After a strangulating two-year stretch, the travel industry rocketed out of the gate this year.

Summer vacation spending is forecast to hit an all-time high of $214.1 billion in 2023.

Shorter trips – experts have dubbed them the “micro-cation” – are on the rise.

Heck, travelers are dropping an average of $622 for single-night stayovers.

But the best is yet to come.

While “generic” hoteliers will struggle in an era when travelers are looking to pack more fun into shorter stays, their inventive rivals will thrive.

And some of the coolest stayover innovations are already arriving…

- The “Smart Hotel”

These use the Internet of Things (IoT) in a way that combines efficiency, fun, and luxury in one package. You’ll be able to streamline check-ins, find food and entertainment, keep your room safe and comfortable, store your valuables, and get transportation – simply and quickly.

- The Sustainable Stay

Hotels are being built using eco-friendly materials, with energy saving, waste-management, and low-environmental impact as key design considerations.

- Robot Staffs

More and more hotels are using robots to help automate check-in and check-out, carry luggage and act as concierges, or deliver room service.

- Virtual and/or Augmented Reality

These technologies are helping make entertainment, gaming, and new tech-driven attractions become standard fare among hotel offerings. The “try-before-you-buy” potential can offer virtual tours that will act as magnets for new customers.

- The Birth of “Super Brand” Experiences

In that bid to leapfrog their “generic” rivals, hotels are differentiating themselves by adding unique designs, layouts, and cool new “experiential” features to their properties. The novelty factor is no longer faddish – it’s “table stakes” for the top dogs.

The takeaway: We’re seeing growth, and there’s more to come.

So let’s hitch up with this market leader…

The Ultimate Travel Stock

That leader is Marriott International (MAR), the lodging giant whose brand-new corporate headquarters is down in Bethesda, Maryland – not too far from TradeSmith’s corporate base in Baltimore.

Marriott’s genesis was all the way back in 1927, when John Willard Marriott and his wife, Alice, opened a root beer stand in Washington. In 1993, Marriott Corp. split into two firms – property owner Host Marriott (now Host Hotels & Resorts), and Marriott International.

Today, Marriott is the world’s No. 1 hotel chain – as measured by available rooms. It has 31 brands in its portfolio ranging from the luxurious Ritz-Carlton to the budget-friendly Fairfield Inn & Suites.

We’re talking 8,500 properties containing over one million rooms across 138 countries and territories.

This diversity gives Marriott a competitive edge.

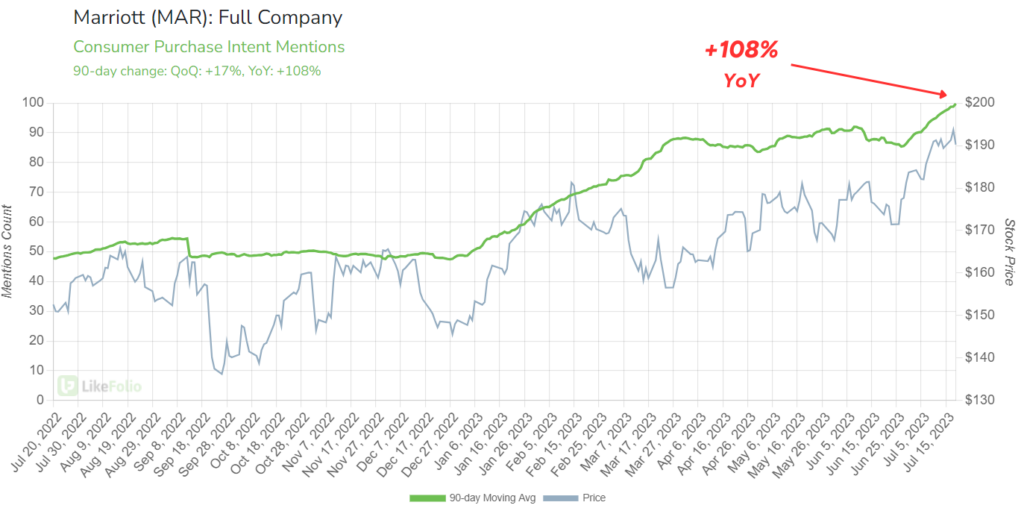

And our LikeFolio research shows that Marriott is hot – red hot.

Consumer buzz levels for Marriott have shot up by a whopping 40% year-over-year.

But even more telling is that Purchase Intent mentions – consumers talking about spending their hard-earned cash with Marriott – have more than doubled over the same time frame: +108%.

This surge spotlights a big jump in consumer interest in Marriott as a destination, which could translate into very real bookings and revenue growth for the company.

See, our proprietary Purchase Intent metric has been proven through rigorous academic research by Georgetown University as “not only predictive of a company’s upcoming sales, but also [to] account for the unexpected component of sales growth that analysts miss.”

Riding the Travel Wave

With that massive upswing in travel – those record-breaking levels we’re hitting this year – hotel-stay numbers will skyrocket.

And as one of the sector’s true top dogs, Marriott will benefit more than most.

Travel stocks are charging higher along with the peak summer vacation season.

And Marriott is really surging: The company’s shares recently hit a new 52-week high of $194.37, up 29% from where they traded a year ago, as of this writing.

The stock won’t stop there: We expect MAR to hit additional new highs – and to breakout to as high as $220 per share by the end of the year.

Good things keep happening.

Just this week, the company teamed up with MGM Resorts International (MGM) on a loyalty program that gives Marriott deeper access to the Las Vegas strip.

By the end of the year, the so-called MGM Collection with Marriott Bonvoy will make it possible for travelers to book rooms at 17 MGM resorts in Vegas and elsewhere via Marriott’s website.

Remember how we talked about the importance of branding, innovation, and “experiential” stayovers? Well, this new partnership will add roughly 40,000 rooms to Marriott’s system, increasing its global inventory by 2.4%. It’ll even give Marriott fees based on total room revenue.

“Las Vegas is not only one of most important destinations in the US but also globally,” Marriott CEO Anthony Capuano told reporters. “Making the full breadth of MGM’s resort portfolio available to our customers is a really compelling proposition.”

Consumers seem to agree – with a flood of posters expressing their excitement over the collaboration.

Inventive companies like Marriott make deals like this consistently. Add in splashes of technology and some of the big new industry trends and you’re talking about a market leader that will pay off big…

And that will pay you while you wait.

The company just announced a quarterly dividend of 52 cents a share – a 30% jump from the previous quarter. The yearly payout of $2.08 a share represents a yield of 1.07%.

Bottom line: As the travel sector reignites, Marriott makes a promising play.

With a real-time pulse on what consumers on Main Street are loving, we’re able to spot stocks like Marriott as they’re ready for liftoff – and the trends driving them – way ahead of Wall Street.

And no trend in the LikeFolio universe is accelerating quite as fast and furious as artificial intelligence. Consumer conversations around AI are up a remarkable 486% year-over-year.

Trillion-dollar AI behemoths like Nvidia (NVDA) tend to get the most attention. And to be fair, we love this stock too. Nvidia shares have gained 252% since our database flagged its upside potential in September.

But where our system really shines is in identifying the smaller players – the ones the rest of the market hasn’t caught onto yet – that are gaining serious momentum with consumers.

This “tiny” AI player is a perfect example: Our data reveals consumers are raving about its service, with demand mentions soaring 88% year-over-year, as of this writing.

We believe it could be one of the most exciting AI-powered opportunities of the year.

And the best part? Shares are currently trading for less than $3 apiece.

Until next time,

Andy Swan

Founder, LikeFolio