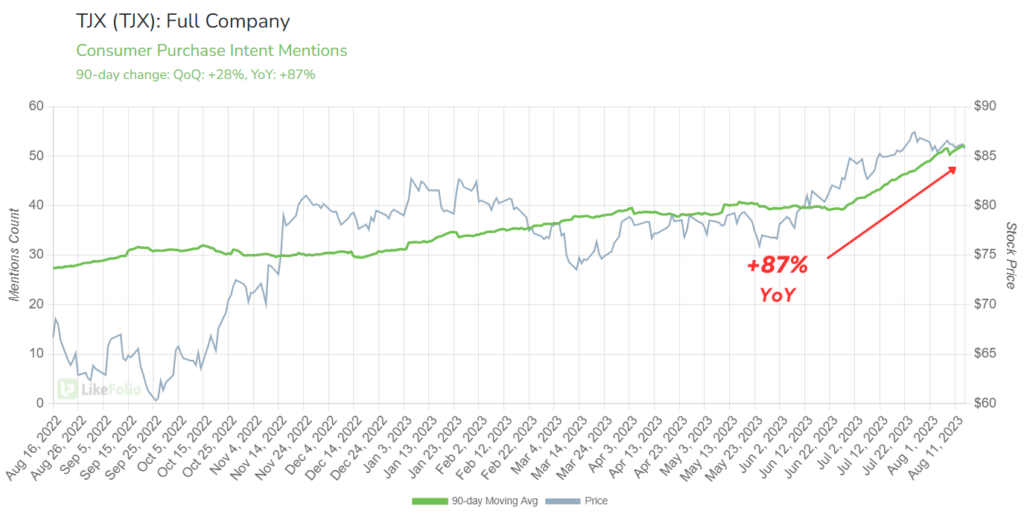

Even more telling: TJX Purchase Intent mentions – aka folks talking about spending their hard-earned cash at one of its stores – have surged an incredible 87% year-over-year.

This morning’s massive earnings beat proved what we knew: As other retailers flounder, TJX stands out as a success story that’s winning over consumers – and shareholders.

Sales grew 8% year-over-year for the quarter to $12.8 billion, while profits soared 23%.

TJX sees more growth ahead – and raised its full-year outlook, just in time for the holiday shopping season.

In its shareholder letter, TJX executives noted: “The Company is well-positioned to take advantage of a marketplace that is loaded with outstanding quality, branded merchandise and is in a great position to flow exciting merchandise to its stores and online throughout the fall and holiday shopping seasons.”

That’s because TJX’s discount model, much like the off-price markets of old London, allows it to cut costs in areas that other retailers cannot.

This advantage gives the company an edge in serving above-average income households and offers a “phenomenal” opportunity to get off-price merchandise.

Other retailers struggle with bloated inventory. TJX takes those extra products off their hands – and puts them in front of consumers for an unbeatable price.

From the bustling streets of 17th-century London to the vibrant aisles of T.J. Maxx and Marshalls, the thrill of discovery and the joy of a good deal continue to captivate shoppers.

And that makes TJX a great bet.

We’ve done some bargain-hunting of our own in the market, looking for fantastic “deals” on artificial intelligence stocks – small-caps and “under the radar” players trading for just a few bucks… but with the potential to soar.

And we discovered a gold mine of opportunity…

A basket of five small-cap AI stocks that our LikeFolio Data Engine flagged as “buys” with 1,000% growth potential over the next year.

Four of these stocks are trading for under $3. But they won’t be for long.

Go here now to get the details.

Until next time,

Andy Swan

Founder, LikeFolio