Luxury retail is flexing its muscles again.

Despite concerns about a slowing consumer, LikeFolio data suggests high-end shoppers are still spending, driving strong results for brands catering to the premium and luxury market.

I know what you’re thinking: “In this economy?”

But stick with me…

While headlines are calling for the end of luxury – like Forbes’ “5 Reasons the Luxury Market Decline in 2025 Won’t Recover in 2025” – this data says otherwise… and reveals two more companies due to surprise the market over the coming weeks.

Recent Earnings Confirm Strength at the Top

Ralph Lauren (RL), Tapestry (TPR) – which owns Coach, Kate Spade, Stuart Weitzman – and even struggling Peloton (PTON) all recently posted better-than-expected earnings. Each company raised guidance, citing sustained demand from affluent shoppers.

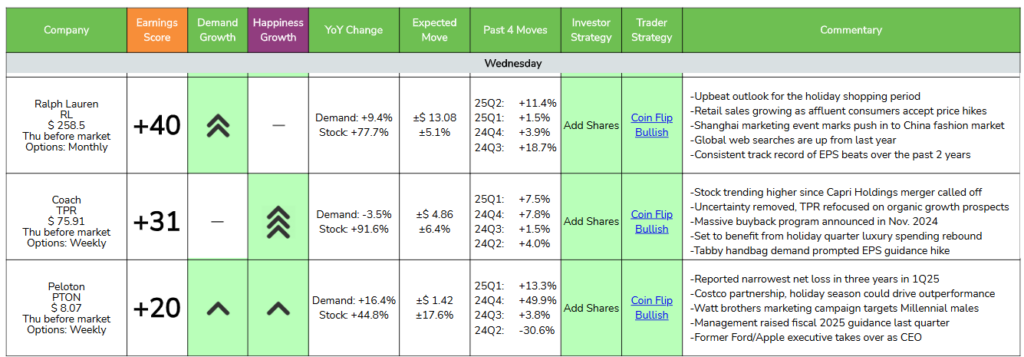

Before their reports, Earnings Season Pass members received exclusive earnings predictions on RL, TPR, and PTON in their Week 3 Scorecard. As you can see below, our data assigned all three companies bullish Earnings Scores – landing our subscribers a critical advantage.

All three companies delivered the results we were looking for:

- Ralph Lauren (RL): Delivered an 11% revenue jump, hitting $2.1 billion, beating estimates. Management raised its full-year growth outlook to 6%-7% from the prior 3%-4% range, pointing to luxury consumers’ resilience.

- Tapestry (TPR): Reported record holiday sales, up 5% year-over-year to $2.2 billion, with Coach leading the way (+10%). The company boosted its full-year earnings guidance to $4.85-$4.90 per share.

- Peloton (PTON): While revenue fell 9% year over year, cost reductions led to improved margins and free cash flow turning positive. Management slightly raised full-year revenue guidance, showing stabilization.

These results confirm what our data already knew: That premium and luxury consumers continue spending, defying broader retail softness.

That’s exactly the kind of backdrop we want heading into On Holding (ONON) and Lululemon’s (LULU) next earnings reports.

ONON & LULU: Positioned for Outperformance?

Both On Holding and Lululemon have strong momentum heading into earnings, supported by LikeFolio data and broader consumer trends.

On Holding (ONON): Earnings Preview

- Stock Performance: +67% YoY

- Web Traffic: +32% since March* (noting March due to a domain change)

- Next Earnings Report: March 4, 2025

On continues to see explosive demand for its premium athletic footwear. Sales grew 34% year over year last quarter, and the company reaffirmed its full-year guidance for 30%+ revenue growth.

LikeFolio data shows consumer interest is still growing, bolstered by new product drops and the company’s expansion into apparel: Web traffic to On’s site is up 32% from a year ago, signaling continued demand that could drive another strong quarter.

The key question for investors: Can ONON keep delivering high growth while improving margins? Especially with the stock – and expectations – so high.

Despite last quarter’s record revenue, earnings missed estimates due to high investment costs. Management needs to balance scaling up with profitability. But if fourth-quarter numbers come in strong, the stock has room to run.

Lululemon (LULU): Earnings Preview

- Stock Performance: -17% YoY

- Web Traffic: +11% YoY

- Next Earnings Report: March 20, 2025* (unconfirmed)

Lululemon has been a powerhouse in premium activewear. Last quarter, revenue grew 9% year over year, and management raised holiday-quarter guidance, now expecting 11% to 12% growth. The company has steadily expanded internationally, with strong performance in China and Europe.

Investors will be watching margins closely – LULU has held an industry-leading ~20% operating margin, and recent reports suggest the company has effectively managed inventory levels, reducing the need for excessive discounting.

LikeFolio data shows consumer engagement remains high: Lululemon’s web traffic is up 12% in the last month following a strong holiday performance.

The Key Takeaways for Investors

At LikeFolio, our singular goal is to help you make money by keeping you ahead of the market – and we do that with proprietary consumer-driven insights Wall Street is largely missing out on.

What we’ve learned:

🔑 Luxury Demand Remains Strong

Recent earnings from Ralph Lauren, Coach-parent Tapestry, and even the post-COVID laggard Peloton, confirm premium consumers are still spending. This trend bodes well for ONON and LULU – especially considering recent LikeFolio data.

🔑 ONON and LULU Are Both Gaining Momentum on Main Street

Both On and Lululemon have solid fundamentals. Anyone could tell you that. But WE know that both On and Lululemon are seeing rising web traffic in real time – our best measure of forward-looking consumer demand.

🔑 Earnings Beats Could Fuel Further Gains for These Stocks

The fact that RL, TPR, and PTON shares all moved higher on their recent reports suggests a pattern we can leverage – investors are rewarding companies effectively capturing this demand. With more than a decade of historical data and trading experience under our belt, we’re confident that ONON and LULU’s momentum could translate to earnings beats when they go to report in March – and fuel further gains for data-driven investors like you.

To be clear: We never mistake our data for a crystal ball. Nothing is ever guaranteed. But with this knowledge – backed by data – you’ll be a step ahead of the crowd… while the rest are left guessing.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Shopify’s Next Growth Era: AI-Powered Commerce

Shopify is leveling the commerce playing field with AI – and changing the game for good. Here’s how…

It’s Make or Break for Our Favorite Ugly Shoemaker

Crocs has something to prove as its stock hits 52-week lows. Here’s what we’re watching…