In an industry grappling with tightening consumer budgets and macroeconomic uncertainty, Airbnb (ABNB) offers investors a glimmer of hope.

The broader travel sector is facing challenges. The burst of pent-up demand felt post-pandemic has leveled out. The surge in “bucket list” trips and splurging on vacations missed during COVID has subsided. Americans are settling back into their normal routines.

Demand is softening.

Airbnb itself warned it was seeing “some signs of slowing demand from U.S. guests” on its last earnings call.

But forward-looking LikeFolio data reveals a bright spot for Airbnb – one that could suggest it’s in for a bullish surprise over the coming quarters…

Traffic Tells the Story

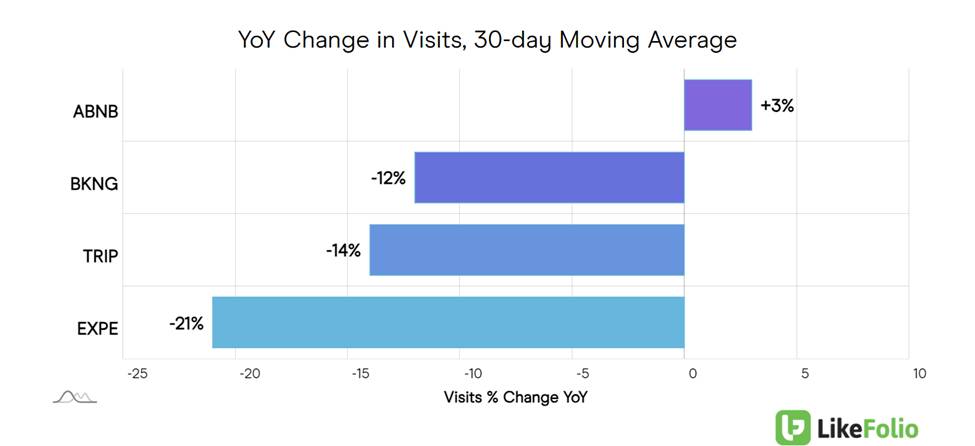

One of the most telling indicators of Airbnb’s relative strength is its year-over-year web traffic growth, which LikeFolio’s insights machine captures in real time.

While Expedia (EXPE), Booking Holdings (BKNG), and TripAdvisor (TRIP) have all seen double-digit year-over-year declines in visits, Airbnb stands alone with a 3% increase:

This is a clear sign that Airbnb’s platform continues to attract users, even as competitors struggle.

However, it’s not all positive. Quarter-over-quarter, Airbnb’s web traffic has dropped 17%. This decline could be attributed to seasonal shifts in travel behavior or broader consumer caution.

Despite this drop, Airbnb’s year-over-year growth demonstrates resilience in an industry where others are faltering.

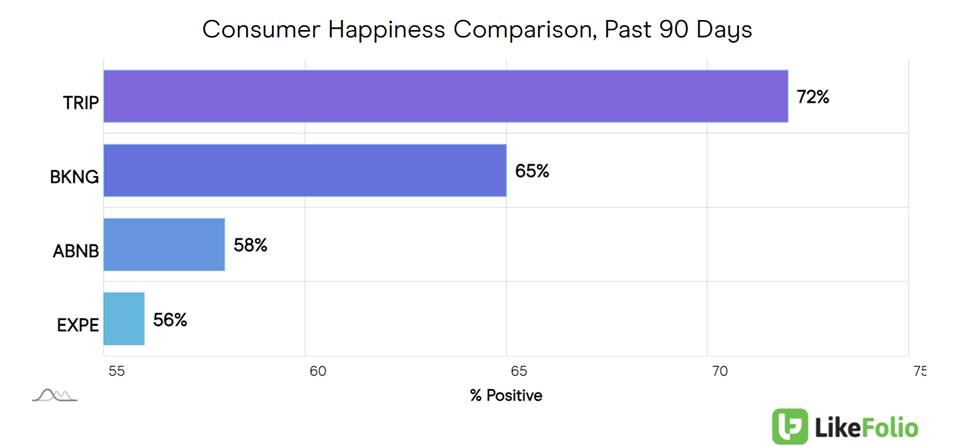

Consumer Sentiment Leaves Room for Improvement

When it comes to Consumer Happiness, Airbnb has shown some improvement, but it still sits near the bottom of the pack…

The company’s efforts to improve the overall guest experience through initiatives like Guest Favorites, Top Property badges, and Icon Experiences, have helped boost positive sentiment by four points in the last month.

Still, ABNB’s 58% score is notably lower than TripAdvisor, which leads with a 72% happiness rating, and Booking.com, which sits at 65%.

The competition is fierce in this space, and Airbnb’s consumer satisfaction needs to continue improving to remain competitive.

The Impact of Operational Changes

Another key contributor to Airbnb’s improved consumer sentiment is its decision to remove 200,000 underperforming listings that failed to meet guest expectations. This strategic move has led to a more consistent and reliable experience for travelers, which should help the company continue its upward trend in Consumer Happiness over time.

Additionally, Airbnb’s increased focus on international expansion – especially in less mature markets – offers potential for further growth.

The company is leveraging its strong brand reputation to tap into new regions, creating opportunities that can offset some of the pricing pressures and margin constraints it’s facing in established markets.

Financials: A Balancing Act

Airbnb’s revenue growth is following a positive trajectory. The company reported an 11% year-over-year increase in revenue in the second quarter. That said, earnings per share (EPS) missed estimates by 6 cents.

Looking forward to next quarter, analysts expect revenue to rise another 9% year over year, but EPS is projected to decline by 7% as Airbnb continues to face pricing pressures and rising costs.

We’ll be watching this decline in profitability closely. While revenue growth is encouraging, competition and macroeconomic headwinds may continue to squeeze Airbnb’s bottom line.

Shorter booking windows and an increase in last-minute bookings highlight the current consumer mindset – cautious spending and more price sensitivity, which could continue into the holiday season.

Stock Performance: A Mixed Picture

From a stock perspective, Airbnb shares have been volatile. Year-to-date (YTD), shares are flat, but they are down 9% over the past three months. The recent trend, however, has been more positive, with shares climbing 12% in the last month.

Despite this upward momentum, Airbnb’s stock is still trading at a P/E ratio of 18.5, much lower than its three-year average of 39.7, suggesting potential value if the company can improve profitability moving forward.

The Bottom Line

Airbnb is navigating a challenging landscape better than most of its competitors.

Its ability to grow web traffic and improve consumer sentiment amid sector-wide headwinds speaks to the strength of its brand and platform. However, short-term profitability concerns and heightened competition from major players like Expedia and Booking.com remain key risks.

Playing ABNB from Here

Over the long term, Airbnb’s focus on international growth and commitment to improving the guest experience will be crucial drivers for long-term success.

In the near term, investors should keep an eye on Airbnb’s third-quarter earnings report next month, which will provide critical insight into how the company is managing these challenges.

As of this writing, we don’t know the exact date ABNB will report (the company has yet to announce it); it’s likely to drop sometime in the first week of November.

We do know that Earnings Season Pass members will be armed with our best recommendation for playing ABNB’s third-quarter earnings thanks to our unique earnings “cheat code.” That cheat code is our Earnings Score. ABNB’s score will tell us how bullish or bearish we should be on its upcoming report – and the best way to play it.

You saw how LikeFolio predicted United Airlines’ (UAL) earnings beat earlier this week. We do that for hundreds of companies every single quarter.

The invitation’s always open: You’re free to join us right here.

The timing couldn’t be better with a new earnings season freshly underway and dozens of opportunities still ahead.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

How LikeFolio Data Spotted United Airlines’ Earnings Liftoff

UAL just delivered the first of many earnings season victories. Here’s how we called its ascent – and what comes next…

Sports Betting Stock Showdown: Winners and Wildcards This Football Season

In this DraftKings vs. FanDuel rematch, new data reveals one stock pulling ahead – and a potential wildcard winner…