Last week, we warned our Derby City Daily readers that a “buy the rumor, sell the news” event could hit Nvidia (NVDA).

We analyzed the market psychology, the soaring stock price, the high expectations, and the potential risks heading into its critical second-quarter earnings report.

The idea was that investors were buying up NVDA shares on positive rumors – anticipating yet another blowout earnings report.

Then, once the news was announced, all those folks would sell their shares to take profits off the table.

Because the thing about a “buy the rumor, sell the news” phenomenon is, it doesn’t matter how great the actual news is. The stock can still plummet once it’s released.

And then it happened.

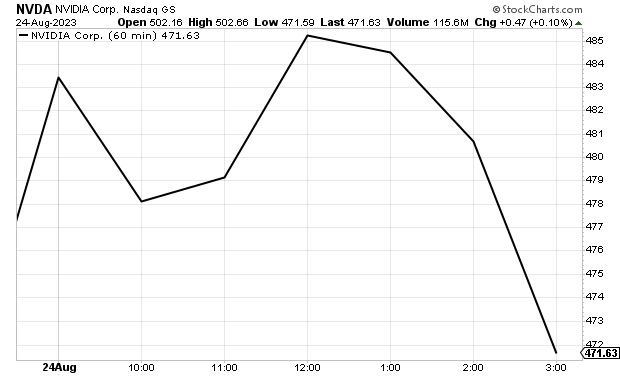

On Thursday, even with NVDA’s incredible results and an initially bullish reaction across the tech sector, the stock plummeted through the day from its opening highs and ended the day basically flat.

Meanwhile, the rest of the semiconductor and tech sectors tanked, leading to a one-day decline of over 2% in the Nasdaq.

They “sold the news.”

But I’m not saying this to brag.

I’m saying this because being right means being prepared: It means understanding the market, following the data, and making informed decisions.

That’s the “edge” we bring you with Derby City Insights to help you get the jump on every other investor out there.

Our social media machine sifts through millions of posts per day to give us a real-time read on where consumers are spending their money.

It’s a huge advantage – one that gave our MegaTrends subscribers a chance to cash in on NVDA under $130 per share and make 262.34% in under a year.

And it’s one we can use now to cut through the noise and focus on the moneymaking opportunities at hand…

A Pivotal Moment for Stocks

Nvidia’s earnings sell-off was not just a one-off event.

A big reversal after such an incredible earnings report could signal a significant short-term correction, especially in tech and semiconductor stocks.

If and when that correction occurs, we’ll be ready to move into some of our favorite long-term growth opportunities…

Names like The Trade Desk (TTD), Tesla (TSLA), and yes – Nvidia – are all worth buying on a short-term pullback.

We’ve covered each of these names extensively, so check out our most recent updates on each in these free Derby City Daily issues:

- This Company’s AI Knows What You Want Before You Do

- Rising Gas Prices Could Be a Boon for EVs in 2024 (Emerging Winners)

- Why a Near-Term Nvidia Pullback Could Open a Lifetime Opportunity

We see a clear runway for growth for each of these stocks and will be monitoring consumer behavior on Main Street from here.

But rest assured: These AI opportunities are just getting started. And our paid-up subscribers will be the first to know about the next stocks we’re targeting.

In fact…

🔥 Hot Off the Press: 125% AI Profit Opportunity 🔥

Paid-up LikeFolio Investor subscribers received a brand-new buy alert today for an AI gaming stock that could skyrocket 125% in the next two years.

With a recent pullback in the stock price giving us an ideal entry point to maximize our profits, you won’t want to wait on this time-sensitive opportunity…

Click here to find out how you can join today for immediate access to that trade and more.

More Exclusive Opportunities and Resources to Unlock with LikeFolio Investor

- Buy This AI Gaming Stock for a Shot at 125% Gains 🔒

- The $25.8 Billion Industry Apple Can’t Seem to Win 🔒

- Add This AI Stock to Your Back-to-School Shopping List 🔒

- This Could Be a $100 Stock in 2024 🔒

- [Special Report] The Great $2 AI Moonshot 🔒

Ready to become a member? Get started here.

Until next time,

Andy Swan

Founder, LikeFolio