Electronic vehicles (EVs)… e-commerce and global payments… gaming and entertainment… cryptocurrencies.

Each one of these is a big new market with high rates of growth that are projected to reach out for years.

Each opportunity has one or two tech heavyweights that are widely viewed as the “market leader.”

And each one of those “leaders” is generally viewed as a great cash-in candidate – companies whose shares can electrify your portfolio.

How can you argue? After all:

- The global EV market is forecasted to zoom from producing 8.15 million vehicles in 2022 to 39.2 million in 2030, a compound annual growth rate of 21.7%, says MarketsandMarkets Research. And Statista projects EV market revenue will skyrocket from $61.2 billion this year to $139.1 billion in 2027, a 22.8% CAGR over an even shorter stretch.

- “Social commerce” sales – a specialized subset of e-commerce – will nearly triple from $492 billion in 2021 to $1.2 trillion in 2025, making it the hottest new sales channel, says researcher globalpayments.com.

- The global online entertainment market will soar from $297.5 billion in 2021 to $865.6 billion by 2027, a CAGR of 18.8%, says Expert Market Research.

You get the idea.

Choose the right company – the right stock – and any one of those markets is enough to ignite your investing returns.

But here’s a little secret we want to share…

There’s one tech player whose business cuts across each of those markets. In fact, this company is a behind-the-scenes player whose “enabling technology” makes these markets go.

And the story gets better still.

Because there’s one more market we haven’t mentioned – and it may be the hottest market of them all.

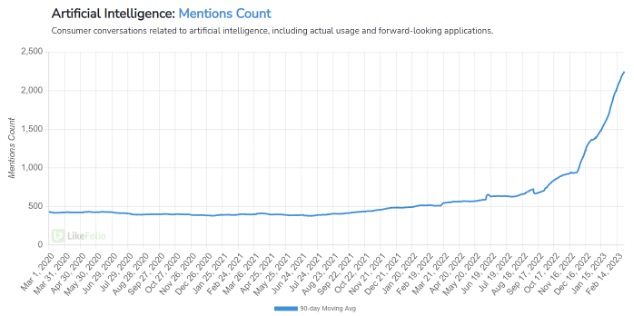

I’m talking about artificial intelligence or AI. It’s a market that – thanks to innovations like ChatGPT – is dominating the headlines right now, and in turn, dominating consumer consciousness. The AI market was valued at $86.9 billion last year and is projected to grow 36% a year to reach $407 billion by 2027. And this “enabling tech” firm is essential to that market, too.

We’re going to tell you about this AI catalyst firm here today – and how the tech firm is showing up on our radar, too…

The ‘Secret Sauce’ AI Stock

The company in question is Nvidia (NVDA), an innovative chipmaker that reaches into high-tech vehicles, gaming, e-commerce, cybersecurity, cryptocurrencies, cloud computing, online entertainment, and more.

This “OG” of the computing industry, having invented the GPU (graphics processing unit) way back in 1999, has gone on to manufacture some of the world’s most advanced computer chips and graphics cards.

And AI – or “machine-learning” – is yet another promising opportunity it’s tapping into.

The Santa Clara, California-based Nvidia is a market leader in graphical-computing semiconductors. There’s a lot of crossover in its “secret sauce.” For instance, its visual/graphical/computing technology offers elevated security, and that added level of safety has uses in digital payments, cryptocurrencies, cloud computing, and outright cybersecurity.

Nvidia’s chips serve as the brains of “autonomous” vehicles – Silicon Valley lexicon for “driverless cars,” aka vehicles that are able to guide or drive themselves do so because they “learn” – get smarter – as they operate. That’s a form of machine learning, or AI, which has all sorts of other uses, too.

And that puts Nvidia in the “sweet spot” of AI.

“Every time you use a wayfinding app to get from point A to point B, use dictation to convert speech-to-text, or unlock your phone using face ID…you’re relying on AI,” consultant Accenture Inc. wrote in a recent analysis. And companies across industries are also relying on – and investing in – AI…to improve customer service, increase efficiency, empower employees and so much more.”

Corporate leaders are seeing the light. In 2021, executives of the world’s 2,000 most-valuable companies who talked about AI on their earnings calls were 40% more likely to see their stock price rise, Accenture found. That’s up from 23% in 2018.

But “when it comes to making the most of AI’s full potential and their own investments, most organizations are barely scratching the surface,” the consultant said.

Here’s how our system has spotlighted Nvidia’s shares.

Consumers Are Zeroing in on Nvidia

We’re big fans of Nvidia here at Derby City Daily – and that’s because we see massive opportunity for growth.

In January, we identified NVDA as a high-value stock whose shares have been way oversold, meaning its current stock price was nowhere near reflective of how much value this company is delivering.

Since then, its stock price has rebounded a solid 37%. (That didn’t take long.)

Buzz for Nvidia is climbing too, with social media mentions gaining 19% from last year:

And that buzz is translating into real demand, currently being driven by consumer-facing products like its GPU chips, and pacing 17% higher on a year-over-year basis:

Nvidia has often fallen victim to its own success.

We saw its stock come back to earth after massive gaming and crypto booms over the last three years.

But the key moving forward: Not only is Nvidia best in class when it comes to chip technology, but it’s powering major developments in one the fastest growing trends in the LikeFolio universe:

Artificial intelligence.

And that gives Nvidia real staying power as an investment opportunity.

Enjoy,

Andy Swan

Co-Founder