Retailers have a “shrink” problem in 2023. It’s an industry term for theft and damaged inventory that’s been popping up more and more this earnings season.

Last week, it was causing headaches when a “mob of criminals” ransacked an L.A. Nordstrom (JWN) for $300,000 in merchandise…

This week, it was the excuse Dick’s Sporting Goods (DKS) used for falling short of profitability expectations in the second quarter.

Dick’s CEO Lauren Hobart called it “an increasingly serious issue impacting many retailers.” And she’s right. Her company shed $3 billion in value on Tuesday as DKS shares sank over 20% on the revelation.

Fellow retailer Ulta Beauty (ULTA) has faced its fair share of challenges with inventory shrink, theft, and organized retail crime (ORC).

During its second-quarter earnings call last night, Ulta reported a decrease in gross profits as a percentage of net sales “primarily due to lower merchandise margin, higher inventory shrink, and higher supply chain costs.”

So far today, Ulta shares have tumbled 4% on the announcement, down 26% from the stock’s $551.43 all-time high in April.

And as surprising as this may sound, Ulta’s post-earnings “shrink” sink has me thrilled.

Not because we’re cynical and want Ulta to fail… or because we were betting against the company…

But because Ulta’s pullback could be the “ulta-mate” buy-the-dip opportunity.

And I’ll show you why here today…

Perfectly Positioned in a Thriving Industry

While retail theft is an issue, Ulta is using a “full-court press” to address it.

It’s hiring more staff, more security – and armed security in some locations – putting products behind locked cabinets, and working with the landlords of their location to have a police presence in the parking lot.

Theft will always be something any retailer has to deal with, but this isn’t something that is wrong with Ulta’s products or brands.

Quite the opposite.

Ulta is a force to be reckoned with in the $579.2 billion global beauty industry.

It’s starting from a strong foundation: Even in the worst economic conditions, beauty product sales stay buoyed – even getting better in some cases – thanks to a contrarian trend coined “The Lipstick Index.”

The theory is that when consumers can’t splurge large amounts on vacations, new cars, or high-end clothes… a tube of a new lipstick or a bottle of perfume can substitute in as a more affordable luxury.

This theory rang true in late 2007 and into 2008 when the Great Recession began and nail polish sales took off; even during the Great Depression as industrial production was cut in half, cosmetic sales still rose.

From “prestige” (aka expensive) luxury products to generic and drugstore-level brands stocking its shelves, folks can turn to Ulta to treat themselves, but they don’t have to break the bank to do so.

A single tube of lipstick at competing beauty store Sephora might cost you $27 but at Ulta, you can grab that new shade of Ruby Red for $15 on average.

And once a customer is in the door, Ulta’s Ultamate Rewards program keeps them coming back.

It’s free to sign up – and 40 million folks already have. The more you spend, the more rewards you collect, like special discounts, free gifts, early access to new products and deals, free shipping, and more.

The Ultamate Rewards program works so well that a whopping 95% of Ulta’s sales are tied to the program, says Nicole Bernhardt, the exec who heads it up.

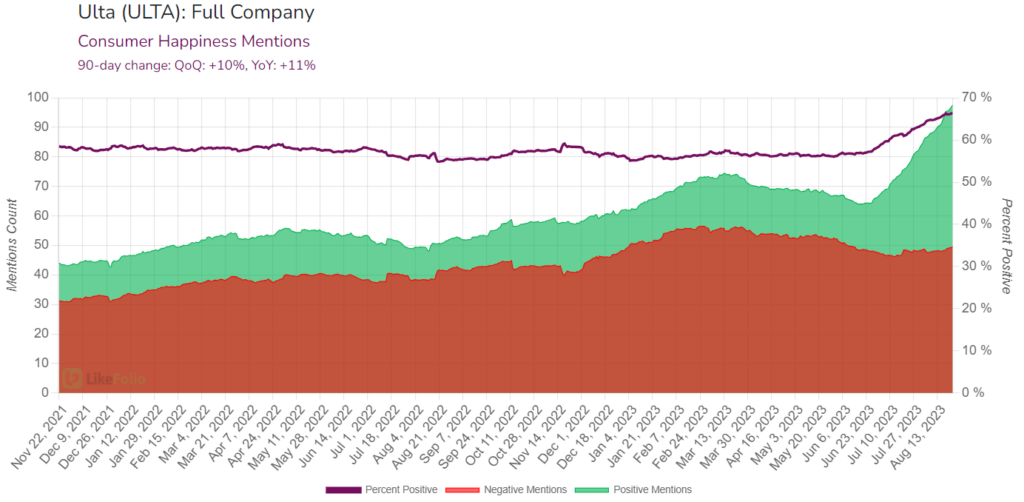

Consumers are loving it, and Ulta’s Consumer Happiness is way up, gaining 11% year-over-year.

And we saw that demand reflected in last night’s earnings report:

- Net sales grew 10% year-over-year to $2.5 billion

- Earnings per share increased by 7.5% over the same period (beating Wall Street expectations on both counts)

- And Ulta upped its 2023 outlook to account for better-than-expected earnings.

Despite the temporary dip in its stock price, we know Ulta’s approach is working.

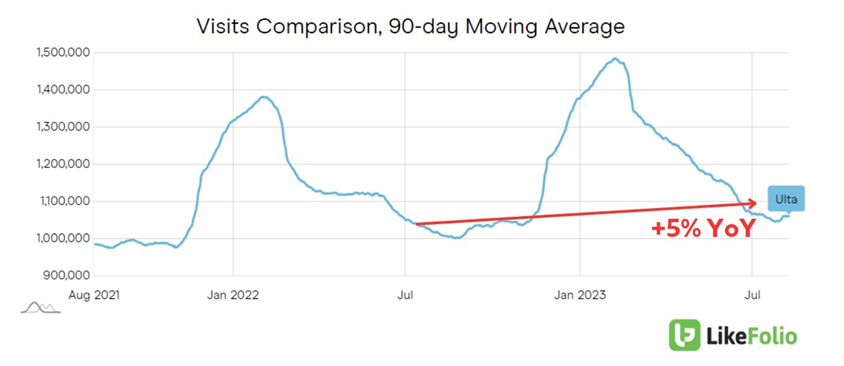

Purchase Intent mentions are accelerating by as much as 38% year-over-year – and web visits are up by 5%, showing strong positive momentum continuing on Main Street.

And younger consumers are especially engaged with the brand as Ulta lines up its next generation of spenders.

Ulta is the number-one beauty choice for Zoomers, according to Piper Sandler’s 2023 Teen Survey, with a whopping 63% of female respondents already being Ultamate Rewards members.

With these consumer insights in hand, you can see why we’re confident that Ulta’s challenges with “shrink” are temporary roadblocks rather than fundamental flaws in the company’s business model.

The company’s strong position in the teen market, innovative loyalty programs, and alignment with industry growth trends make it a compelling investment for the future.

And at the end of the day, this dip gives you a strategic entry point to invest in a company that continues to dazzle in the ever-evolving world of cosmetics.

Our edge is now your edge.

And we invite you to level up that edge – and unlock the next big winner on our radar – right here.

Until next time,

Andy Swan

Founder, LikeFolio