Every week is important in the stock market because it offers new opportunities to make money, but this week holds particular significance because of the much-anticipated release of the April Consumer Price Index (CPI) on Wednesday.

Expectations are for CPI to report in at 5%, with core CPI (food and energy prices excluded) coming in at 5.4%.

The numbers will show whether the Fed’s fight against inflation is working and interest rate hikes can be paused and eventually slashed… or if inflation is still running wild and the Fed has more work to do.

So, any results that don’t conform to expectations – good or bad – could send stocks on a wild ride.

Fortunately, with our proprietary social media data, we already have a “sneak peek” into what consumers are saying about certain companies and how they may perform on their own merit.

📅 Earnings Headliners This Week (May 8 – 12, 2023)

- H&R Block (HRB) Reports Tuesday, May 9

- Unity Software (U) Reports Wednesday, May 10

- Fiverr (FVRR) Reports Thursday, May 11

Here’s what to expect for each company…

H&R Block (HRB): Reports Tuesday, May 9

Outlook: Extremely Bearish

You would think a tax company reporting financial results after doing a bunch of taxes would have a strong earnings report.

But our data shows this may not be the case.

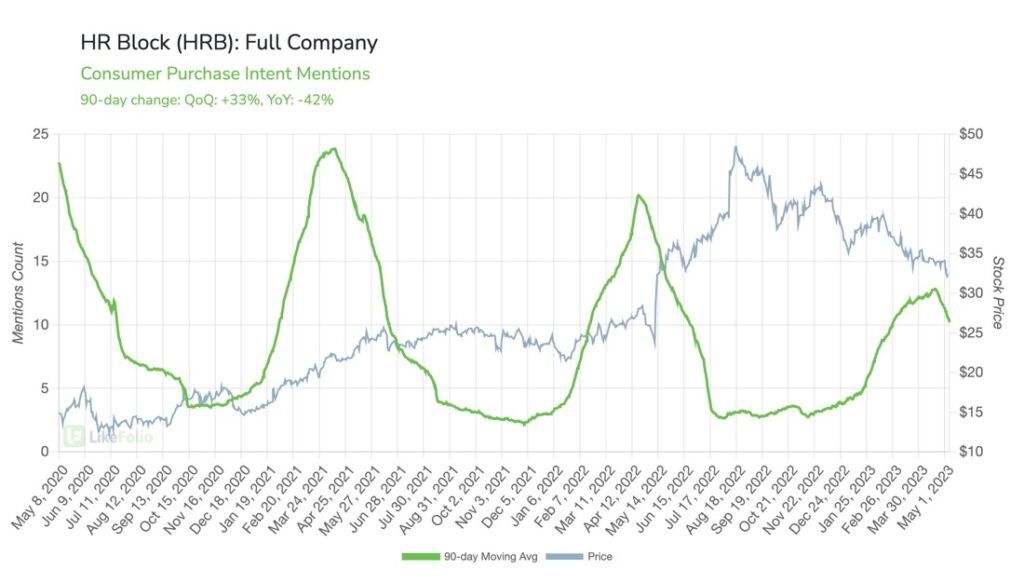

Over the last year, people mentioning using or intending to use H&R Block dropped 42%, and the company’s earnings score of -78 reflects a very bearish picture:

Negative mentions have prevailed during the key tax season, and on top of that, tech and operational investments could have weighed on margins.

The stock has been on a long, slow descent from $50, and the fact that the IRS is reportedly considering offering free e-filing for all Americans could have huge implications.

Unity Software (U): Reports Wednesday, May 10

Outlook: Very Bullish

On a brighter note, Unity Software (U) – a tech company that provides software solutions for creating, running, and monetizing 2D and 3D content – could be set up for a rally.

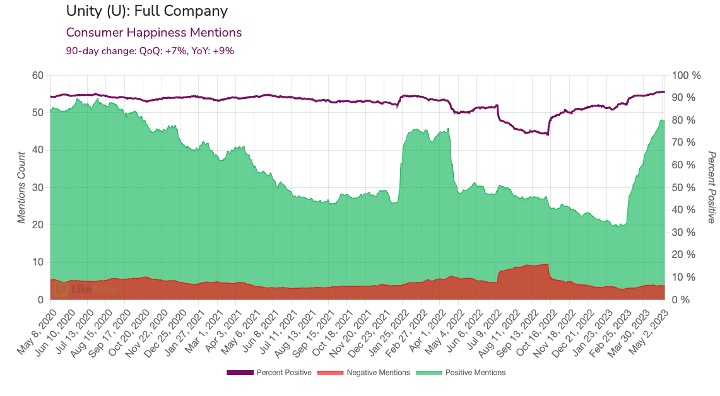

Consumer Happiness Mentions are up 7% quarter-over-quarter and 9% year-over-year.

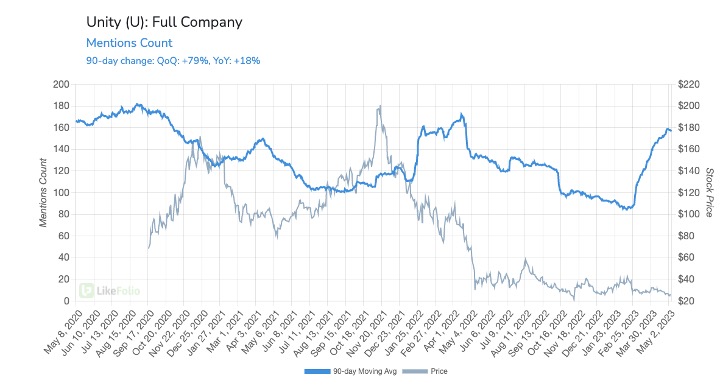

Our data also shows that more people are talking about Unity Software, and you can see there is a clear divergence between the Mentions Count in blue and the stock price in grey:

Technical indicators point to oversold conditions, and short covering could add to a potential rally, with short interest at 15%.

U has an earnings score of +62.

Fiverr (FVRR): Reports Thursday, May 11

Outlook: Extremely Bearish

We recently covered how artificial intelligence (AI) was disrupting business models… and not in a good way.

Chegg (CHGG) has said that it embraces AI, but it’s a little late to the party.

About a month ago, Chegg announced that it would leverage ChatGPT to power its study aid that is supposed to provide personalized practice tests and study guides.

The problem is, ChatGPT launched in November and students have already been figuring out how to use it for their homeworks.

Why would they pay for something from Chegg when they can use ChatGPT for free?

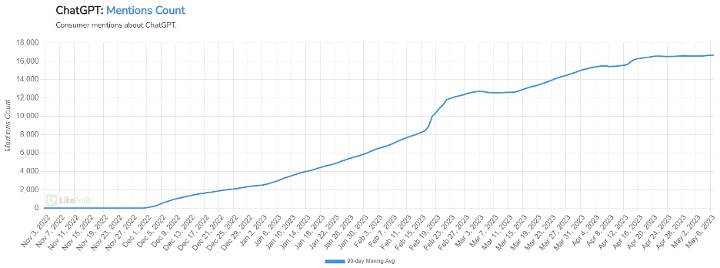

Similarly, Fiverr’s customers may be seeing less of a need to use the company’s platform, thanks to AI innovation. Fiverr offers a space for people to find freelance writers, researchers, artists, and more, but services like ChatGPT are already filling some of those roles.

Just take a look at the rise in mentions of ChatGPT:

Basically, people are realizing AI can perform many of the services they may have formerly paid for on Fiverr.

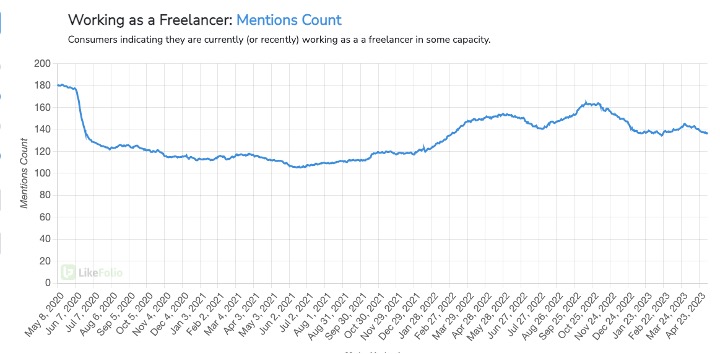

We’ve also seen mentions of people working as freelancers start to drop since November 2022, which means there may be less of a talent pool to choose from on Fiverr. And a smaller talent pool means a smaller income stream for Fiverr, which takes a cut of each freelancer’s earnings:

The stock is limping toward its earnings call around 52-week lows and has an earnings score of -73.

Until next time,

Andy Swan

Co-Founder