The U.S. advertising market is finally on an upswing. After a slow start to the year, forecasts are now predicting a 5% uptick in ad spending in 2023.

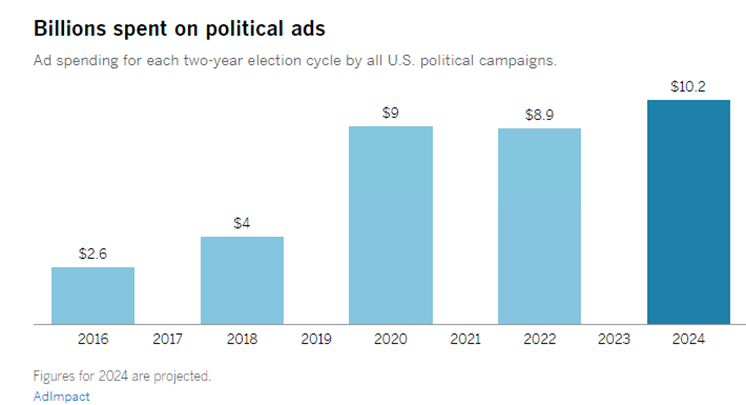

And that’s nothing compared to what’s coming in 2024 – when the new election cycle will drive a record-breaking political ad spending spree expected to top $10 billion.

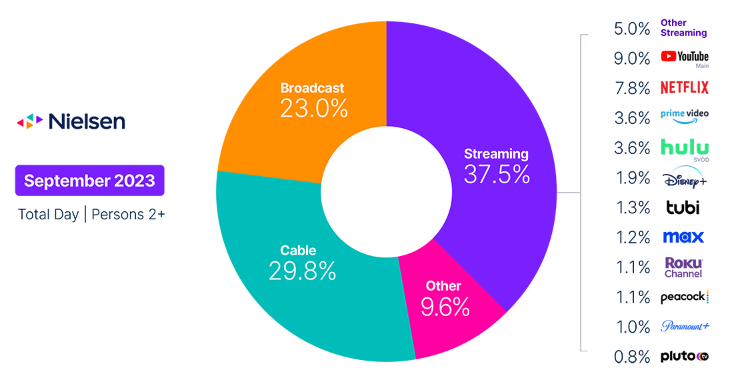

Those advertisers will be looking for a captive audience where they can get the best bang for their buck. And with streaming now capturing the bulk of TV viewership, the choice is clear.

As advertisers increasingly allocate more budget towards digital platforms versus traditional cable, the streaming companies attracting the most consumer eyeballs stand to gain significantly… while investors who bet on the right names reap the profits.

A tiny streaming player like this one, with its industry-leading Consumer Happiness near 87%, looks like one heck of a steal under $3.

The more established Disney+ (DIS) makes an exciting opportunity, too, as its ad-supported tier attracts millions of new subscribers.

But the company we’re bringing you today could be in the most lucrative position yet.

In addition to offering a wide range of content through its popular digital channel, this streamer also sells hardware – and that dual role gives it a unique value within the crowded streaming sector.

And LikeFolio data suggests the company is already gaining steam. Take a look…

Roku’s Uniquely Profitable Position

Roku (ROKU) has come a long way since launching its first digital streaming device in 2008. That model, the Roku DVP N1000, was developed in partnership with Netflix (NFLX) – now arguably one of Roku’s largest competitors.

The idea was to give consumers an affordable way to stream their favorite shows with a standalone device that was a fraction of the cost of the traditional game consoles of the time.

By the end of 2022, Roku claimed the largest streaming operating system (OS) in the U.S., dominating in market share over behemoths like Amazon.com’s (AMZN) Fire TV, Alphabet’s (GOOGL) Android TV, and Apple’s (AAPL) Apple tvOS.

With that success, the company has expanded its hardware offerings to include its own line of smart TVs, speakers, and smart home devices.

The Roku Channel – its core streaming service – gives users access to a massive platform of free and premium content, including original series like The Great American Baking Show with Paul Hollywood and even award-winning movies like Weird: The Al Yankovic Story, starring Daniel Radcliffe.

Consumers can also access upwards of 39,000 apps through the Roku Channel Store, which is the most of any other streaming platform out there right now.

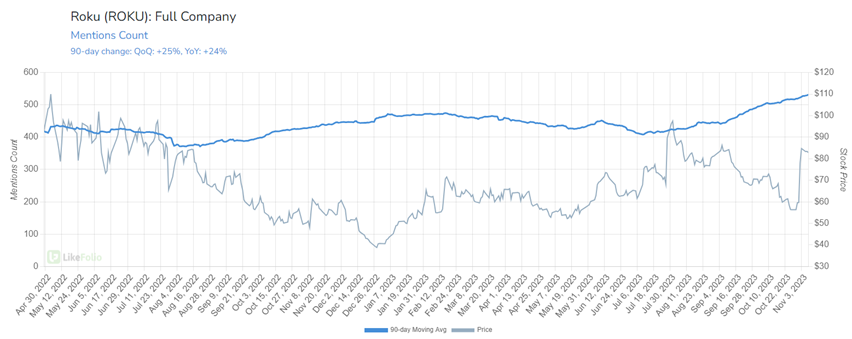

We’ve been keeping an eye on Roku as its momentum builds on Main Street and can tell you that consumer mentions around the company have shown notable growth – gaining 24% year over year:

But here’s where it gets really exciting.

The Ad Spending Catalyst

On November 1, the streaming giant not only posted a surprise core profit for the third quarter but also projected higher-than-expected quarterly revenue, logging over 100 billion in streaming hours over the three-month period.

ROKU shares soared upwards of 30% in the 24 hours following that earnings report… and at today’s open price of $87.60, are now up 46% in a matter of two weeks.

This positive trend is not limited to Roku.

Remember that Disney’s ad-supported Disney+ products grew by approximately 2 million subscriptions in the fourth quarter to a total of 5.2 million in another recent earnings report that sent shares soaring.

More than 50% of those new U.S. subscribers chose an ad-supported Disney+ product. And over the past six months, those folks spent 34% more time watching the service.

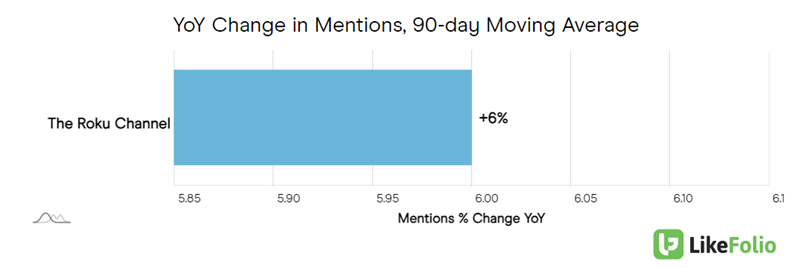

Similarly, Roku’s success is amplified by its strategic push toward original content on its streaming channel, which attracts both subscribers and advertisers.

LikeFolio data shows buzz around The Roku Channel ticking 6% higher on a year-over-year basis:

And the upcoming election cycle adds another layer of potential growth for Roku.

Political ad spending traditionally surges during these periods, and the 2024 cycle will be no exception – expected to set a new record topping $10 billion.

Streaming will be a big target for those dollars.

And with its advanced targeting and analytics capabilities, Roku is well-positioned to capture a significant portion of this spending.

Bottom line: As traditional TV fades, Roku’s platform offers a compelling alternative for investors who want to play a rebounding ad market higher.

There’s another big winner here set to benefit from the same surge in ad spending as Roku – but at a fraction of the market cap; this $3 stock could hold even bigger upside for investors in 2024.

Until next time,

Andy Swan

Founder, LikeFolio