For nearly half of America, betting on their favorite sports team is just a few clicks away, thanks to DraftKings (DKNG).

The mobile sports betting platform was live in 25 states as of the first quarter of 2024, collectively reaching approximately 49% of the U.S. population.

It’s been a lucrative six years for online sports betting platforms since the Supreme Court opened the door for state legalization in 2018.

With every new state that goes live comes a new revenue stream. And DraftKings is a shining example, achieving 53% year-over-year revenue growth in the most recent quarter for a total haul topping $1 billion.

LikeFolio’s predictive consumer insights are keeping us at the forefront of this “mega” trend. Our proprietary stock-picking device led our followers to a 217% win on DKNG to cap off 2023. (There are more profits where those came from here.)

However, new headwinds are mounting from Uncle Sam. And once again, we’re here to keep you a step ahead…

Tax Hurdles and Regulatory Challenges

As legalization spreads, states are taking note of just how much money is up for grabs – and they want a bigger piece of the pie.

Illinois earned $1.5 billion in tax revenue from online sports betting operations and casinos in 2023 alone. That was at a flat 15% tax rate. The state just upped its earnings potential, introducing a new progressive tax rate of 20% to 40%.

If that sounds high (it is), just wait: New York imposes a stunning 51% rate.

As states raise taxes on their operations, online sports betting companies like DraftKings and FanDuel (FLUT) face significant challenges.

Potential increases in New Jersey and Massachusetts are on the table next, threatening to put more pressure on competitiveness and profitability.

DraftKings CEO Jason D. Robins warns that higher taxes might make it harder for the company to compete and potentially even send customers away from the legal gambling market. This increased tax burden may lead to cuts in marketing and adjustments in partnerships, making it harder for these companies to sustain their current growth trajectories.

Marketing incentives are essential for companies like DraftKings to entice customers to join and use their platform.

For example, DraftKings spent over $340 million on sales and marketing last quarter to build brand recognition and capture market share. That’s less than it spent the year prior as key markets matured, but it highlights the importance of initial heavy marketing investments.

Once a significant user base is established, companies can reduce marketing expenditures, shifting focus to customer retention, which improves profitability.

Future Outlook and Opportunities Ahead

Despite these challenges, taxes aren’t a death blow.

DraftKings benefits from being a major player in a growing market, which makes it more resilient to legislative shifts.

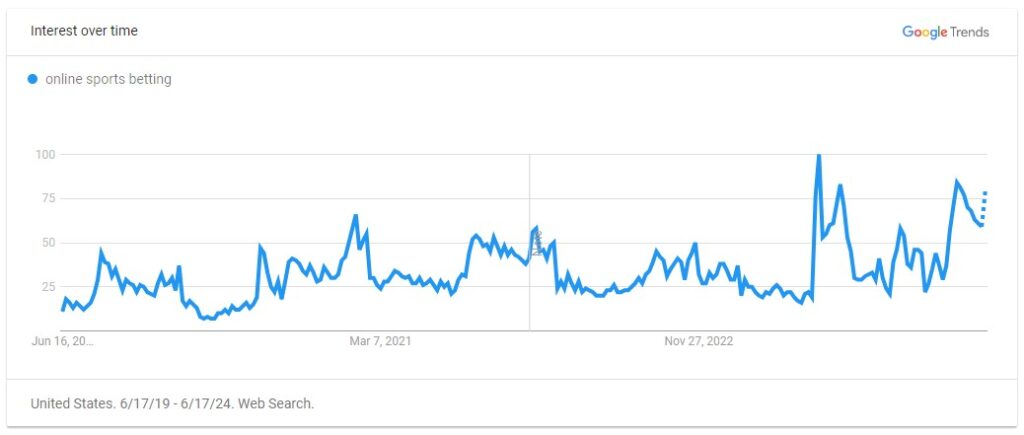

Just look at the explosion in consumer interest in online sports betting over the last year:

The success of brick-and-mortar casinos under various tax regimes suggests that higher taxes are manageable. In Europe, even with tax rates ranging from 15% to 60%, profit margins remain stable.

Analysts remain optimistic about DraftKings, with strong growth projections and positive catalysts anticipated to offset recent tax concerns.

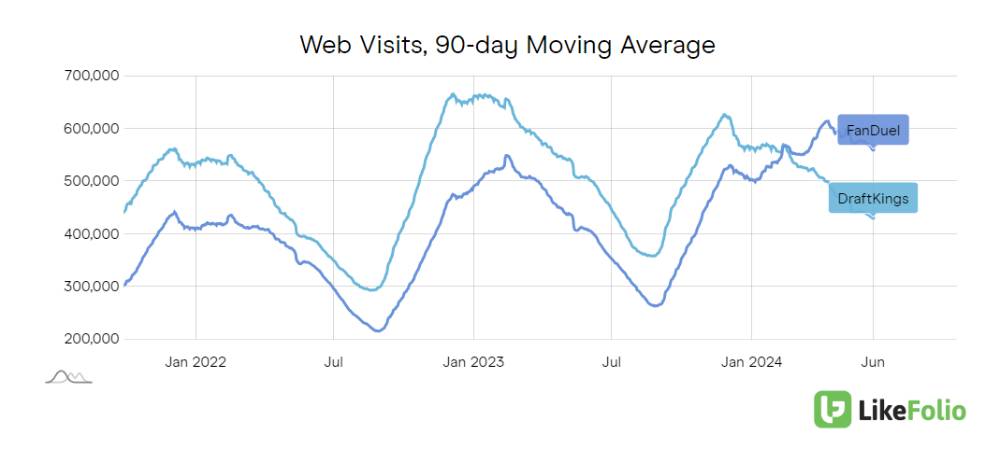

While DraftKings is currently trailing FanDuel in web visits, potentially due to less promotional activity, there is still tremendous growth potential in additional legalized markets.

We expect volatility in the near-term, especially if rising taxes slow down the company’s march to profitability. The market is watching for a permanent swing to profitability in 2025, with an expected full-year loss in 2024.

But DraftKings is still only halfway to full U.S. audience exposure. And that’s an exciting place to be.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Will AI Boost Apple’s Bottom Line – or Bust It?

Apple’s AI Play: Everything you need to know about Apple Intelligence and what we’re watching now…

Buc-ee’s Challenges Casey’s for America’s Favorite Convenience Store

Now entering: The surprisingly lucrative world of over-the-top gas stations…