A major shift in the sports broadcasting landscape is underway with massive implications for consumers and investors alike…

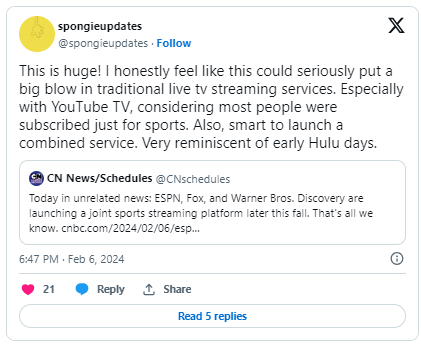

ESPN (DIS), Fox (FOX), and Warner Bros. Discovery (WBD) have joined forces to launch a new live sports streaming service.

It’s a monumental decision that impacts major players in many investor portfolios, from DIS and WBD, all the way down to smaller names like Fubo (FUBO) and Roku (ROKU).

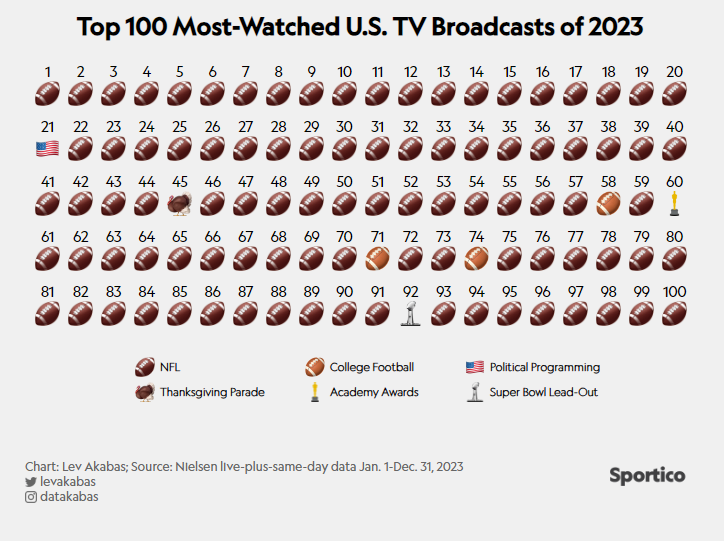

Why? Because when it comes to TV, live sports reign supreme. Sporting events made up a whopping 96 of the top 100 most-watched TV broadcasts in the U.S. last year, according to Nielsen ratings. This graphic from Sportico puts things into perspective:

But until now, there was no clear “one-stop shop” for sports streaming. And that’s exactly what these media titans are teaming up to provide.

The joint venture aims to consolidate live media rights across a wide array of major leagues, including the NFL, NBA, WNBA, MLB, NHL, UFC, Formula 1, NASCAR, the PGA Tour, the FIFA World Cup, NWSL, and MLS, among others.

- It will launch under a newly formed company, each parent owning an equal stake.

- It will include all the sports networks owned by these three media titans – ESPN, ABC, TNT, TBS, Fox, and more.

- And users will have the option to subscribe directly through a new app or as a bundle with one of these parents’ existing platforms (Disney+, Hulu, Max).

We don’t know the name of the service or how much it will cost. Yet. And we don’t know exactly when it will launch, other than later this year.

But what we do know is the success of this initiative could redefine sports consumption and set a new standard for the integration of live sports into digital and streaming platforms.

And for one stock in our portfolio, this opportunity could be a game-changer.

Here’s why…

Tapping into America’s Insatiable Appetite for Live Sports

Live sports are a vital component of the media landscape, offering unparalleled engagement and reach opportunities for brands.

The Super Bowl is the pinnacle example: Last year’s Big Game drew a record 115 million viewers to watch the Kansas City Chiefs go head-to-head with the Philadelphia Eagles.

This year’s Super Bowl LVIII matchup in Las Vegas is sure to attract even more eyeballs with Taylor Swift in attendance. And the price tag on a 30-second ad spot? $7 million – minimum.

That’s an extreme example, sure. But it proves just how valuable this arena has become.

The fact is that those loyal fans need a platform to watch and engage with their favorite teams all year round.

When Thursday Night Football first landed on Amazon Prime (AMZN) in September 2022, Amazon saw the most new signups it’s ever seen in a three-hour period.

So we know live sporting events are a massive driver of subscriptions.

But they’re also looking for match announcements, highlights, recap videos, and more.

Like I said… America’s sports obsession runs deep.

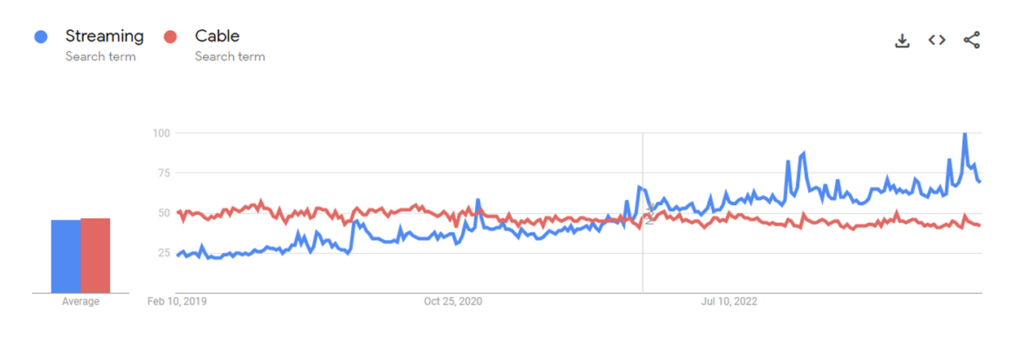

And at a time when more consumers than ever are bypassing traditional media platforms for online content…

Streamers that offer this level of access are in prime position to capture those viewers.

And as they do, advertisers will be paying special attention.

See, the unique loyalty and passion of sports fans also fosters an ideal environment for advertisers to connect with an engaged and broad audience.

As digital and streaming platforms continue to evolve, the value of live sports advertising grows, offering exposure to millions of viewers and tapping into the emotional investment fans have in their favorite teams and players.

This joint venture is bound to attract substantial advertiser interest.

And that’s just what Disney needs…

Disney’s Golden Ticket

By bringing together a diverse array of live sports rights under one umbrella, this strategic collaboration among Disney-owned ESPN, Fox, and Warner Bros. Discovery, stands to significantly bolster Disney’s position in the competitive live streaming domain.

Not only will an influx of ad dollars help Disney make up for the decline in ad revenue it’s experienced over the last couple of quarters…

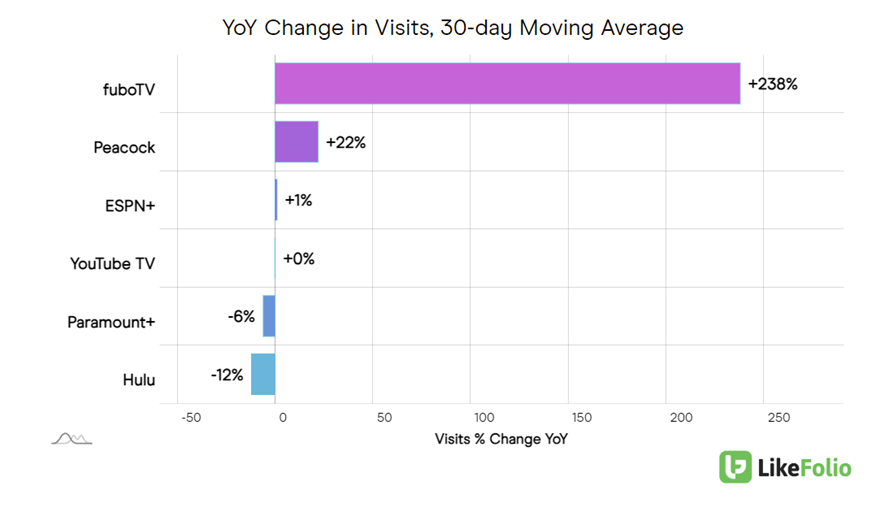

But until now, Disney’s Hulu was falling behind in the streaming race:

(You can see Hulu sitting at the bottom of the pack when it comes to website visits with a 12% year-over-year decline.)

A new live sports offering promises to reinvigorate Hulu’s standing against rivals like YouTube TV (GOOGL) and FUBO, while aligning with Disney’s broader corporate restructuring towards distinct divisions focusing on entertainment, sports, and experiences.

Disney’s experiences segment has driven the company’s growth of late, reaching all-time highs in revenue, operating income, and operating margin in the most recent quarter.

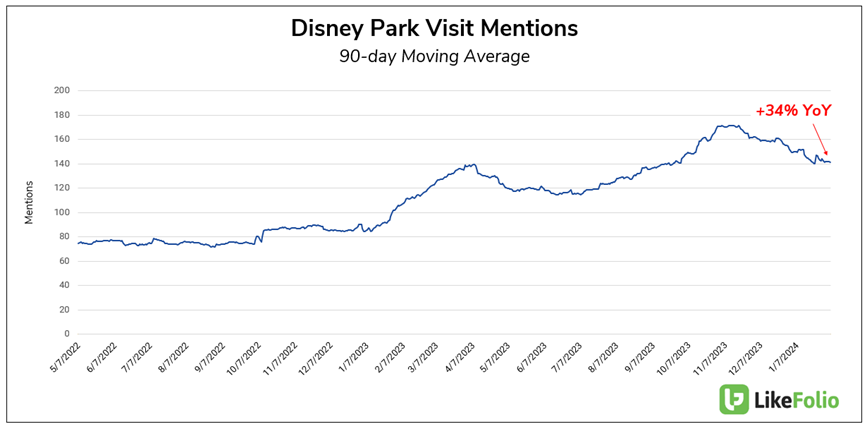

It’s clear on our end that interest in Disney’s parks continues to grow on Main Street – mentions of visiting Disney parks have spiked 34% year over year:

As that profit engine keeps chugging along, this move into live sports streaming will be pivotal in Disney’s ongoing efforts to adapt to the changing media landscape and consumer preferences.

The Bottom Line

We hope you grabbed DIS shares under $100 when we told you to. Because Disney’s stock price rocketed more than 14% just this week.

And to our LikeFolio Investor subscribers who are now up 32% on DIS, congratulations.

These real-time profit alerts are really paying off.

And the best is yet to come.

Increased revenue opportunities, the ability to reach audiences of any size, engagement with the fan base through interactive features, enhanced social media exposure…

These advantages are critical in a landscape where fans demand access to their favorite sports content across multiple devices and platforms.

With this live sports platform, Disney will tap into it all.

Our predictive algorithm identified DIS as a winner before it skyrocketed, giving our members an early shot at the profits. (Get an inside look at how it works and the next stock it’s targeting here.)

As this venture unfolds, all eyes will be on its implications for the sports broadcasting industry, consumer engagement, and the broader digital media ecosystem.

But we’ll be keeping an especially close eye on how this impacts the stocks in our portfolio – and notify members as soon as our system signals it’s time to make a move.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Why We’re Not Gobbling up DoorDash Just Yet

With high-profile events like the Super Bowl on the horizon, DASH needs to impress…

Perks, Points, and Profits: American Express’s Winning Formula

Here’s why our long-term outlook on AXP just gets better and better…