Grill masters stocking up for their Memorial Day cookout were in for a rude awakening at the checkout counter this year.

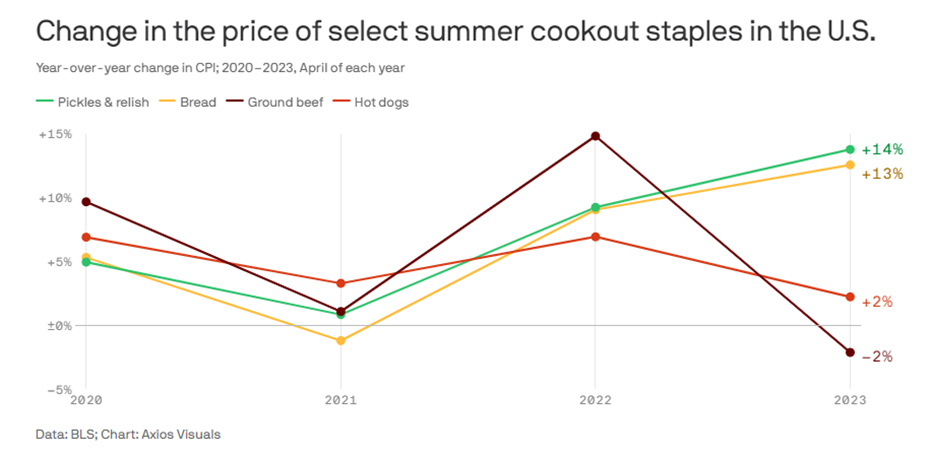

The price of soft cushy hamburger buns? Up 13%. Those beloved briny pickles that complete any burger worth scarfing down? Tack 14% onto last year’s price.

And don’t even get me started on ketchup. A 32-ounce bottle would’ve set you back nearly 28% more than it did in 2022.

That’s right: Despite cooling inflation rates for food-at-home purchases, data from the Bureau of Labor Statistics shows grocery bills are still shaking out 7% higher than a year ago.

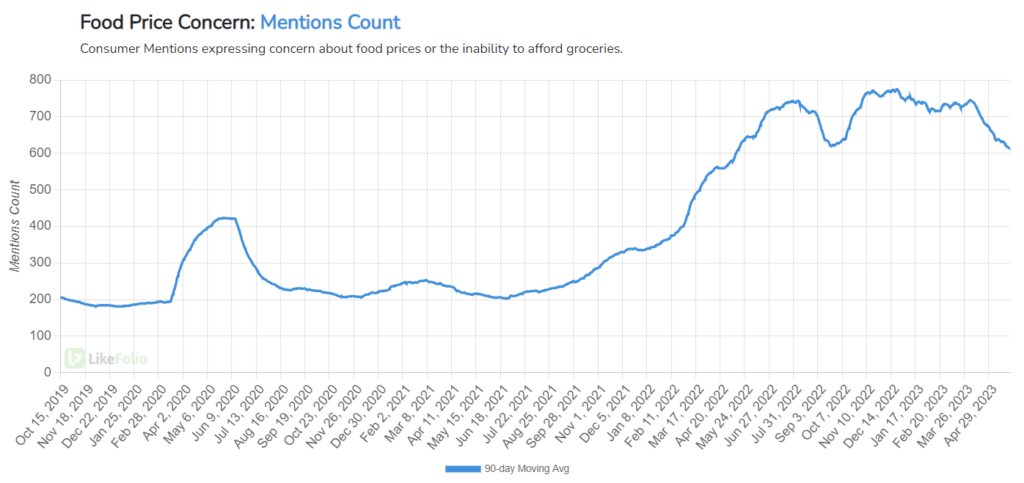

And LikeFolio data proves those costly trips to the market are still taking their toll on consumers, with food price concern mentions remaining 191% higher on a two-year basis.

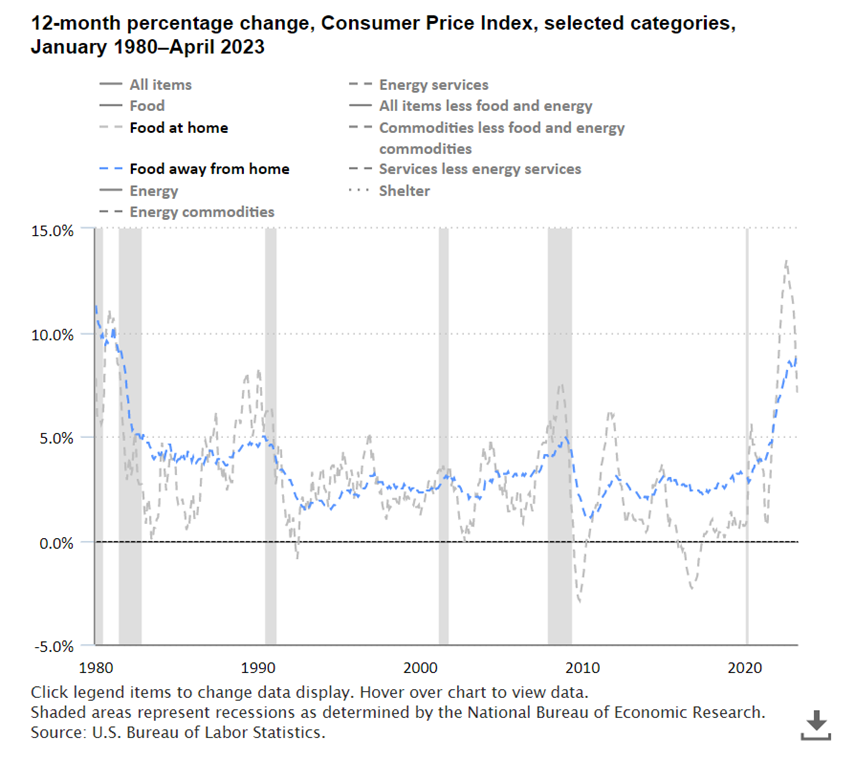

But as expensive as those DIY Memorial Day hamburgers might’ve been – that’s nothing compared to the sticker shock of grabbing one at a sit-down restaurant right now.

For the first time in this post-pandemic inflationary economy, restaurant menu prices are running hotter than grocery prices at an even greater 9% year-over-year increase, according to BLS data:

Look, if I’m gonna pay up for a meal out, I don’t just want quality food – I want innovative menu offerings, tasty beverages, and most of all, stellar service.

And it’s not just me.

Fed up with high menu prices, consumers are getting picky about where they dine out. And certain brands simply aren’t making the cut anymore.

Words like “overpriced,” “undercooked,” and “slow service” are becoming more common in social media discussions around a handful of staple restaurant chains.

At the same time, many of these names have seen their stock prices rally by double-digits over the last year.

But our forward-looking consumer data shows trouble brewing in the restaurant industry.

And investors that buy into the hype on these “overcooked” restaurant stocks may get burnt…

Food Price Concerns Threaten Popular Restaurant Stocks

For months, the cost to prepare food at home was greater than the perceived cost to go out to eat.

Couple that setup with a consumer preference toward experiences, and you can feel the casual dining tailwinds at your back.

The problem is – that narrative has shifted.

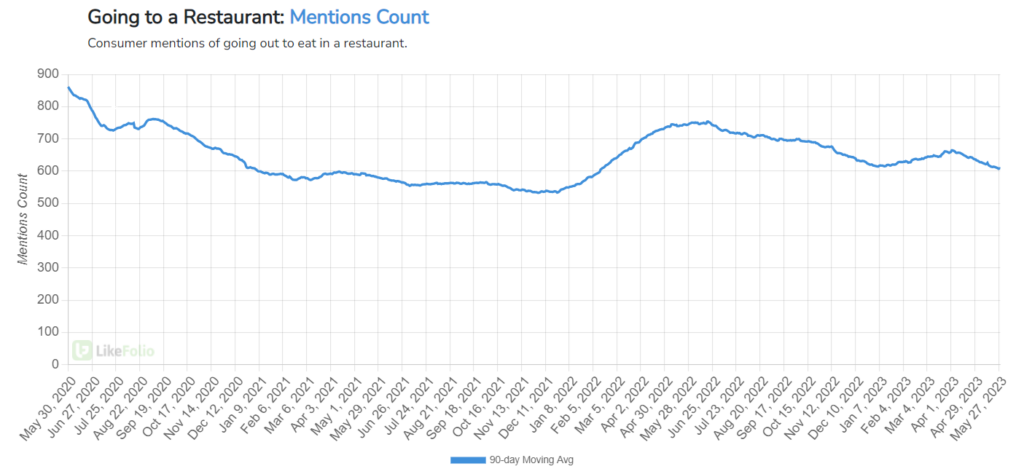

Consumer mentions of going out to a restaurant to eat have slipped by 19% year-over-year after showing resilience in 2022.

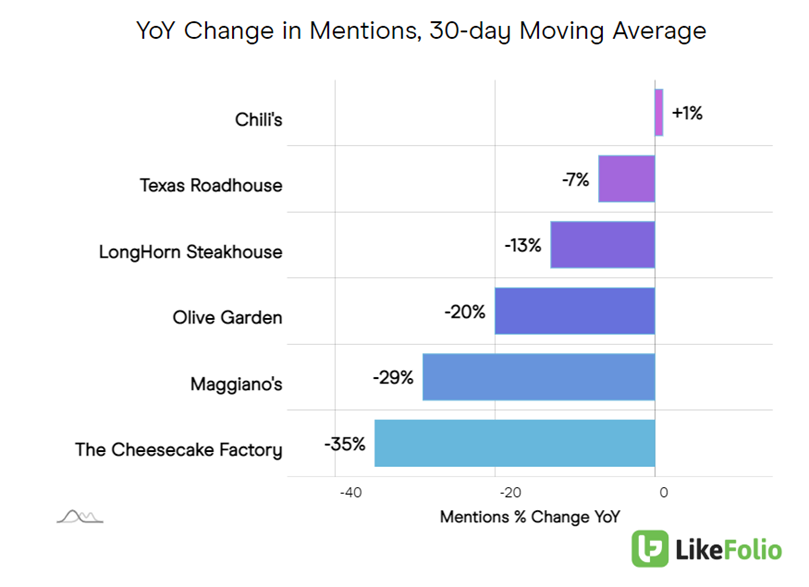

And this trend is taking a real toll on consumer demand. Check out the dramatic decline in consumer mentions of these popular restaurant names:

Brinker (EAT)-owned Chili’s is the only one “up,” if you count 1% as a gain, while mentions around its Maggiano’s chain are down 29%.

Texas Roadhouse (TXRH) mentions are down by 7%.

Darden’s (DRI) premier brand, Olive Garden – which accounts for 50% of company sales – has seen mentions slide 20% while mentions of LongHorn Steakhouse have declined 13%.

And The Cheesecake Factory (CAKE) is logging the biggest lag in mentions – down 35% over the same period.

Yet when it comes to their stock prices, most of these names are trading higher than they were a year ago…

- DRI (Olive Garden, LongHorn Steakhouse): +28%

- EAT (Chili’s, Maggiano’s): +29%

- TXRH (Texas Roadhouse): +38%

Well, except for CAKE (Cheesecake Factory), which has lost 4%.

With a growing divergence between stock market performance and consumer demand, we’ll be watching for the bearish opportunities emerging in the restaurant industry.

Until next time,

Andy Swan

Co-Founder