How we consume television has evolved dramatically over the past decade as folks ditch costly cable packages for an array of streaming services that allow them to watch what they want, when they want, from just about anywhere there’s an internet connection.

You can see how each year since 2015, streaming has eaten away a significant chunk of traditional TV’s market share – with 90% of today’s viewers now beaming a show directly into their living rooms:

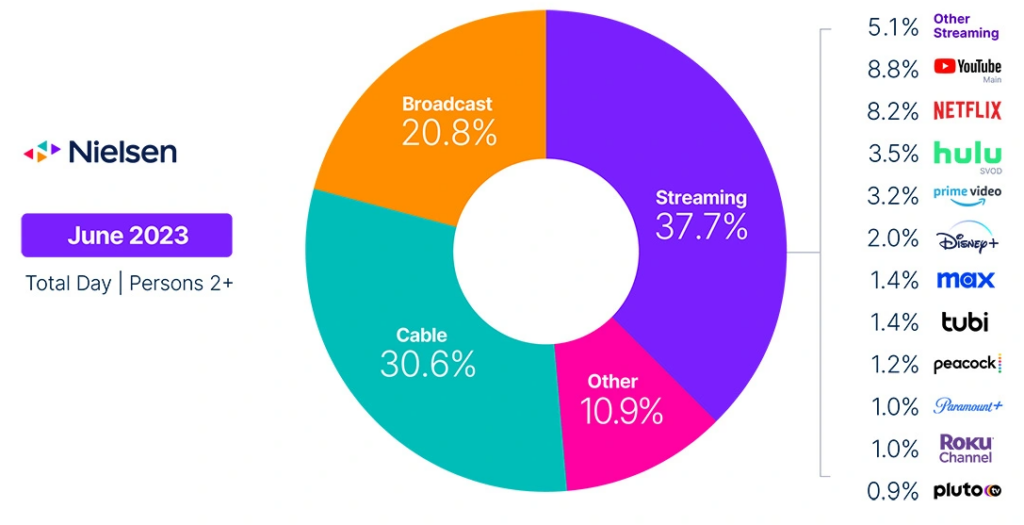

The latest Nielsen TV usage report revealed 37.7% of total TV viewing happened through streaming – representing a new record.

Netflix (NFLX), Roku (ROKU), Hulu, Peacock, Disney+, and now Max… folks now have endless options for consuming their television… and consume they do.

Between July 10 and July 16, Americans spent nearly 3.7 billion minutes – yes, billion – just streaming the fictional law show “Suits.”

What most of those folks didn’t realize while binging that legal drama for the thirteenth time is that every time a new episode queued up, a rapid auction was taking place behind the scenes to decide which ad they were going to see.

These auctions happen in a matter of milliseconds and leverage incomprehensible amounts of data to feed you just the right ad at just the right time.

That eerie moment when you’re chowing down on your favorite snack and an ad for that exact brand pops up? That’s what I’m talking about here.

And the mastermind making it all happen? A company called The Trade Desk (TTD).

Take a look at how the seismic shift from traditional TV to streaming has opened up the opportunity of a lifetime for this company – and for the folks who own shares today…

How TTD Capitalizes on This Shift

TTD is a digital advertising platform that allows advertisers to manage and optimize their campaigns across various channels efficiently.

At least, that’s the jargony explanation you’ll find on the internet.

Here’s another way to think of it.

Rather than blindly placing ads and hoping they’ll catch a buyer, like they did way back when, we now have data – and lots of it.

TTD found a genius way to harness all that data with sophisticated algorithms to ensure ads reach their desired audiences with pinpoint accuracy.

The company acts as a bridge that connects advertisers (other companies looking to sell their products and services) with potential audiences.

With massive user bases and a captive audience, streaming platforms like Roku are a goldmine for a company like TTD.

Roku provides the space, and TTD ensures that the right ad fills that space, targeting the viewer with content that aligns with their preferences and browsing habits.

But what really sets TTD apart is its AI.

TTD integrated AI into its platform well before the term caught fire with consumers. Its AI engine Koa scours the vast expanses of the internet, processing over 600 billion daily queries to offer insights that advertisers dream of.

Kokai takes that a step further, with a digital media buying powerhouse that harnesses deep learning and handles a whopping 13 million advertising impressions every second.

It’s a game-changer, assisting advertisers in making split-second decisions to get the best bang for their buck.

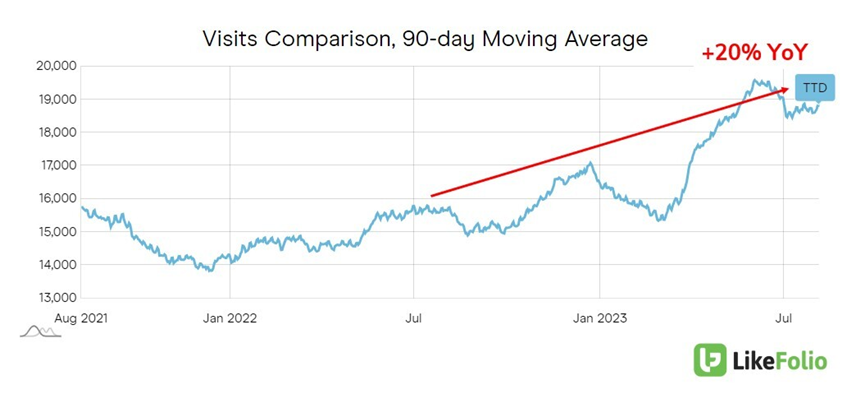

And here’s proof: Web visits surged 20% year-over-year following Kokai’s launch…

While Consumer Happiness rocketed a full five points higher from last quarter:

Happy customers today = growth tomorrow.

The Momentum Is Palpable

TTD reported blowout earnings this week, including 23% year-over-year revenue growth, a 40% boost to earnings per share, and an incredible 95% customer retention rate, all of which surpassed analyst expectations.

It’s clear TTD is outpacing the broader digital ad market.

And yet the stock price slid following the announcement.

We expect this to be a fleeting dip – similar to what we saw after last quarter’s earnings beat.

Because that sky-high customer retention rate wasn’t a one-time deal: it’s been a consistent trend over the past nine years.

As the world transitions further into the streaming age, TTD’s unique offerings and unwavering commitment to innovation position it as a clear winner in the ad-tech space.

Bottom line: TTD’s trajectory looks promising, both in the short and long term. The stock has already returned 40% since we first named it a favorite here in Derby City Daily. And we’ll happily use this dip in the stock price to scoop up more shares.

I’ve already got another opportunity lined up for you today that’s capitalizing on the same AI and streaming tailwinds as TTD. Riding the hottest investing trends of the year – but trading at just $2 a share – this stock looks like one heck of a bargain right now.

Click here to grab the details this weekend.

Until next time,

Andy Swan

Founder, LikeFolio