In the video game world, Minecraft – the No. 1 best-selling video game of all time with 238 million units sold – is the exception to the rule for creating a smash hit.

The instantly-recognizable blocky universe that Microsoft (MSFT) shelled out $2.5 billion for in 2014 was built by a programmer using Java over the course of a weekend.

For the rest of the industry, creating a runaway success is a labor-intensive, high-cost endeavor.

Most of the video games that make it to market require three to five years of development and hundreds of thousands, if not millions (or hundreds of millions) of dollars, to get there.

The No. 2 best-selling video game after Minecraft, Grand Theft Auto V, cost Take-Two Interactive (TTWO) a cool $265 million.

Typically, only multibillion-dollar behemoths like Take-Two, Activision Blizzard (ATVI), and Electronic Arts (EA) have the resources and technical prowess to construct games that stem entire franchises; Take-Two is working on its sixth iteration of Grand Theft Auto. Activision has pumped out 22 Call of Duty games.

But the gaming landscape is undergoing a radical transformation thanks to artificial intelligence (AI). More specifically, generative AI – the same tech that enables ChatGPT.

With prompts, gamers can use generative AI to create entire gaming worlds from scratch with zero coding experience.

In short, the AI revolution is democratizing gaming – turning players into creators – and creating a new pocket of the industry where companies enabling this transformation are thriving.

There’s Nvidia (NVDA), of course, the GPU manufacturer that goes well beyond gaming hardware with entire AI platforms that are fertile ground for generative AI applications…

And Microsoft, the tech titan, with its Azure AI platform.

But if we only brought you stocks with trillion-dollar market caps, that wouldn’t give you much of an “edge.”

Especially when there’s a smaller player in this realm with a fraction of the market cap and all its growth still ahead of it…

Democratizing the Gaming Industry

It might have a fraction of the market cap of the other tech giants we’ve mentioned today at $16 billion…

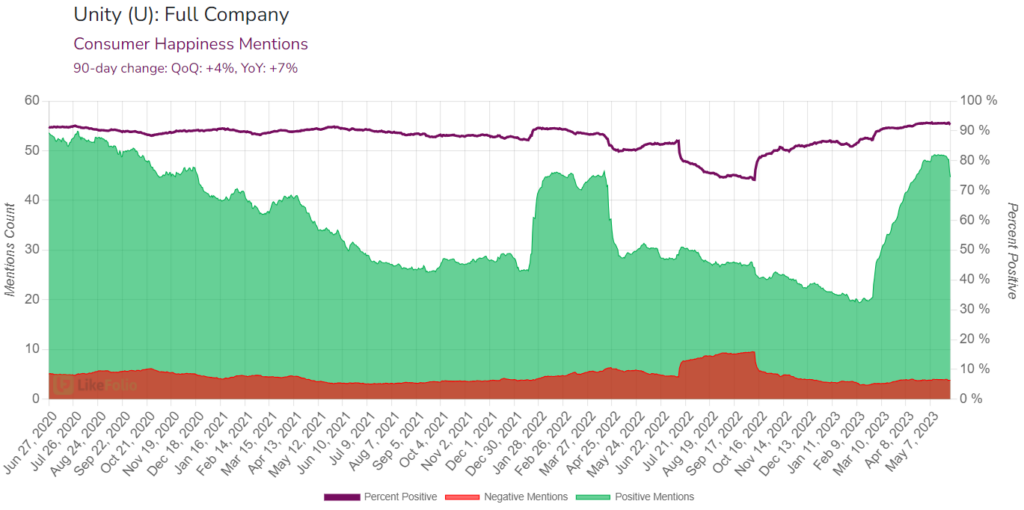

But when it comes to our single best long-term indicator of success, Unity Software (U) is blowing every other name I’ve mentioned today out of the water with one of the highest Consumer Happiness scores in the LikeFolio universe (92%).

Even more impressive is the growth behind that number: Consumer Happiness is up by 7% year-over-year.

The difference? Unity is making game development accessible to everyone.

The company’s real-time 3D development tools and services allow customers to create, run, and monetize interactive 2D and 3D content for PCs, tablets, mobile phones, gaming consoles, and AR/VR (augmented reality and virtual reality) devices.

Its software caters to the gaming industry but extends way beyond that with applications for architects, auto designers, filmmakers, and more.

The key to making that software truly “accessible” comes down to a term cryptocurrency investors know by heart: decentralization.

In this context, decentralization refers to ownership models in games that let players create, earn, or obtain in-game resources that can be sold or traded.

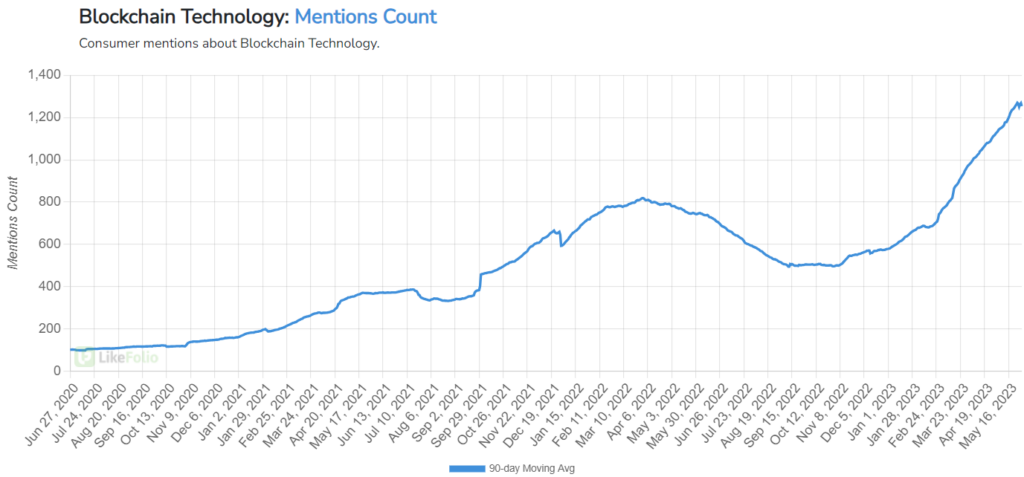

Unity leverages blockchain technology – one of the fastest-growing trends we track (+69% year-over-year) – to make it happen.

In February, Unity launched an entire “Decentralization” category page in its Unity Asset Store to help game developers find solutions to manage digital assets and build on blockchain networks.

MyMetaverse CEO Simon Kertonegoro referred to the launch as “a truly inspiring moment and a historic move” for the blockchain gaming industry, going on to say, “Everyone in gaming respects Unity… They’re the people’s champ.”

Operating at the intersection of blockchain tech and gaming, Unity is often associated with the “metaverse” mania of 2021.

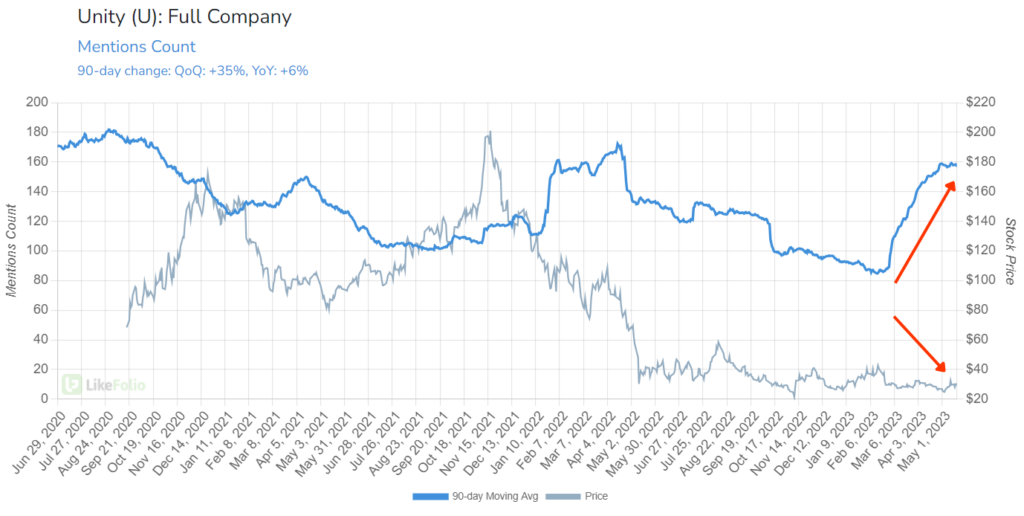

And like many COVID-era tech darlings, Unity shares had a steep fall from November 2021 highs – from $172 to $42 as of this writing.

But as the obsession with the metaverse quelled, a new obsession with blockchain technology and AI sparked.

And today, Unity’s software applications are more relevant than ever.

Buzz around Unity is gaining significantly on a quarter-over-quarter basis: mentions are up by 35% and counting.

As U chatter reaches a fever pitch, and its stock price lags behind, this stock looks more and more like a classic divergence opportunity.

From here, we’ll be keeping a close eye on future integrations of blockchain technology in gaming development, as well as growth driven by the adoption of AR/VR technology.

The gaming industry evolves at breakneck speed.

But with Derby City Daily, we’ll be in your corner all along the way keeping you up-to-date on the investment opportunities it creates.

Until next time,

Andy Swan

Founder, LikeFolio