In our inaugural issue of Derby City Daily on February 27, we made a hard charge out of the gate with three stocks that Landon, Megan, and I hand-picked as some of our favorite opportunities for 2023:

- My pick was streaming ad giant The Trade Desk (TTD).

- Landon went with computer chip pioneer Nvidia (NVDA).

- And Megan chose Zurich-based shoemaker On Holding (ONON).

We chose these names carefully. Our consumer insights machine was picking up significant momentum in three core areas:

- Strong Consumer Demand

- High Consumer Happiness

- Macro Trend Tailwinds

But a lot has happened since then…

Irreverent interest rate hikes from the Fed, lightning-fast advancements in artificial intelligence, and an all-out banking crisis are just a few of the market shakeups we’ve faced in 2023.

So we’re revisiting TTD, NVDA, and ONON to see how the opportunities we spotted back then are holding up today.

Are the same macro tailwinds still benefitting these companies? Are they keeping consumers happy? Has demand stayed strong?

Find out how we’re playing these early-year picks now – and what comes next…

📰 Inside This Issue:

The Trade Desk (TTD): ⬆️ 16%

| PICK | OPEN PRICE FEB. 27 | OPEN PRICE MAY 12 | GAINS TO DATE |

|---|---|---|---|

| TTD | $55.37 | $64.16 | 15.88% |

You know that ad for your favorite snack that pops up while you’re binge-watching sitcoms?

Odds are, it originated from The Trade Desk.

This company specializes in digital advertising with a platform that helps brands harness the power of real-time data to better reach potential target customers.

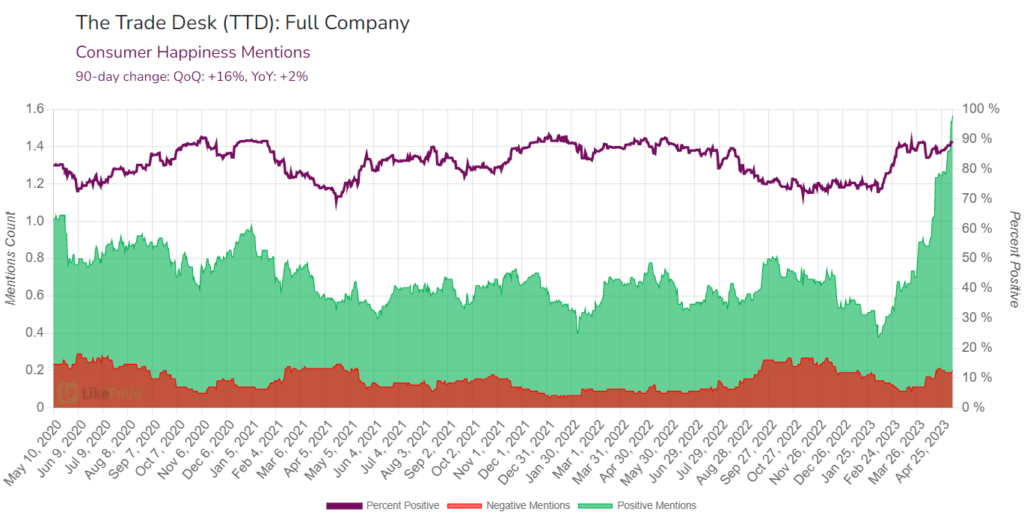

Ad spending is down across the board, but demand for TTD’s software is currently pacing 22% higher year-over-year. Perhaps even more impressive, though, are the Consumer Happiness improvements our system is registering.

Sentiment around TTD has improved by 16% quarter-over-quarter to reach an impressive Consumer Happiness level of nearly 90%.

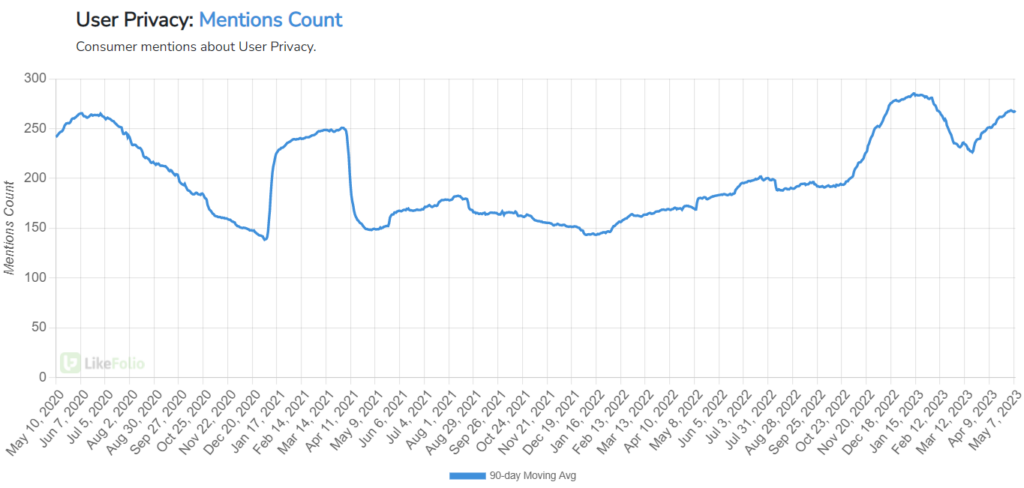

Interestingly, TTD is positioned to benefit from a trend that is harming others in the digital ad business: an increasing focus on user privacy.

User privacy concerns are top of mind for consumers right now as social media mentions trend 59% higher year-over-year.

Privacy policy changes at Apple and Google have made it harder for advertisers to target audiences… but they’ve also opened the door to new solutions, which TTD is providing.

For example, the company’s Unified ID (UID2) tool is making ads more relevant without using third-party cookies — and at the same time, less user intrusive by using encrypted email addresses.

Networks and streamers such as NBCUniversal, Paramount, Tubi, and AMC Networks have integrated UID2 into their platforms. And so far, they seem to be happy with the results: In the first quarter, TTD continued its nine-year streak of 95% customer retention.

That satisfaction is paying off big time for the company: TTD’s first-quarter revenue came in at $383 million, an increase of 21% year-over-year. And TTD clearly sees blue skies ahead, as it expects to far surpass that figure in Q2 with at least $452 million in revenue.

We’re still bullish on TTD as a long-term bet.

Nvidia (NVDA): ⬆️ 20%

| PICK | OPEN PRICE FEB. 27 | OPEN PRICE MAY 12 | GAINS TO DATE |

|---|---|---|---|

| NVDA | $236.70 | $285.29 | 20.53% |

Nvidia is an innovative chipmaker whose products power high-tech vehicles, gaming, e-commerce, cybersecurity, cryptocurrencies, cloud computing, online entertainment, and more.

The company invented the GPU (graphics processing unit) in 1999, the foundation of all things digital, including ChatGPT.

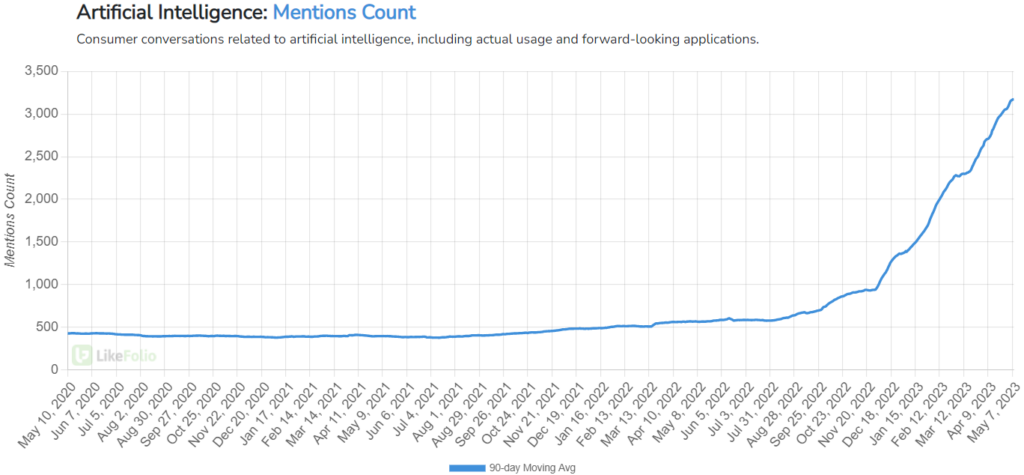

That’s right – NVDA is an artificial intelligence (AI) play.

It teamed up with Microsoft (MSFT) to build an advanced cloud-based supercomputer to help enterprises train, deploy, and scale state-of-the-art AI models.

And as interest in AI surges to new heights in 2023…

…NVDA’s share price has gained too.

Meanwhile, Purchase Intent mentions have climbed 16% year-over-year from their 2022 lows.

Mentions of and demand for NVDA’s products will only continue to surge as AI pervades more areas of our lives.

The best part? When it comes to the growth path for the AI industry, we’re merely at the start of the runway: Next Move Strategy Consulting expects the AI market to grow from nearly $100 billion in 2021 to nearly $2 trillion in 2030. That’s an increase of more than 20x in less than a decade.

And with NVDA’s chips serving as the product of choice for many of the big players in the AI industry, the company has practically guaranteed itself a generous slice of that pie.

The company is expected to report earnings May 24, so we’ll be keeping close tabs on the data from here.

But long-term, we’re definitely bullish.

On Holding (ONON): ⬆️ 56%

| PICK | OPEN PRICE FEB. 27 | OPEN PRICE MAY 12 | GAINS TO DATE |

|---|---|---|---|

| ONON | $20.98 | $32.69 | 55.82% |

Jim Cramer went on air March 22 to tell millions of CNBC viewers that ONON “is one of the best growth stories out there…”

Of course, he only said that after the company reported stunning 92% revenue growth for the fourth quarter and shares zoomed 26% in a single day.

The tiny Zurich-based shoemaker was running under the radar for Cramer and most investors until that “surprise” earnings beat.

But not for us.

On was on our watchlist here at LikeFolio – and with the launch of Derby City Daily, we made sure it was on yours too.

Since Megan highlighted ONON in that first issue, shares have gained 56% and counting… Which means if this was a competition (isn’t it always?) Megan’s pick would take the cake.

We shared our initial outlook on ONON ahead of Tuesday’s earnings call, which you can check out here.

And you can look forward to a full Earnings Sneak Peek in Derby City Daily tomorrow.

We’re thrilled that our wins have become your wins. Expect many more to come.

Until next time,

Andy Swan

Co-Founder