Hasbro (HAS) turns 100 this year.

It’s been a special journey.

The Pawtucket-based toymaker is a cultural icon that made memories for generations of Americans thanks to brand names like Monopoly, Twister, Transformers, Play-Doh, Nerf, Milton Bradley, Parker Bros, and G.I. Joe.

But it’s a New Age with new challenges for the $29 billion U.S. toy industry.

Electronic devices are muscling aside the board games so many of us gathered our families around in our own youths.

Video games, smartphones, and tablets are now the go-to fun sources and time-consumers for kids.

Complicating this digital shift is the sad reality that kids are growing up faster these days. They quickly tire of the toys and games that entertained so many of us for years – a phenomenon that’s been dubbed “age compression.”

Hasbro has refused to get left behind. It’s adapted. And it’s found a way to win:

- By going digital itself

- By turning to an unlikely set of customers for growth: The “Kidult”

- And by leveraging demand for box-office brands through savvy licensing agreements.

LikeFolio’s proprietary data is telling the tale too.

Hasbro has infused new leadership talent across the top of the company – a key reason it’s leading the toy industry’s digital shift and capitalizing on pop-culture fandom.

It has plenty of room to grow, especially internationally.

Last year’s acquisition of D&D Beyond added “Dungeons & Dragons” — the world’s biggest role-playing game — to the Hasbro portfolio.

And social media is buzzing about the latest Hasbro stuff and this summer’s launch of the D&D streaming channel.

So, with the stock down and the dividend yield high, we are playing the “Magical Gains Ahead” card… And dealing “Kidults” into the game.

Let me show you why at 100, Hasbro still has some magic up its sleeve for investors…

Going Digital

Companies like Hasbro that are rolling out electronic games – and digital versions of classics – are winning. While archrival Mattel (MAT) and others that are late to the game are falling behind.

For example:

- An app version of “Magic: The Gathering” recently became Hasbro’s first billion-dollar brand.

- And a digital take on the hugely popular “Dungeons & Dragons” role-playing game is now garnering buzz on social media.

Together, these brands ignited 12% growth in digital gaming sales in Hasbro’s first quarter – offsetting an inventory glut of traditional toys. Though earnings missed, Hasbro’s $1.001 billion in revenue blew away estimates of $876 million.

And upcoming innovations like a D&D virtual tabletop will continue to capture players’ hearts – and wallets.

Bottom line: Hasbro is deriving growth from digital games even as retailers continue to flush out excess inventories of traditional toys.

The Nostalgia Factor

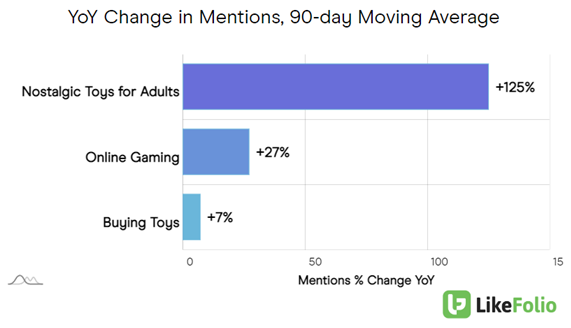

With “Kidults,” we’re talking nostalgia – about grownups whose tastes in current entertainment or media are more suitable to kids.

It’s a trend.

And it’s big.

Really big.

Thanks to these rejuvenated commitments to nostalgic pop culture, the collectible slice of the toy market has exploded: It was worth $426 billion last year, says researcher Market Decipher. And that’s expanding the opportunity set for toy manufacturers like Hasbro.

Nostalgic action figures and games tied to hit movies and TV shows are blurring the line between pop culture and toys – and have become an especially hot ticket item for adult consumers.

Strategic Licensing Agreements

According to The Toy Association, licensed toys and games account for nearly one-third of overall toy sales. No wonder toymakers like Hasbro are keenly tuned into highly-anticipated movie and streaming releases.

Hasbro is tapping into this demand by forming licensing agreements with successful box office blockbusters and TV franchises like “Super Mario Bros” and “Star Wars.”

It is also cranking out content of its own. “Transformers: Rise of Beasts” drops on Paramount this month.

Can't wait to see Rise of the Beasts #Transformers

— Isaac Parris (@IsaacParri25278) June 7, 2023

The company’s direct-to-consumer website, Hasbro PULSE – using the tagline “where fans come first” – gives “superfans” a convenient place to shop for Star Wars, Transformers, Marvel, and other popular film-based products.

Customers are loving the vibrant colors and details of the products as well as the fast shipping and eco-friendly packaging materials.

Ahh!!!!! 😄😄😄 I got myself a Power Rangers In Space Astro Megazord (Zord Ascension Project)!!! It’s so cool!! 🤩🤩🤩 The detail, the paint job, the weapons!! So awesome 😎#powerrangers #megazord #hasbro pic.twitter.com/cpDIUhB3EC

— Danny Kramer – Voice Actor (@DannyKramerVO) May 13, 2023

For any fans of the old school Avengers, @Hasbro has been giving some incredible love lately. #MarvelLegends pic.twitter.com/bEUm2uyXNT

— Mike Ott (@ottermymind) May 13, 2023

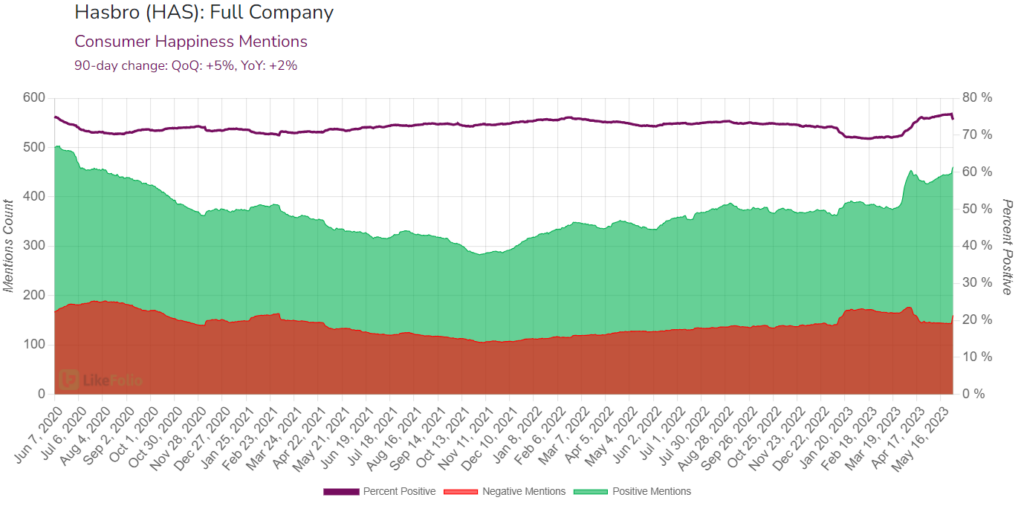

LikeFolio Data Around HAS Is Strengthening

Thanks to improved product availability through Hasbro PULSE – along with excitement over this summer’s 24/7 D&D TV channel launch – Hasbro’s Consumer Happiness trounces its peers at 75%.

Better yet, comprehensive demand for Hasbro products has increased in each of the last five quarters thanks to the box office success of “The Super Mario Bros Movie” and other fresh takes on classic character stories.

JUST IN: “The Super Mario Bros. Movie” has surpassed “Frozen” to become the 2nd highest-grossing animated movie of all time. The movie has made $1.288 Billion globally 🍿🎬💰 pic.twitter.com/VHXxI8rzCj

— Daily Loud (@DailyLoud) May 31, 2023

Consumer mentions of buying Hasbro games, toys, and trading cards hit a post-pandemic high in last year’s fourth quarter. And they have kept trending higher here in 2023 as an expanding lineup of digital games – including a digital version of the popular “Magic: The Gathering” trading card game – generates consumer buzz.

A Compelling Growth-and-Income Play

Forecasts have Hasbro reporting top-line growth in the third quarter, which is when the company will have easier comparisons in time for the holiday shopping season.

Management’s “Blueprint 2.0” strategy keys in on cost-cutting and higher-margin brands. It’s already off to a good start. And the improvements should fatten Hasbro’s bottom line over the next few years.

The stock currently trades at roughly $60 a share – having ranged between $45.75 and $89.26 over the past year.

Current estimates have a consensus one-year target price of $73.50 on HAS with targets running as high as $89.

An added benefit: Hasbro’s shares are yielding a hefty 4.67% right now. And that payout has been boosted for 18 straight years.

That wealth formula is nothing to toy with.

And make no mistake: Hasbro is a gamer.

Until next time,

Andy Swan

Founder, LikeFolio