On Black Friday, Americans kicked off a record holiday spending spree when they shelled out an estimated $9.8 billion – just online.

Then, Cyber Monday eclipsed that number with an estimated $12 billion in online sales.

That’s because e-commerce retail now makes up a significant portion of our holiday shopping routine. As a share of total retail sales in the U.S., e-commerce made up 16.3% of last year’s fourth-quarter haul:

Now, with less than a week to go before the big day, the “last-minute” gift-buying panic is setting in. Folks are calculating delivery times, seeing that “Arrives after Christmas” notice, and realizing time is running out.

Make no mistake: The 2023 holiday spending spree is far from over.

At LikeFolio, we’re checking our list to see which companies are thriving this season. And for our money, there’s one clear winner…

This company amassed collective sales of $4.2 million per minute during peak Black Friday shopping on November 24.

Since we recommended the stock to our paid-up LikeFolio Investor subscribers, it’s delivered 80% gains. And we expect more where those profits came from.

Here’s the full story on the stock topping our Nice List this year…

On the Nice List: Shopify (SHOP)

Shopify streamlines e-commerce by providing an all-in-one platform that integrates efficient shipping management tools, partnerships with leading delivery services, and advanced analytics to help online businesses optimize their logistics and supply chain operations.

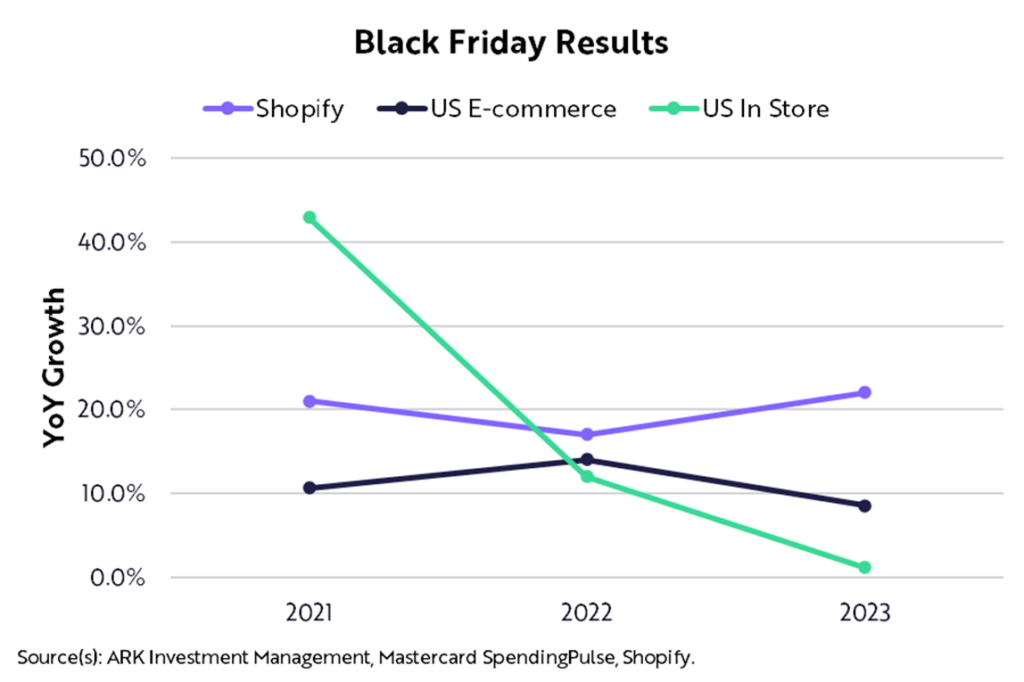

Shopify’s merchants achieved a record $4.1 billion in sales on Black Friday, marking a 22% increase from the previous year and significantly outpacing overall retail growth.

This e-commerce platform is outperforming both in-person shopping and online shopping trends at large. You can see this trend for yourself below:

Shopify’s impressive holiday shopping performance sent shares surging to their highest level in over a year, upwards of $77 a share as I write this.

That means our LikeFolio Investor subscribers are looking at an 80% gain, thanks to our early April 2022 recommendation.

From here, Shopify’s prospects continue to look promising.

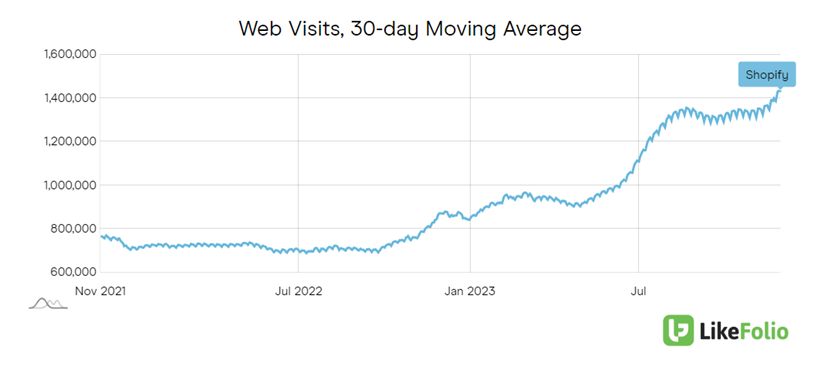

LikeFolio analytics show web visits rising significantly through the winter season:

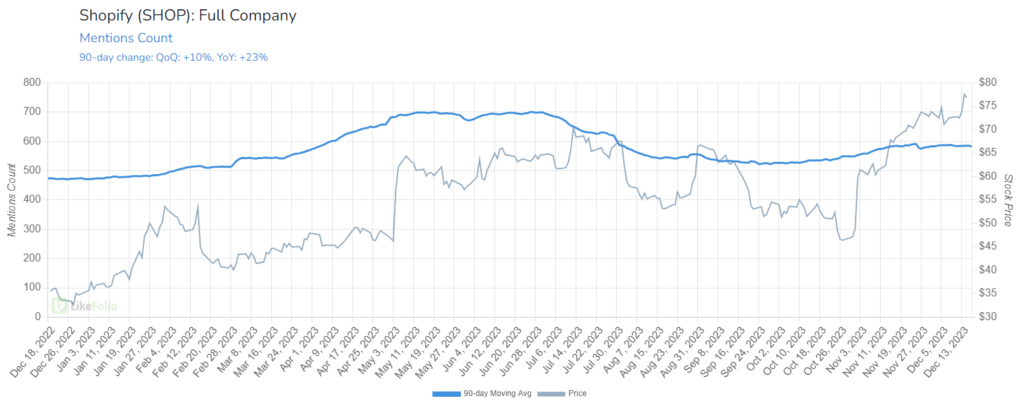

Even after a strong summer, Shopify mentions have continued to rise by 23% year over year, supporting a sustainable growth trajectory.

(Mentions are from consumers checking out with Shopify Pay and from merchants utilizing Shopify to meet business needs.)

The takeaway: Shopify is well positioned to grow as e-commerce becomes more and more relevant for consumers.

Online shopping prevails across all demographics, especially among Millennials, with 55% making online purchases in 2022.

Looking forward, it’s making a strategic investment in Faire, a wholesale platform valued at $12.59 billion, aiming to enhance its merchant services by integrating Faire’s technology.

This partnership not only expands Shopify’s market reach but also provides its merchants with a unique opportunity to connect with wholesale buyers, strengthening its position in the e-commerce industry.

- SHOP Outlook: Bullish

Discover the next Shopify as soon as it hits our radar with real-time profit alerts from LikeFolio Investor.

Until next time,

Andy Swan

Founder, LikeFolio