Artificial intelligence (AI), electric vehicles (EVs), and cryptocurrency.

These burgeoning sectors are at the epicenter of today’s technological revolution, each one transforming the very fabric of our society… and generating unprecedented wealth in the process.

Early investors in Nvidia (NVDA), Tesla (TSLA), and Bitcoin (BTC) can tell you first-hand. Since 2016, these industry-leading investments have soared to stratospheric heights, each one, minting millionaires along the way:

- NVDA: +16,600%

- TSLA: +1,100%

- BTC: +16,100%

But there’s something else these paradigm-shifting innovations have in common – something that could spark the next wave of profits for those who know where to look.

See, AI, EVs, and cryptocurrencies all require massive amounts of energy:

- To travel 100 miles, the average EV requires about the same amount of electricity that the average American home uses in one day.

- To train a large language model (think: GPT-3), it’s about the same amount of electricity that 130 American households consume annually.

- To mine Bitcoin every year, we’re talking about an electrical energy footprint on par with the entire country of Poland.

It’s easy to see how this energy consumption presents a challenge – but today, I’ll show you how it also creates an opportunity.

The Energy Demand Surge

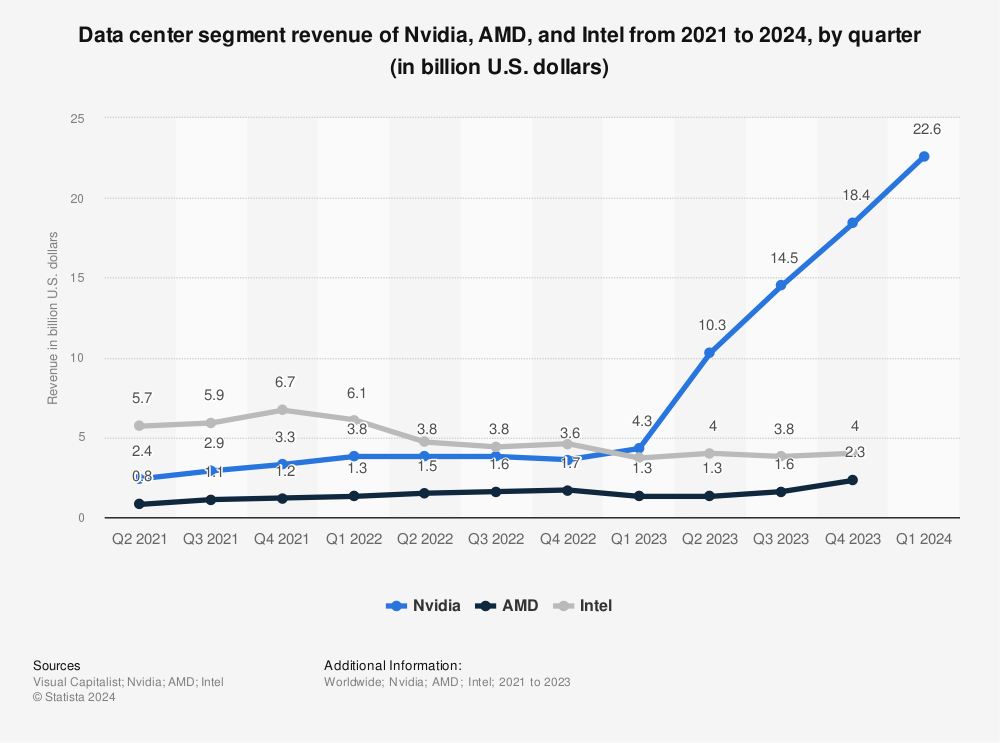

On the AI front, Nvidia’s data center business is surging, reflecting the increasing computational power required for AI:

We learned earlier this week that Nvidia’s data center revenues exploded 427% year over year to a record $22.6 billion in Q1 and that demand is only going to climb exponentially from here.

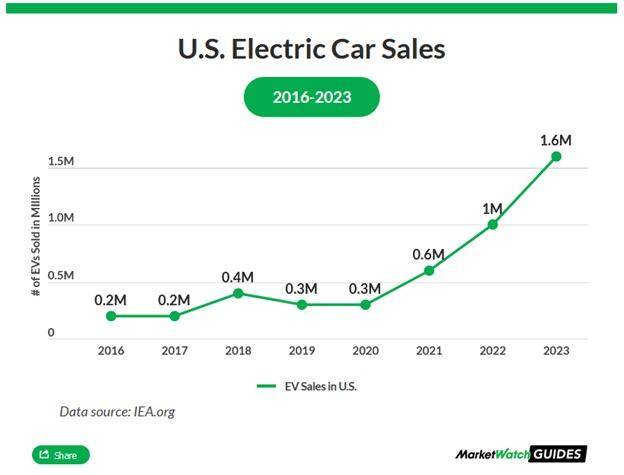

Similarly, U.S. electric car sales have skyrocketed from just 200,000 units in 2016 to 1.6 million units in 2023:

Tesla has benefitted greatly by being at the forefront of this revolution with Elon Musk at the helm. As EV sales soared, TSLA shares followed – gaining more than 1,000% since 2016.

And if you missed out on those gains, don’t worry because this new Elon invention, dubbed his “most daring and disrupting project” yet, could be even bigger.

But remember, the growth trajectory in these sectors is not just about technological advancements; it’s about their underlying energy consumption.

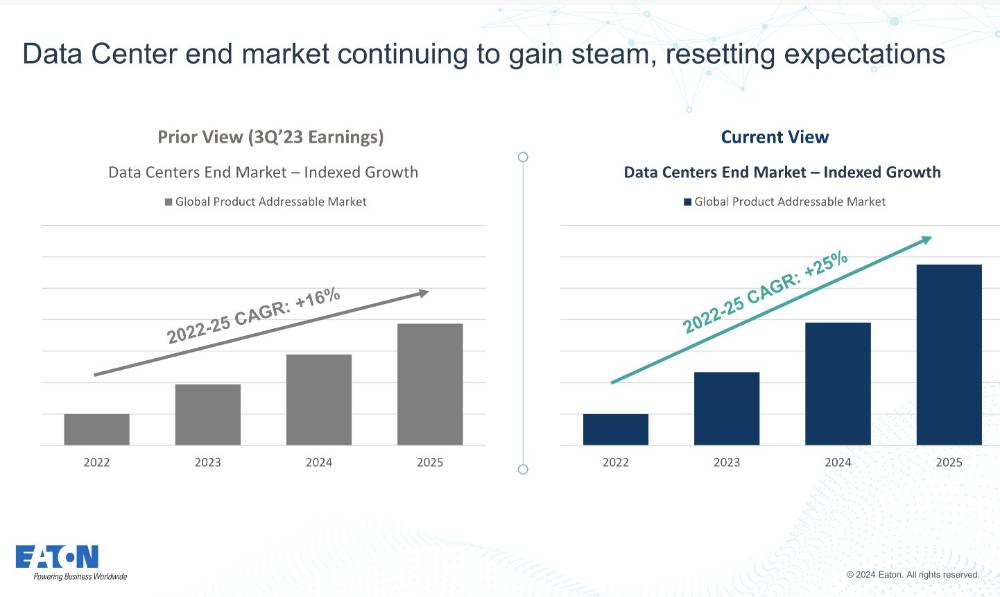

Growth forecasts for data centers are only heading one way: up. Revised expectations now estimate a compound annual growth rate (CAGR) of 25% from 2022 to 2025.

Investment Opportunities Beneath the Surface

These trends suggest a whole array of “unseen” opportunities for investors who are willing to look beneath the surface. Here are a few key areas to consider:

- Commodities

The raw materials needed for these technologies – lithium for EV batteries, rare earth elements for advanced computing, and even traditional energy commodities – are all poised for increased demand. Investing in mining companies and commodity ETFs (exchange-traded funds) could yield substantial returns as these technologies expand.

- Energy Service Providers

Companies that supply the infrastructure for increased electricity usage are crucial. This includes grid enhancers, renewable energy providers, and even traditional utilities expanding their renewable portfolios.

- Efficiency-Based Small Caps

Small-cap companies specializing in energy efficiency, such as those producing advanced cooling systems for data centers or innovative battery technologies, offer high growth potential. Their products can significantly reduce the operational costs of energy-intensive technologies.

- Nuclear Power

As the demand for clean, reliable energy sources rises, nuclear power is becoming an increasingly attractive option. Investments in nuclear technology companies and uranium producers could be beneficial as the world seeks sustainable energy solutions.

The Path Forward

The convergence of AI, EVs, and crypto is reshaping our energy landscape. While the immediate focus often falls on the headline-grabbing advancements in these fields, savvy investors should look to the “unseen” investment opportunities in the foundational elements that support this growth.

As these technologies evolve, the need for efficient, abundant, and clean energy solutions will only become more critical. Investors who harness these trend tailwinds have an opportunity to benefit financially while contributing to the sustainable future of technology.

By anticipating the infrastructure needs of tomorrow’s tech, savvy investors can position themselves at the forefront of this energy revolution.

Until next time,

Andy Swan

Founder, LikeFolio

Top Stories in AI, EVs, and Crypto

These are some of our very favorite topics to cover in Derby City Daily. Check out our most recent coverage…

- In AI: Think you missed out on NVDA? Here’s Proof It’s Just Getting Started.

- In EVs: Find out What the Market Is Still Getting Wrong About Tesla… so you don’t make the same mistake.

- In Crypto: Learn about the stock we believe makes The Ultimate Leveraged Bitcoin Bet.