There’s no avoiding it: We need to talk about Nvidia (NVDA).

The artificial intelligence (AI) chipmaker took center stage this week as traders and investors alike prepared for its earnings report to spur a potential $300 billion swing in shares.

Going into this thing, I saw bulls touting NVDA as “the most important stock in the world right now,” with fears that a negative result could send the entire market spiraling.

The anticipation was palpable.

Now that we’ve seen what Nvidia had to offer, it’s time to debrief.

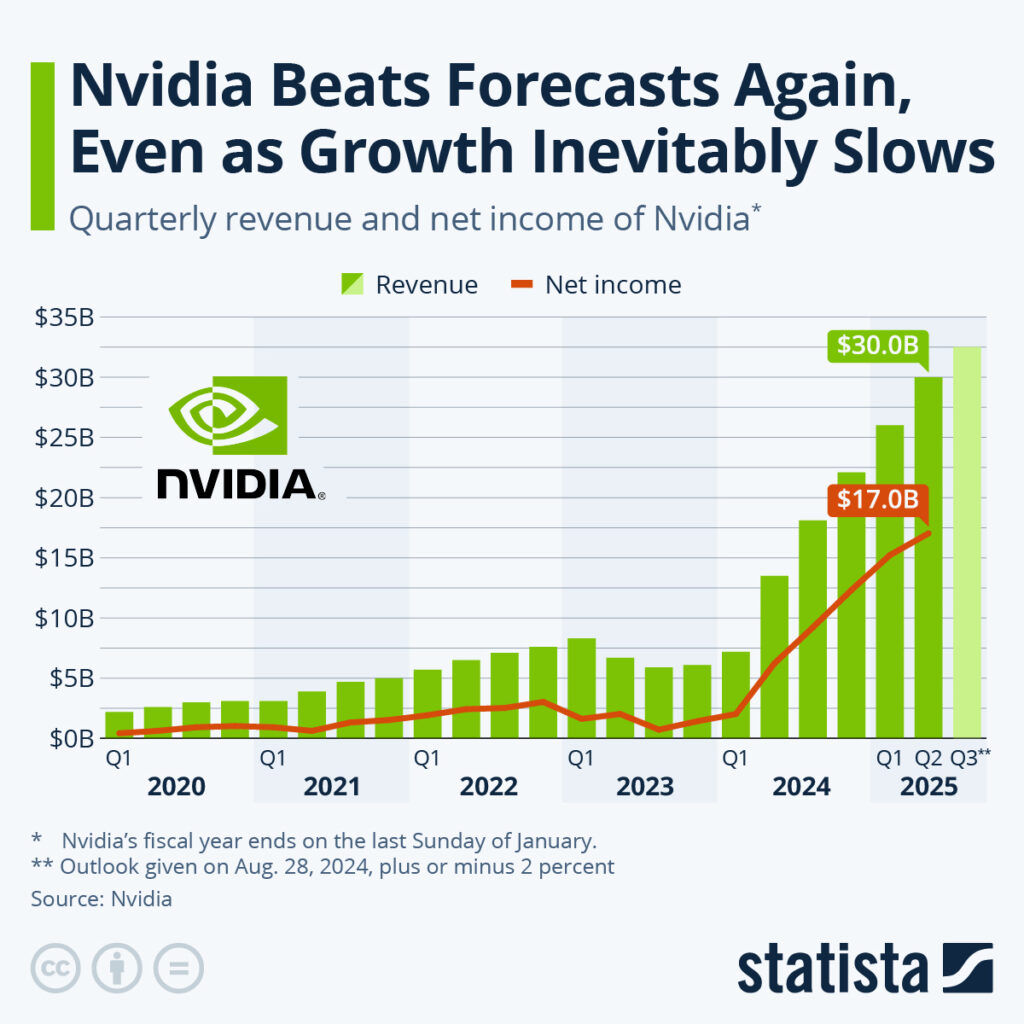

Nvidia delivered a phenomenal report.

Quarterly revenue surged 122% to a record $30.04 billion, coming in above analysts’ expectations of $28.7 billion. Earnings of 68 cents per share also came in higher than the consensus 64 cents per share – growing 152% from the same period last year. Data center revenue was up as much as 154% year over year.

The market’s reaction was… not so phenomenal.

After opening the week at $129.57, NVDA shares tumbled ~10% to a low of $116.71 on Thursday as the market digested the news.

We were expecting a move in the opposite direction. And I’ve seen a lot of worried investors having second thoughts about this company’s growth prospects.

So, let’s talk about it right here, right now.

To address those concerns head on – and show you where NVDA is headed next – Landon and I just filmed a special video edition of Derby City Daily.

Watch now to find out where Nvidia goes from here in less than 10 minutes:

Bottom Line: NVDA Is Still the GOAT in AI Tech

We’ve never seen a trend catch fire with consumers like AI. And as fast as AI has been cruising, Nvidia is in high gear in the express lane – and leading the pack.

Naysayers have doubted the company’s valuation for quarters now. Yet from a long-term perspective, NVDA has always managed to push higher.

At LikeFolio, we see signs of continued market expansion, explosive capex spend from big tech, and strong digital demand – as we outlined here earlier this month. (Told you NVDA at $100 was a gift.)

In addition, Nvidia’s next-gen Blackwell chip should begin to generate revenue by the end of year, and we expect this to be a significant catalyst.

The Blackwell chip promises to advance AI capabilities significantly, offering 4x faster training speeds, 30x faster inference, and enabling real-time generative AI on trillion-parameter models. It also features 25x lower total cost of ownership and energy consumption than the Hopper GPUs.

As you can see, there’s a lot to love about NVDA.

We see any pullback serving as a great entry point or accumulation opportunity for long-term investors.

Now, before I go, you heard Landon and I talk a bit about NVDA competitor Advanced Micro Devices (AMD) in today’s video. This is a name our paid-up members are well acquainted with – one we’ve even called “the next Nvidia.”

If you’d like to learn more about AMD, you can get caught up right here.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. Our colleague Jason Bodner has a knack for picking AI stocks (the last one outperformed NVDA by 460%). And he recently filled us in on an off-the-radar stock that he believes is set to power the whole world economy with AI. It’s just 1% the size of Nvidia right now – but if he’s right, this name could crush all other AI stocks starting in September. We figured you might be interested, so here’s the link where you can learn more.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

800% in Two Years: This Apparel Stock Is Beating NVDA’s Gains

And this dip is a perfect opportunity to get in on the action…

From AI to FOMO: Apple Is Riding 3 Enormous Tailwinds into September

Here’s why next month will be critical for the company – and its investors.