Let me share one of my very best stock-market secrets…

If “fast-cash trades” are your thing, earnings season can deliver the hottest trades you’re looking for.

The next earnings season kicks off just days from now. And it’ll be your best trading opportunity of 2023.

This isn’t hype – it’s based on solid facts and peer-reviewed research.

Earnings reports are the financial markets’ version of political elections. Public companies periodically release something called “earnings guidance,” a sneak peek at their financial performance that serves as a kind of campaign promise.

When those businesses later issue their quarterly earnings reports, investors can “vote” by buying or selling the company’s shares – based on whether the firm met, exceeded, or fell short of its forecast.

Studies show that the stock price of a soon-to-report company contains something called an “earnings announcement premium,” and that stocks make some of their biggest moves – up or down – after these quarterly reports.

Indeed, a study by the National Bureau of Economic Research (NBER) found that the days before and after these earnings reports are characterized by above-average volume and wider price swings.

And there can be a lot of follow-on action – feeding into prolonged rallies or painful freefalls.

That’s why earnings season is almost always the best place to find “fast-cash trades.” But even in a trendless market like the one we’re navigating now, three things tell me that the run of earnings we’ll start to see in days will open the hottest trading window we’ve seen in years.

Let me run through those three reasons – and then tell you how you can ride along with us…

Reason No. 1: A Sideways Market = A Big Profit Window for Fast-Cash Seekers

Moribund markets are where buy-and-holders go to die. And with the S&P 500 treading water around the 4,000 level, that market bellwether is smack dab in the middle of a trading range that’s lasted almost a year.

“What comes next?” and “when will that happen?” are the two questions worried investors want answered. And given the fog of the “flat-and-uncertain” market we’re traveling through, I wouldn’t answer either one.

The good news is you don’t need an answer to make a lot of money.

But you do need a different approach – a different investing strategy.

In a stalled, directionless market like this one, I want to be more active with my money. I want to jump on opportunities that open and close in days or weeks – not months or years.

And earnings season is the perfect venue for this kind of “quick-strike” strategy.

Even though the broader indices aren’t establishing clear trends, individual stocks still make big moves after companies report quarterly earnings – and those big moves can put cash in your pocket.

Want proof? In the last quarter alone, out of 17 earnings trades employing our popular “high-probability” trade strategy, we had a win rate of 82% for an average gain of 21.89%… each time in five days or less.

Get in on a stock that’s set to pop on earnings… Watch as the company reports its numbers… And get out with a hefty profit within five days.

That’s my plan, and earnings trading is how I’ll achieve it.

Reason No. 2: The Best Weekends Are Worry-Free Weekends

War.

Bank failures.

Recession fears.

Inflation, rate hikes, layoffs, global intrigue.

The greater the market uncertainty – and the bigger the opportunity for ugly surprises – the more important it is to protect your financial keester.

Translation: Reduce your risk.

And one easy way to do that is to reduce the amount of time your money is exposed to risk.

Earnings trading accomplishes this with tremendous effect. You get into trades with super-short “risk windows” of just five days.

Get in on Monday. Get out on Friday. Park your cash. And enjoy that weekend.

Reason No. 3: A Bullseye on Earnings

As Team Powell throttles back on its rate-hike campaign, Wall Street heavyweights will zero in on corporate earnings – and whether companies are meeting, beating, or falling short of forecasts.

That’s the earnings game Wall Street plays.

And that’s why I believe this soon-to-start earnings season could be the most crucial in years – with the highest profit potential for the trades we do.

With a stable interest rate environment, Wall Street could pour billions into companies with strong sales, expanding margins, and surging profits. And it will drain billions from the companies that disappoint.

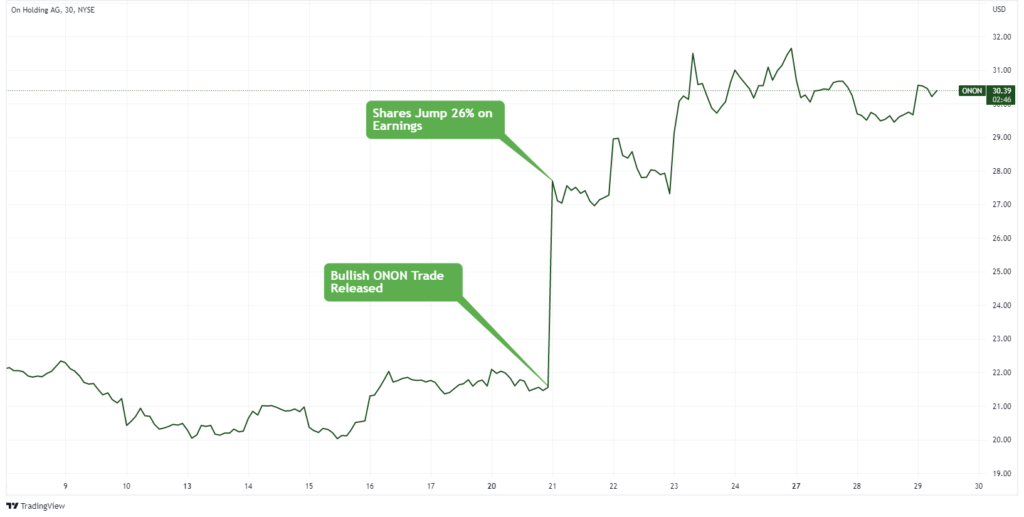

We saw exactly this in the preceding earnings season when innovative shoe retailer On Running (ONON) beat earnings forecasts – triggering a 26% jump in its stock price and causing our suggested earnings trade to return 102% in less than five days.

And that’s just one example of the big, earnings-driven stock moves we saw in the final few weeks of the last earnings season.

In fact, I’m predicting that the soon-to-start earnings season will see at least 15 big-name stocks move by at least 20% during the week that they report earnings.

That means big profit potential for investors like us – with an edge.

And we’ll teach you how to use that edge in a special event we’re planning that you can claim your seat for today…

How to Claim Your Seat at the “Earnings Season Party”

Personally, I never show up to a party empty-handed – be it for the Kentucky Derby, the Super Bowl, or earnings season. And you shouldn’t, either…

Because Landon and I have made it our business (literally) to teach everyday investors like you how to profit from earnings season.

That’s why we’re hosting a special live broadcast to kick off the “Earnings Season Party,” and we want YOU to join us.

We’ll show you how to trade ahead of the earnings reports of more than 400 companies during the next 40 days of earnings season so you can get in, get out, and get paid… dozens of times in the coming weeks.

But you have to claim your seat for this “Earnings Season Party” now…

So click here to reserve yours.

Until next time,

Andy Swan

Co-Founder