Look, the naysayers still don’t get it – Tesla (TSLA) isn’t a car company.

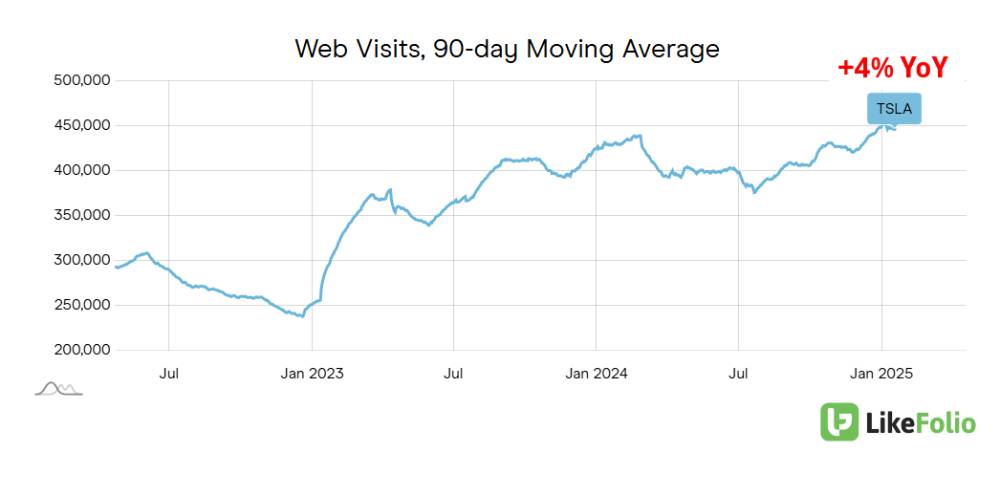

It’s an artificial intelligence (AI) powerhouse that happens to make cars. And consumer interest continues to hover near all-time highs.

Tesla shares got a serious boost on Donald Trump’s presidential victory, and if you’ve been following along with our coverage, you know we see this stock as one of the major winners under his administration.

The “not-just-a-car company” announces earnings next week (January 29). And since TSLA pre-releases key data, we already know quite a bit of info:

- 2024 Deliveries: 1.79 million (down from 1.81 million in 2023)

- 2025 Growth Target: 20-30%

- Energy Storage Q4: 11.0 GWh

- Total 2024 Energy Storage: 31.4 GWh

- Cybertruck Q3 Sales: 16,000+ units

The bears were quick to criticize the pullback in deliveries. TSLA shares are down from their recent highs.

But the spreadsheet warriors are missing the point…

Tesla is a long-term play – and the cultural shift is real.

Tesla Is Creating a Movement

Here’s what’s really happening.

Tesla dropped the latest upgrade to its full-self driving (FSD) software, FSD v13.2, in December. And my goodness, the results are impressive: 5x more AI compute power, smoother rides, and even nailing tricky moves like reverse driving and parking.

The real kicker?

Tesla’s pushing for robotaxis in 2025 with safety levels 700x better than human drivers.

Yes, 700x better. That’s not a typo.

Tesla is also taking a calculated approach with insurance.

Use FSD? Watch your premiums drop.

This isn’t some marketing gimmick – it’s Tesla betting real money that its AI drives better than humans. When’s the last time you saw an insurance company voluntarily lower rates? The more real-time data Tesla has, the better its technology becomes.

Even the Skeptics Are Converting

At LikeFolio, we’re logging stories of old-school truck guys falling in love with their Cybertrucks, noting: “Two doors down, my neighbor bought that $160,000 Cadillac EV SUV, and hehe, it is a hot mess compared to the Cybertruck.”

It’s hard to argue these numbers:

- Monthly active Tesla app users? Up 17% year over year.

- Brand interest? Hit new records, up 4% year over year.

Wall Street’s Wake-Up Call

Finally, the big money is catching on to what we’ve known for years. Check out these price target moves in the last month:

- Piper Sandler: $500 🚀 (from $315)

- Mizuho: $515 + upgrade to “Outperform”

- Morgan Stanley: $430 (from $400)

- Barclays: $325 (from $270)

- Baird: $480 (from $280)

Tesla has something no one else can buy – billions of miles of real-world driving data. Every Tesla on the road makes its AI smarter. Every mile driven widens the gap.

What are we watching from here?

- Robotaxis rolling out in 2025

- Optimus robots hitting production in 2026

- Lower-cost models in the pipeline

- More drive-in diners with movie screens and roller-skating waitstaff (yes, really)

We’re also tracking some headwinds:

- BYD’s dominance in China with 3.02 million deliveries outpacing Tesla’s 1.79 million global sales, while its $11,000 Seagull EV disrupts the entry-level market.

- European market share continues eroding against Volkswagen and BMW, as potential elimination of the $7,500 EV tax credit threatens Model Y affordability.

- Most notably, Tesla posted a 1.1% year-over-year delivery decline (1.79M vs 1.81M), marking the first annual drop in company history.

The Bottom Line

When everyone else was building better cars, Tesla was building an AI empire. We see the near-term delivery dip as a speed bump. The real story is the AI revolution happening under our noses.

Five analyst upgrades in a month tell you all you need to know – Wall Street is finally catching up to what we’ve been saying all along.

Tesla’s integration of AI into products and services, from vehicles to energy solutions, positions it to capitalize on emerging applications in automation and robotics, supported by proprietary data and hardware advantages.

Remember: We’ve been pounding the table on this for years. The pullback isn’t a warning sign – it’s an opportunity.

With Tesla CEO Elon Musk’s political aspirations taking shape under Trump’s White House, we wouldn’t be surprised to see more headline-fueled volatility in the weeks and months ahead.

Stay true to your conviction. It will pay off in the long run. It always has with TSLA.

While all the other investors out there fall victim to the volatility, you could turn Trump’s first 100 days in office into the most profitable window of your life. Here’s how.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Special Report: 3 Trump Trades for the Next 4 Years

With Trump in the White House, we’re bringing you three ways to profit from his deregulation promises in a special report…

3 Bullish Plays to Kick off a Red-Hot Earnings Season

Earnings season is here – and our data reveals three compelling opportunities set to play out in just a few days…