“Jack of all trades, master of none.”

We often use the phrase to caution against overreach.

A business that attempts to do everything may end up succeeding at… well, nothing.

Uber Technologies (UBER) defies that conventional wisdom.

The company that’s become synonymous with ride-sharing has ambitiously ventured into the broader logistics and delivery sectors.

It’s a bold strategy that sets it starkly apart from competitor Lyft (LYFT), which continues to concentrate solely on passenger transport.

And despite the conventional wisdom… that strategy seems to be working.

Uber and Lyft: Paths Diverged

Uber began as a ride-hailing startup in San Francisco in 2009 with a simple idea – to make it easier and cheaper for consumers to get where they need to go.

Lyft launched in 2012 with a similar concept – to make ride-sharing easier. And for a while, these ride-hailing apps were virtually interchangeable from a consumer perspective.

But where Lyft has pretty much stayed in its ride-hailing lane since 2012, Uber veered off on a different course.

Uber expanded into food delivery with Uber Eats in 2014, and over the next few years, would try its hand at self-driving vehicles, freight transportation, artificial intelligence (AI), peer-to-peer carsharing, helicopter flights, grocery delivery, and more.

Not every venture stuck, and this bold “move-fast-and-break-things” approach came with its fair share of controversy.

But it also helped launch Uber into the $133 billion tech behemoth we know today.

A League of Its Own

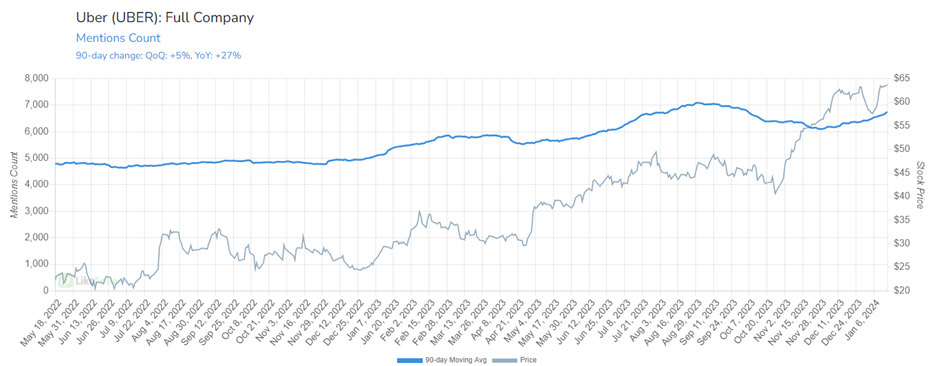

LikeFolio data sheds light on the growing divide between Uber and Lyft, which may as well be operating in different universes today.

While Lyft has seen a 22% year-over-year decline in web traffic, Uber’s has grown by 6% in the same period:

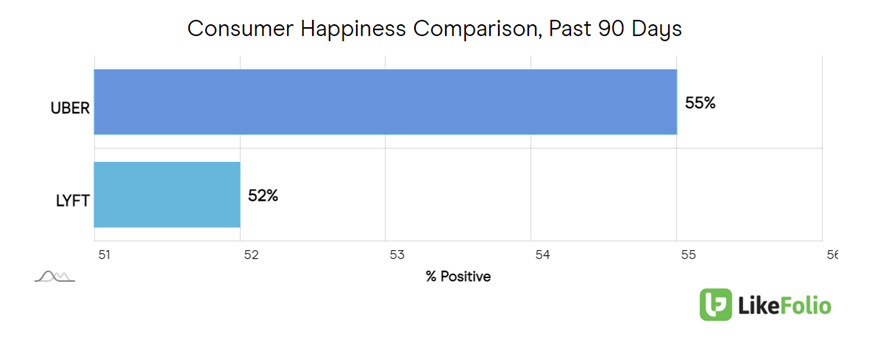

Even more telling for us is in their Consumer Happiness levels, where Uber leads by three points, and Lyft maintains a dismal 52%.

These metrics suggest Uber’s bid to engage customers beyond its original ride-sharing service is paying off.

And the market is on board: Over the past year, Uber’s shares have climbed an impressive 123%, in stark contrast to Lyft’s 10% decline.

Real Results, Ambitious Plans

While Uber missed some financial benchmarks in Q3, the bright spots outshined anything else:

- Uber passengers took 2.4 billion rides in Q3 for a new record, representing 25% year over year growth…

- Gross bookings increased 21% year-over-year, totaling $35.3 billion…

- And net income came in at $221 million – proving its profitability.

Leadership also noted continued acceleration on this front as consumers continue to spend on services instead of things.

Uber’s mobility service, aka its ride-hailing business, currently leads its delivery service in growth: +31% year over year, compared to +18% year over year, respectively.

But the company is working to improve this with a strategic plan to turn Uber Eats into a one-stop delivery solution.

Its recently announced partnership with Sprouts Farmers Market (SFM), for example, gives Uber Eats users direct access to on-demand grocery delivery. Rumors of a potential acquisition of grocery delivery service, Instacart (CART), further underscore this ambition.

What Comes Next

While LikeFolio data can’t speak to Uber’s operational efficiencies, Uber’s long-term growth trajectory looks promising.

The consistent increase in mention buzz and engagement points to a strong future, with Uber strategically positioning itself for sustained growth and leadership in the logistics sector.

Bottom line: Uber’s shift from being a mere ride-sharing service to a versatile player in logistics and delivery is a bold strategy that handily places the company in a league of its own. And right now, we are still in the early innings.

Near-term, we’re watching to see how consumer demand fares over the next few weeks ahead of the company’s earnings event on February 7, 2024. 📅 (Mark your calendars.)

The bar is certainly high. And Earnings Season Pass members will know exactly how to play UBER’s earnings when the time comes.

You can join in on the action today.

We’ve got hundreds of earnings profit opportunities coming over the next few weeks that you won’t want to miss.

Until next time,

Andy Swan

Founder, LikeFolio

New in Derby City Daily This Week

Stay ahead of the investing curve with free consumer demand insights from Derby City Daily. Here’s what’s new this week…

Make Money from New Year’s Resolutions with These 3 Stocks

Add these stocks to your moneymaking watchlist for 2024 as they capitalize on the New Year’s Resolution bump…

AAPL Unfiltered: New Data from Our Research Desk

See how the tech behemoth is faring in 2024 – before its next profit catalyst hits in February…