Here’s a question for you: Would you rather pay full price for that holiday office party outfit you’ll only wear once? Or would you rather rent a designer ensemble for a fraction of the price – no closet space required?

For consumers with expensive tastes but shrinking budgets, clothing rental services like Rent the Runway (RENT) seem like a no-brainer.

The concept is solid. And it’s proved popular.

During its last quarter, Rent the Runway subscribers hit a record high.

The only problem is that RENT – along with leading competitor, Stitch Fix (SFIX) – has yet to be profitable.

But I can show you an up-and-comer that is…

It’s called Nuuly.

Like those other brands, Nuuly is a subscription-based clothing rental service that allows customers to rent multiple fashion items for a fixed monthly fee.

It offers a cost-effective way to enjoy a diverse and constantly rotating wardrobe without incurring the full expense of buying new outfits.

Unlike those other brands, though, Nuuly is raking in the dough.

For the quarter ended October 31, 2023, Nuuly’s gross profit was $17 million – more than double what it made during the same period last year.

The best part?

Nuuly’s success is driving brand awareness and sales for its parent company, Urban Outfitters (URBN) – and that’s an opportunity you can invest in today…

📣 Breaking News: On December 29, one tiny $6 company is about to dominate a massive $300 billion market and insiders are scrambling.

For full details on this fast-moving story, go here now.

How Nuuly Became URBN’s Ace in the Hole

Urban Outfitters is the parent company of trendy fashion outlets Urban Outfitters (its namesake), along with Anthropologie, Free People, and yes, Nuuly – its ace in the hole.

With an incredible 68% surge in subscribers during the most recent quarter, Nuuly was the growth engine that helped URBN achieve record revenue of $1.28 billion.

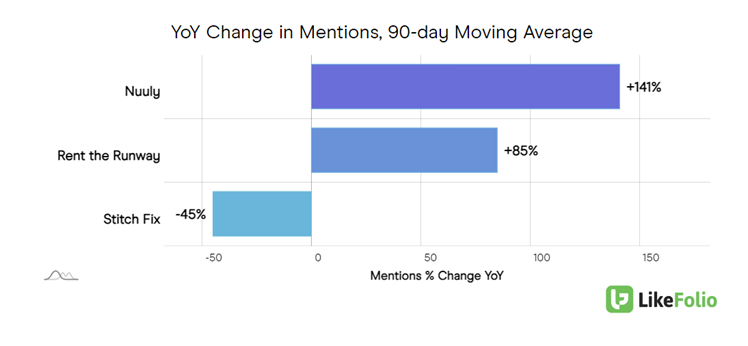

LikeFolio data proves just how much Nuuly is catching fire on Main Street.

Mentions have risen by more than 140% on a year-over-year basis, way outperforming those other direct-to-consumer/discovery clothing models we mentioned earlier:

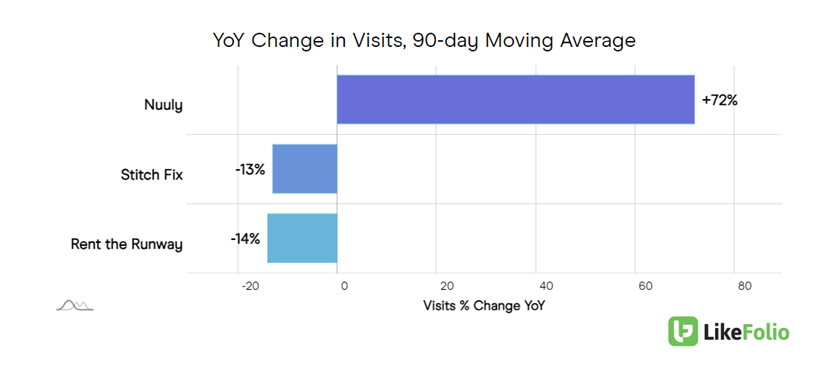

Forward-looking web visits follow the same trend. Nuuly has seen its web traffic grow 72% year over year, while Stitch Fix (-13%) and Rent the Runway (-14%) logged drop-offs.

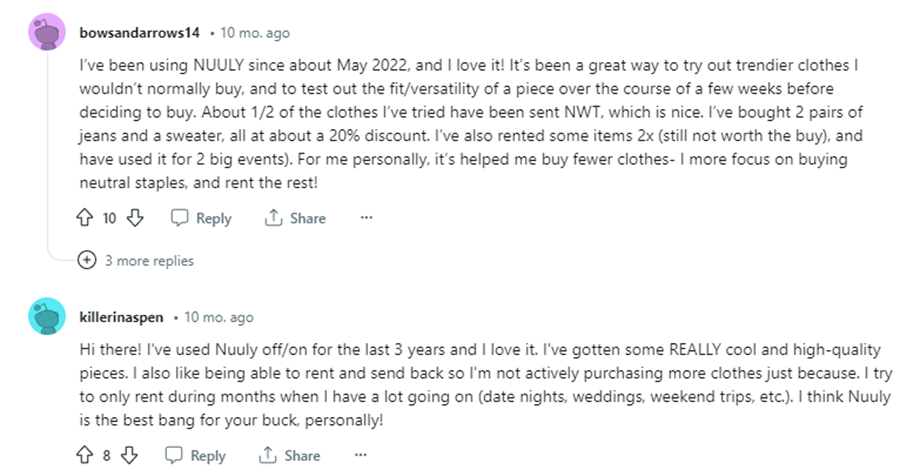

So, what is Nuuly doing right that these other rentals haven’t quite figured out?

It comes down to three things:

- Consumers love that they can self-curate a box of high-quality items for less than the price of a single item would run brand new in the store.

- Its monthly subscription is easy to pause, allowing consumers to remain on-brand for trips and special events.

- With several “slots” open in consumer rental boxes, users can try out different brands and be a bit more exploratory when it comes to their fashion.

Most importantly for URBN investors though: Nuuly is ushering new customers into the door of the company’s core brands… and it shows.

“With the strong partnership of our sister brands Anthropologie, Free People, FP Movement and Urban Outfitters as well as over 400 other partner brands, we have curated what we believe is the most compelling rental clothing assortment on the market.”

– Dave Hayne, Chief Technology Officer, Urban Outfitters; President, Nuuly

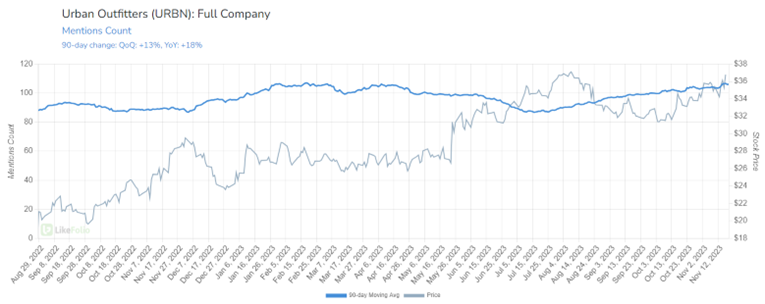

Comprehensive mentions for Urban Outfitters and its portfolio of retailers have risen by 18% year-over-year.

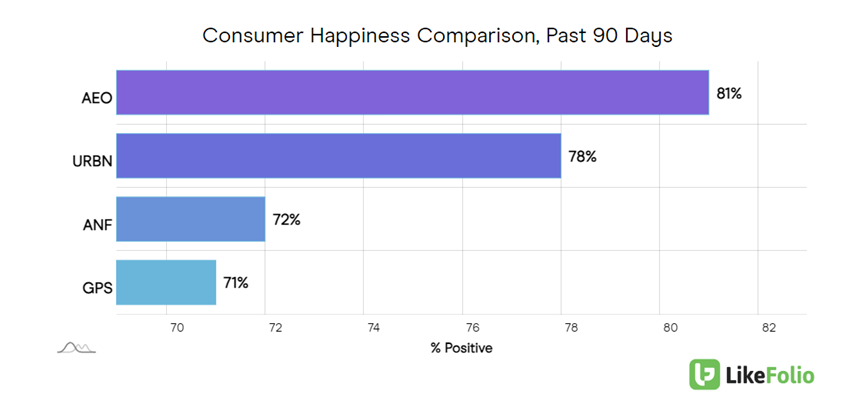

And URBN boasts a high Consumer Happiness level of 78%, providing another vote of confidence that the company can maintain its improved brand positioning over comparable peers like Abercrombie (ANF) and Gap (GPS).

The company reported earnings last week, and despite beating estimates, its stock price pulled back – giving forward-looking investors like you an even more favorable entry point on an exciting opportunity.

Now, for a truly explosive play, be sure to check this out next – an “undercover” AI opportunity that’s more than doubled since March but is still a steal at just $3… and verging on its next big breakout.

Until next time,

Andy Swan

Founder, LikeFolio