For many Americans, 2023’s average tax refund of $3,167 was the single-largest check they cashed all year.

And make no mistake: When John and Jane Doe get that chunk of their hard-earned cash back from Uncle Sam, they put it to good use – often in a way that breathes new life into the economy.

Tax refund season acts like a financial Christmas, pumping fresh cash into the market and giving consumer-facing stocks a chance to capture those dollars.

Of filers expecting a refund in 2024, 37% plan to spend theirs on necessities like rent and groceries, according to a Credit Karma survey, while another 20% will be looking to splurge on something they maybe wouldn’t otherwise be able to afford – such as taking a trip or even buying a car.

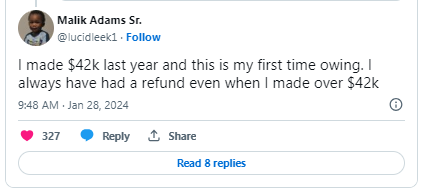

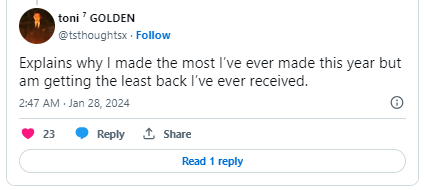

But since the IRS kicked off the 2024 tax season on January 29, we’re seeing a different, more troubling reality play out in our consumer data.

We’re listening to what consumers are saying in real time. And what we’re hearing is that a nosedive in tax refunds is leaving many Americans not with a check to cash, but a bill to pay…

Experienced en masse, lower tax refunds could send ripple effects through the economy.

Much like the 31% of Americans depending on that check to make ends meet, the companies expecting that buoy of cash during tax refund season could be in for a rude awakening.

We’ll let you in on the sectors – and stocks – most at risk of a pullback in spending here today.

With this early intel, you won’t be caught by surprise with the rest of the market…

The “At-Risk” Watchlist

Retail 🛍️

Giants of the retail world like Walmart (WMT) and Target (TGT) are used to seeing their tills ringing incessantly during this period. But this year, they could be in for a rude awakening.

The expected shortfall in tax refunds is set to hit discretionary spending hard. And that could lead to lower sales on those shiny new electronics, stylish new kicks, and home goodies.

Auto 🚘

The automobile sector, where titans like Ford Motor Co. (F) and General Motors (GM) reign, typically enjoys a robust sales season thanks to tax refunds. Some dealers even offer special sales, such as offering to double your tax refund as a down payment.

But they’re about to hit an unexpected pothole. With fewer people getting hefty refunds, fewer will be making those crucial down payments. This could very well lead to a sales slump, forcing these automotive behemoths to rethink their strategies or risk stalling out.

Travel ✈️

Travel darlings like Delta Air Lines (DAL) and Marriott International (MAR) could be looking at a lot of empty seats and rooms as that extra refund cash that usually goes into booking flights and hotels dries up. The impact? Fewer people jet-setting or road-tripping, leading to a potential drop in revenues for these travel stalwarts.

Home Improvement 🏠

Home improvement stores Home Depot (HD) and Lowe’s (LOW) usually bank on tax refunds as a catalyst for consumers to embark on home renovation projects. But with less refund cash flowing, we might see a decline in spending in this sector, too.

Tech 📱

And don’t think for a second that tech is immune. Companies like Apple (AAPL) and Best Buy (BBY) often see a surge in sales from tax refund splurges. But this year, sales of the latest gadgets and gizmos could take a hit as smaller refunds leave consumers tightening their belts.

Don’t Panic – Pivot

As dire as this all sounds, the American economy is incredibly resilient. It’s been through wars, recessions, and all sorts of upheavals and always comes out swinging.

The same can be said for American consumers. In fact, the Consumer Confidence Index hit a two-year high in January. We’ll see where it goes from here.

Companies might need to pivot, offering more affordable options or flexible financing. Consumers, on the other hand, might become more savings-oriented and debt-conscious. (Or keep racking up that credit card bill.)

In this era, financial advisors and budgeting apps might see a surge in popularity as people seek smarter ways to manage their finances.

Bottom line: While a looming tax refund crisis presents a challenge, it’s also an opportunity – for businesses to innovate and for consumers to reassess their financial priorities. The key lies in how quickly and effectively we respond to these changes.

The American economy is nothing if not adaptable, and this situation is yet another test of its resilience.

One thing’s for sure: No matter where the market heads next, LikeFolio’s real-time insight into consumer spending trends will keep you ahead of the game.

Since October alone, we’ve leveraged our social media machine to deliver eight winning picks to LikeFolio Investor subscribers for a shot at 16%, 19%, and 20% gains – and that’s nothing compared to what’s coming next.

See how you can get in on the action today… before the next big profit alert hits.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Why We’re Not Gobbling up DoorDash Just Yet

With high-profile events like the Super Bowl on the horizon, DASH needs to impress…

Perks, Points, and Profits: American Express’s Winning Formula

Here’s why our long-term outlook on AXP just gets better and better…