In the 2022 horror flick, Barbarian, a young woman on a business trip goes to check into her Airbnb (ABNB) rental – only to find it’s been double-booked by a stranger.

The listing also neglected to mention the neighborhood is largely abandoned and lurking with shady characters. It’s the middle of the night and pouring down rain. And all the hotels in the area are already booked up.

Rather than sleep in her car, she decides to take the risk and stay with the nice enough looking man… and things take a twisted turn.

Part of what makes Barbarian so terrifying is that it plays on a modern-day fear that’s based very much in reality: The “Airbnb Horror Story.”

From a group of women finding a bat-infested castle house in Michigan to travelers driving cross-country, only to have their reservations cancelled, leaving them stranded and financially burdened… (Sound familiar?)

With these stories, we’re no longer in the realm of fiction. These are real-life horrors associated with Airbnb. And they’re everywhere.

Fortunately, I’ve never had one of those scary incidents as an Airbnb user.

But I have noticed two key things:

- Airbnb’s pricing can be significantly higher than direct bookings – a personal comparison for a three-night stay revealed a $600 difference.

- And this markup, once widely recognized by users and property managers, could reasonably lead to a loss in sales for Airbnb. My own booking decision (hint: not through Airbnb) reflects this sentiment.

Thing is, these stories, and my experience, aren’t just isolated incidents.

They’re indicators of a deeper issue with Airbnb’s business model.

And this LikeFolio data reveals a troubling tale for investors…

Trending Opportunity: AI Microcap Bursts 25% Higher in November

Our favorite AI moonshot is moving higher – but you can still catch it under $3 if you act fast. The stock burst 25% higher last week after one heck of an earnings performance, confirming what we’ve been saying all along: Consumer demand for this company is red hot. And the profits are only just getting started. More here.

Alarming Data for Airbnb

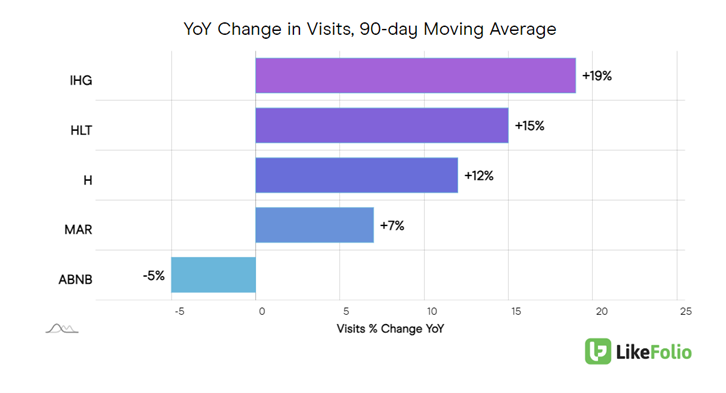

Airbnb web visits have plummeted to their lowest since October 2022, showing a 5% year-over-year decline after a lackluster summer.

Growth levels are significantly lower compared to traditional lodging options like IHG Hotels (IHG), Hilton (HLT), Hyatt (H), and Marriott (MAR).

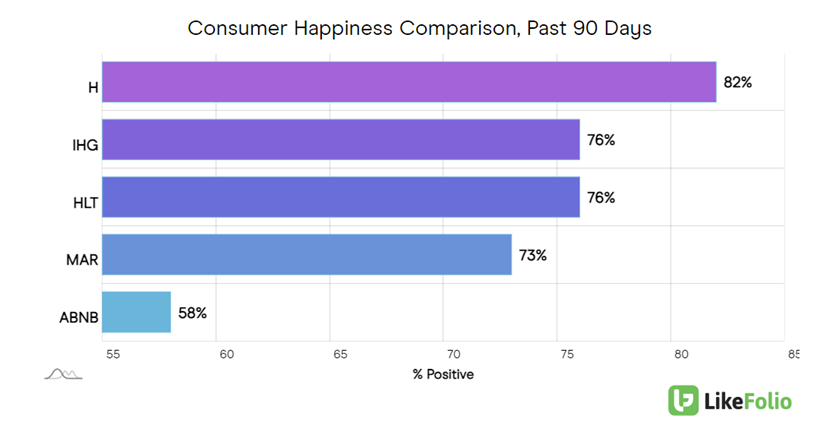

More troubling for a long-term perspective, Airbnb lags behind those traditional competitors in Consumer Happiness levels.

At a measly 58%, it’s not even close to catching up to Marriott’s 73%, not to mention Hyatt’s impressive 82% Consumer Happiness level.

The company reported its third-quarter earnings last week, which featured an 18% year-over-year revenue increase to $3.4 billion, as well as 14% year-over-year growth in bookings. Active listings were up 19%.

While the results looked rosy on the surface, a warning about volatility in the coming quarter put a damper on the market’s reaction.

CFO David Stephenson remarked: “…what we’re seeing is a little bit of softness in our overall kind of demand relative to Q3.”

Airbnb faces legislative challenges in major travel hubs that have us worried about its long-term growth prospects. In New York City, for example, Local Law 18 went into effect in September that virtually bans short-term rentals from operating.

Although the company has compensated for some weaknesses with higher prices, the strategy appears to be alienating customers.

The combination of dangerously low Consumer Happiness and sharply declining web traffic create major concerns around Airbnb.

We’re bearish on this trend and don’t see any stock price drops as buying opportunities.

There are other more promising opportunities in consumer travel for you to take advantage of, though – like the booking stock we alerted our MegaTrends subscribers to in December.

That position is already up 53%, but our latest analysis indicates it could keep soaring all the way to $5,000 by 2025… meaning it’s not too late to get in on the profits.

Paid-up members can check out the latest price target on that opportunity here.

Otherwise, you’re free to go here now to learn how to join for immediate access.

All the best,

Megan Brantley

VP of Research, LikeFolio