Growing up in a small town, getting to eat at “The” Olive Garden was like a fancy treat.

Every August my grandmother would load me up and drive me 45 minutes to the nearest “big city.” After a few hours shopping for new school clothes, she’d treat me to unlimited salad and breadsticks.

To me, this was fine dining.

Fast forward (several) years, my tastes have evolved, and Olive Garden parent Darden Restaurants (DRI) now has a real fine-dining powerhouse under its belt with its recent Ruth’s Chris Steak House acquisition.

Ruth’s Chris officially joined Darden’s other high-end banners like The Capital Grille in June.

As the company made its play for the upscale steakhouse this summer, we were detecting a notable pullback in consumers dining out – alerting our LikeFolio Investor subscribers to a bearish DRI trade in May.

Shares have indeed dipped by about 8%, and our paid-up members are looking at a profitable trade. (To learn how you can receive real-time trades delivered directly to your inbox with LikeFolio Investor, get started here. We’re already putting the finishing touches on the next one.)

However, LikeFolio data suggests it’s the heartwarming, value-driven brands like Olive Garden that are leading Darden’s growth of late.

As the data shifts, so does our strategy.

Here’s how we’re playing Darden from here…

LikeFolio Data Says…

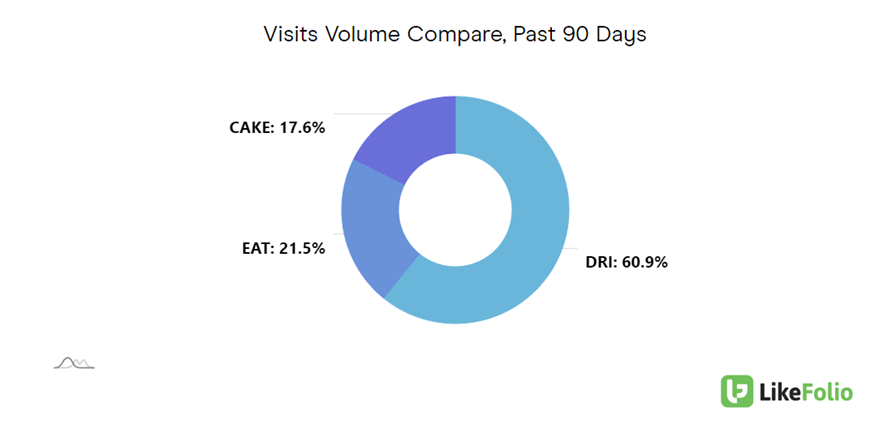

Darden is effectively leveraging its delivery and curbside options, as evidenced by the sheer volume of website visits it’s seeing, compared to industry peers.

It commands just over 60% of web volume when compared with Brinker International (EAT), parent company of Chili’s and Maggiano’s, and The Cheesecake Factory (CAKE).

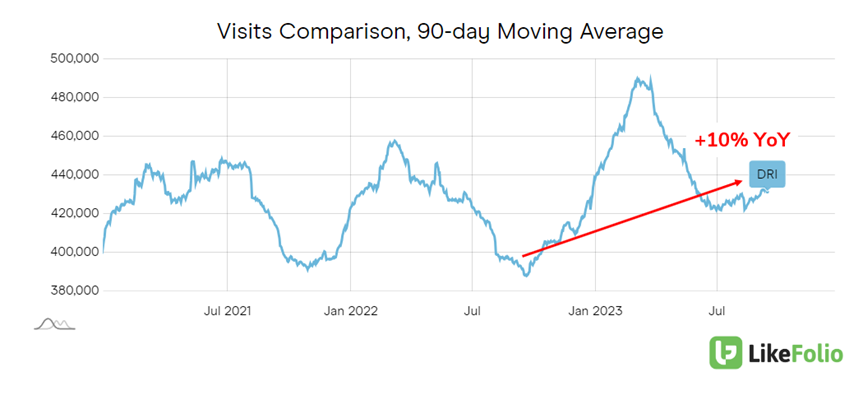

Darden is also logging continued growth in this arena during a typical down season, with web visits to one of its restaurant banners increasing by 10% on a year-over-year basis.

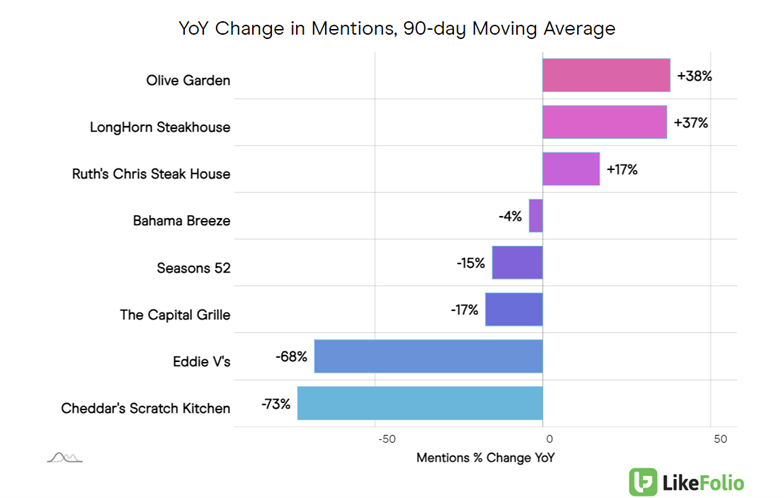

And we know buzz is building for Darden.

Overall mentions of dining at one of Darden’s restaurants are currently pacing 21% higher year-over-year, driven largely by strength in its value brands – Olive Garden (+38%) and LongHorn Steakhouse (+37%).

The relative contrast between those value brands and its legacy high-end brands, like Eddie V’s and The Capital Grille, suggests consumers may still be trading down to more affordable excursions.

It’s also worth noting the promising traction the Ruth’s Chris brand has gained post-acquisition – with mentions climbing 17% year-over-year.

The Happiness Hurdle

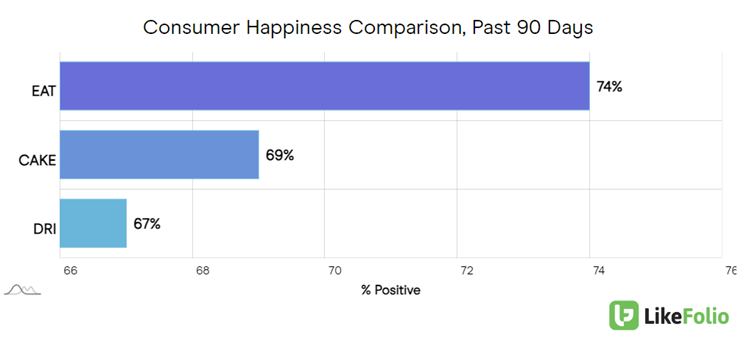

But while Darden’s diverse brand portfolio is commendable, there’s one area that needs a sprinkle of seasoning: Consumer Happiness.

This metric played a pivotal role in LikeFolio’s bearish alert earlier this year as we saw consumers complaining about overpriced, average-quality food and slow service.

At 67% positive, Darden sentiment has declined six points since then and lags behind peers like CAKE and EAT.

It’s not all gloomy, though.

Darden acknowledges this gap and is actively working to elevate its dining experience. Initiatives like the “back-to-basics” philosophy, focusing on food, service, and atmosphere, are steps in the right direction.

And I can tell you from personal experience: The recent “Steak Master Series” at LongHorn Steakhouse, a grilling competition and training program, is a testament to Darden’s commitment to quality and consumer satisfaction.

The company reported its first batch of earnings since Ruth’s Chris joined the ranks on Thursday, and the results were right in line with LikeFolio data.

Overall, Darden beat expectations, bringing in $2.73 billion in revenue for the quarter. Same-store restaurant sales for Olive Garden and LongHorn Steakhouse grew 6.1% and 8.1%, respectively, proving the bright spot in its value brands. But its fine-dining segment suffered a 2.8% decline.

Bottom line: The quest for heightened Consumer Happiness remains, but a breakthrough in Darden’s value brands could give this stock a surprise upside. Investors and diners alike will be watching closely to see if Darden can improve. After all, in the world of dining, a happy customer is the most valuable asset.

Our bearish alert from May is still open for now – and LikeFolio Investor subscribers will be the first to know when it’s time to take profits.

In fact, paid-up members can look forward to a fresh profit opportunity hitting their inbox in the coming days.

While we put the finishing touches on that alert, you can make sure it gets to the top of your inbox as soon as it’s released by clicking here and becoming a member today.

(We’ll even let you in on a $2 AI play we love as a thank you.)

All the best,

Megan Brantley

Data Guru, Derby City Insights

VP of Research, LikeFolio