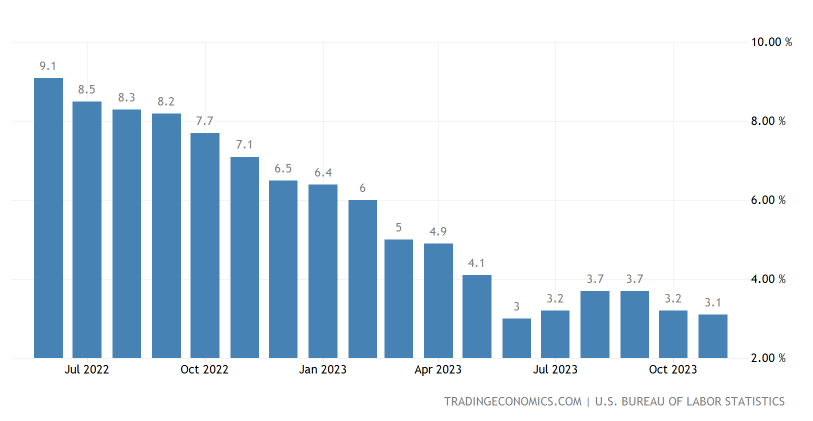

Just in: Today’s Consumer Price Index (CPI) report revealed that prices in November cooled to their lowest level in five months, bringing the U.S. inflation rate to 3.1%.

Good news for retailers, right? Lower prices should drive more consumers into stores as they seek deals on holiday gifts.

After all, Americans are set to spend a record $957.3 and $966.6 billion this holiday season.

But deflation – the overall decrease in the price of goods and services – presents its own challenge for retailers.

And as it does, we’re seeing a notable divergence form between two of the sector’s biggest titans: Walmart (WMT) and Target (TGT).

Who will come out on top? Let’s find out…

Clash of the Retail Titans: WMT vs. TGT

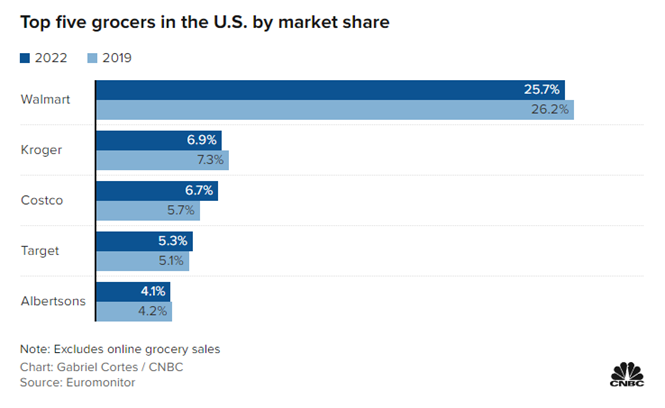

Walmart is the nation’s number-one retailer, bringing in nearly half-a-trillion dollars in sales last year. It’s also the largest grocer in the country, claiming over 25% of the market share…

That position has historically given Walmart an edge over competitor Target, which emphasizes a broader range of goods including home items, apparel, and beauty products.

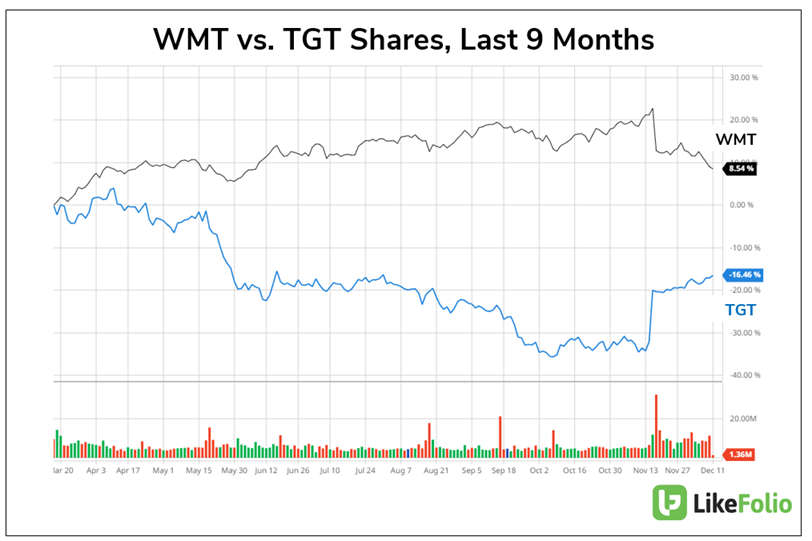

True to form, Walmart’s shares have risen approximately 8% over the last nine months, while Target’s have declined around 16% in the same period.

But mixed earnings results in November sent WMT and TGT in vastly different directions…

- TGT surged 18% following a “not as horrible as expected” report on November 15.

Target reported a drop in total revenue to $25.4 billion, down 4.2% year-over-year, and a nearly 5% decline in comparable sales. But earnings came in stronger than expected at $2.10 per share, significantly higher than the anticipated $1.48.

On the other hand…

- WMT closed 8% lower, despite a “great but not mind-blowing” report on November 16.

Walmart exceeded Wall Street’s earnings estimates with an adjusted earnings per share (EPS) of $1.53, marginally above the expected $1.52; revenue of $160.80 billion also surpassed forecasts. However, a cautious outlook and a slight downward adjustment in its full-year earnings forecast tempered investor enthusiasm. Even strong grocery sales and digital growth couldn’t fully offset the impact of these revised expectations.

These moves are creating a more level bar for both companies heading into the holiday season, and bringing their stocks closer to parity.

So – where do we go from here?

The differentiating factor for these retailers going forward will be how well they can handle the emerging trend of deflation.

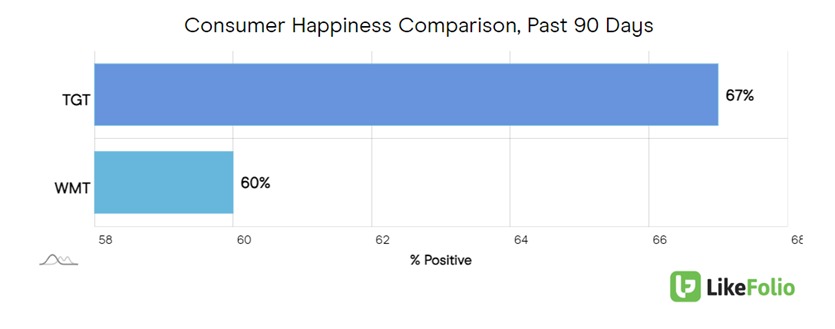

And this is where LikeFolio data can offer key insights, straight from the consumers who matter most. Take a look at what we found…

One Retailer Gains an Edge

In the near-term, LikeFolio data suggests these retailers are likely to continue on their current path, with TGT shares gaining some ground and WMT leveling lower.

Why? Well, Walmart, with its broader customer base, might feel more pressure from deflation than Target, which traditionally caters to a higher-earning clientele.

Check it out: Our consumer sentiment metrics indicate that Target is regaining its appeal, with Consumer Happiness levels 7% higher than Walmart’s. Year-over-year comparisons also show Target’s customer satisfaction on an upward trajectory, in contrast to Walmart’s decline.

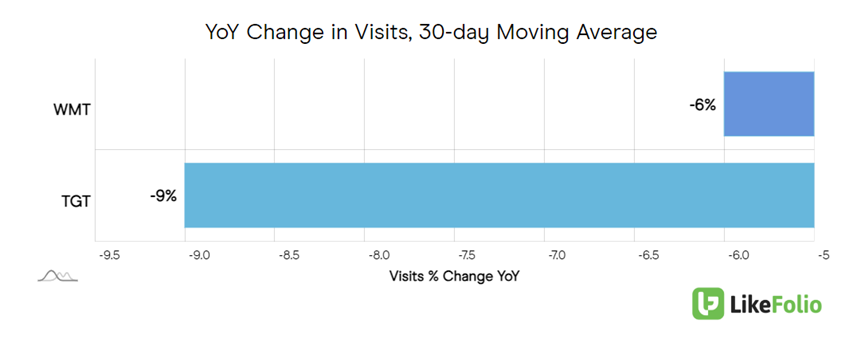

Web metrics reveal a pullback in demand for both companies compared to 2022, with Target experiencing a slightly more severe decline.

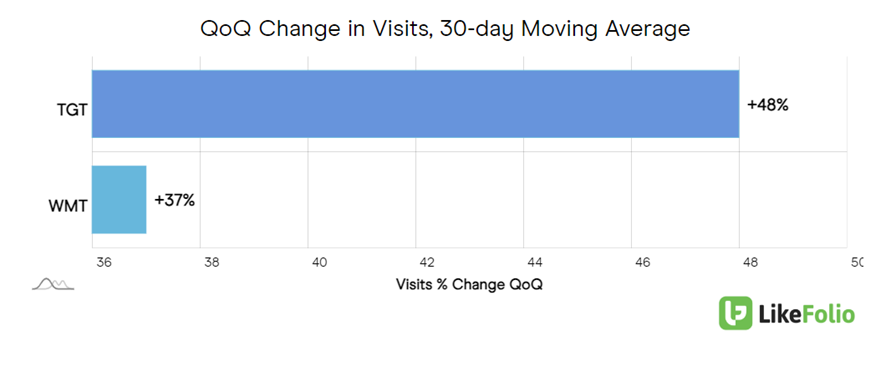

However, Target is showing a stronger recovery short-term, with a 48% quarter-over-quarter increase in web visits compared to Walmart’s 37%.

Where Walmart’s leading position in grocery has typically given it an edge, Target’s edge in beauty and personal care, bolstered by its partnership with Ulta Beauty (ULTA), may help to attract consumers willing to spend more on high-demand items.

Bottom line: Target appears poised for a near-term rise, while Walmart is likely to stabilize at a lower level.

We’ll continue to monitor as the shopping season reaches its peak – and members will be the first to know if we see a shift in consumer behavior.

In the meantime, I want to make sure you saw the 2024 prediction event Landon and I recently put out: Watch it here.

That’s where we share our biggest investing calls for the new year, including the tiny $6 player about to dominate a $300 billion industry.

Some may find it controversial… but trust me.

You’ll want to know this name before the year is up.

Until next time,

Andy Swan

Founder, LikeFolio