It’s a tough time to be a dollar store.

Once the only option in small, rural areas, dollar stores are losing their grip on consumers in retail deserts.

As big-box retailers and e-commerce giants build out their logistics grids, delivery of affordable and essential goods is eating into a once-reliable market.

And you can see it in stock values…

Since this time last year:

- Dollar General (DG): -40%

- Dollar Tree (DLTR): -42%

- Five Below (FIVE): -48%

Is there relief in sight for Dollar General, the largest discount retailer in the U.S., which reports tomorrow morning?

Here’s what we’re watching…

Dollar Stores Are Losing Their Grip

Lower-income Americans (those bringing in less than $35,000 per year), who account for roughly 60% of Dollar General’s sales, are still reeling from high inflation.

Higher prices have forced this cohort to prioritize consumables such as food and household essentials over discretionary items, which typically yield higher margins.

Last quarter, same-store sales increased by half a percent, below expectations. Consumers made more trips but spent less money on each transaction as they “continue to focus their spending on the items they need most for their families.”

Meanwhile, middle- and upper-middle-income consumers are NOT flocking to dollar stores.

During its fiscal second-quarter earnings call for 2024, Dollar General noted that these customers are turning more to online shopping, where dollar stores have struggled to compete effectively.

Walmart’s (WMT) massive rise is no doubt a culprit here. And so is the increasingly popular online discount marketplace, Temu.

One report found that Dollar General customers who shopped at both retailers spent more at Temu compared to Dollar General in the third quarter.

At a high level, Dollar General’s slice of U.S. discount spending dropped from 63% to 52% in the roughly two years since Temu’s launch.

DG stock has also felt pressure from looming impacts of potential tariffs.

Dollar General and other discount retailers rely heavily on low-cost imports. In fact, the impact of import tariffs from 2018 was attributed to the increase in DG competitor Dollar Tree’s price increase from $1 to $1.25.

Feels very doom and gloom, right?

DG is facing headwinds, for sure. But we do see some signs of light…

It’s Not All Doom and Gloom for Discounters

- This morning, Dollar Tree said sales improved in the third quarter.

Consumers aren’t shopping as far in advance as they used to, but they’re also eating more at home to save money, boosting sales for food and other necessities. Shares initially moved slightly higher but now are mostly flat.

- On the web front, we see some signs of traction from Dollar General.

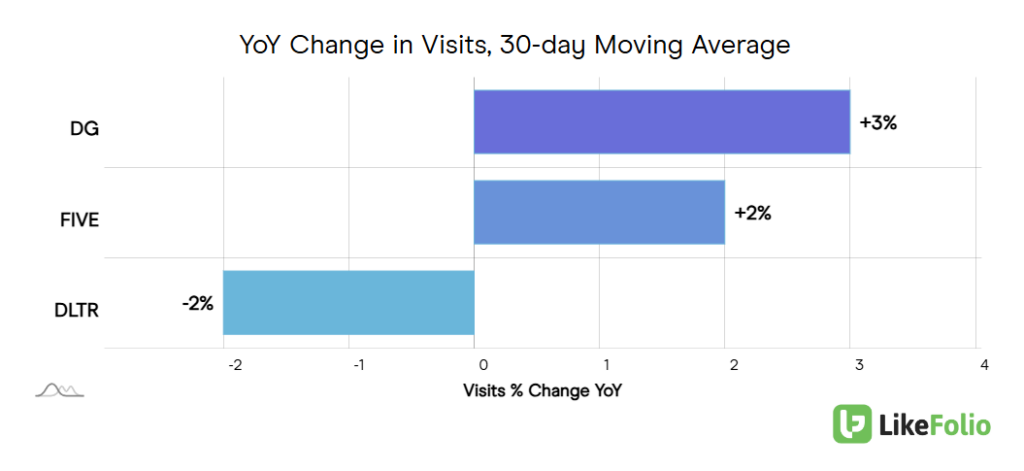

LikeFolio data shows DG web visits are up 3% year over year as the company attempts to build out its digital presence to compete with the likes of Walmart… and even Temu.

A digital footprint will be essential to remain competitive with these e-commerce heavyweights.

- Dollar General joined other retailers in publishing a shoppable holiday catalog this year.

And we mean one that can sit on your coffee table. The catalog features toys that generally cost $10 or less and has a digital version online with shoppable links… a big step for the discounter.

- DG is also beefing up partnerships, recently launching Elf Beauty (ELF) products inside its stores in their full glory.

As one Elf representative noted, “We’re bringing our best products, our holy grails, to the dollar channel.” Meaning, these aren’t sized-down makeup products that are lesser than and specially designed for a dollar store audience.

The Bottom Line

While we don’t see any signs of a major recovery, DG is facing a low bar heading into its earnings report tomorrow. We expect essentials spending to be strong and are watching for signs that discretionary spend is tilting back in Dollar General’s favor.

Dollar stores might be struggling – but Walmart is crushing it. Check this out.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Cut Through the Tesla Noise with This Real-Time Data

Tesla has a target on its back. But conflicting LikeFolio data suggests something bigger is brewing behind the scenes…

Black Friday Special: 3 Early Holiday Shopping Winners

From traditional retail to department stores to specialized gift brands, LikeFolio data sorts the winners from the losers this holiday season…