Wall Street thinks so – but here’s the consumer perspective. That’s what really matters…

Remember when you could get a burger from McDonald’s (MCD) for a dollar?

I certainly do. I also remember when the company ditched its fan-favorite Dollar Menu in 2013. It turned out to be the first of many controversial price hikes that would eventually drive away its biggest cohort of hungry customers.

These days, a Big Mac at a McDonald’s rest stop in Connecticut sets you back a whopping $18.

While McDonald’s leadership railed against this one-off pricing example, the fact remains that MCD’s average menu prices have risen 40% over the last five years.

A 10-piece McNuggets meal will cost you 28% more than it did in 2019, while the price of a medium fry is up 44%.

For a company that claims to have “written the playbook on value,” McDonald’s hasn’t been living up to expectations.

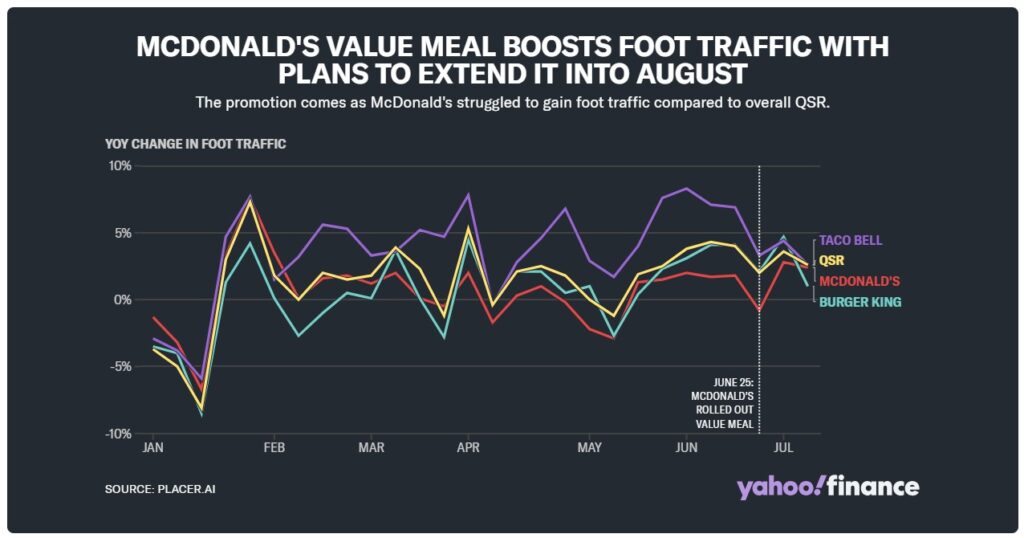

In 2024, higher-than-ever prices have met serious resistance from consumers, leading to slower foot traffic. The once-undisputed King of Fast Food has now alienated its low-income consumer base.

The consequences became clear yesterday: In the second quarter of 2024, McDonald’s recorded its first global sales decline since 2020.

With fewer guests coming in the door, same-store sales in the U.S. slipped 0.7%, net income was down 12% year over year to $2.02 billion, and adjusted earnings per share fell 6% to $2.97.

But it wasn’t all bad news. The fast-food empire admitted its menu is “too expensive.” And it has a plan to right the ship…

The $5 Meal Deal: MCD’s Golden Ticket?

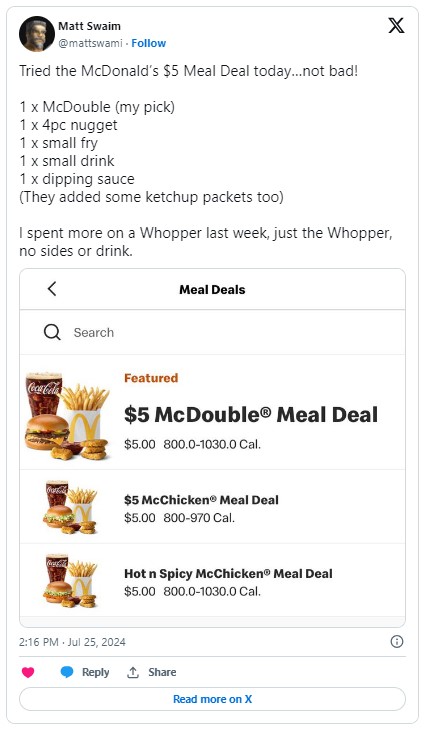

McDonald’s new strategy to win back consumers? A $5 Meal Deal, which hit menus nationwide this summer.

While the $5 Meal Deal has yet to bear fruit in earnings results, it has been effective in getting consumers in the door – and trying other things. For the customers who grabbed one, the average check size was over $10, according to McDonald’s execs.

The company reported a significant boost to foot traffic at its restaurants yesterday, thanks to its new value meal:

With positive results, and an overwhelming majority of franchisees (93%) voting to keep it around, McDonald’s is extending its $5 Meal Deal to at least the end of August. (So, it’s not too late to go grab one for yourself.)

Wall Street seems to agree this $5 Meal Deal could be MCD’s golden ticket. Despite an otherwise dismal earnings report, shares soared yesterday on the news.

But it’s ultimately up to Main Street to decide McDonald’s fate – consumers choose where they spend their hard-earned cash. And that’s where our unique consumer insights give us an edge.

Here’s what LikeFolio’s real-time data reveals about MCD’s prospects…

The Consumer Perspective

McDonald’s is the largest fast-food company in the LikeFolio universe from a mentions perspective, and also sits at the top spot when it comes to food app downloads, boasting more than 150 million loyalty members.

And we can tell you MCD is gaining positive traction since the $5 Meal Deal hit menus nationwide.

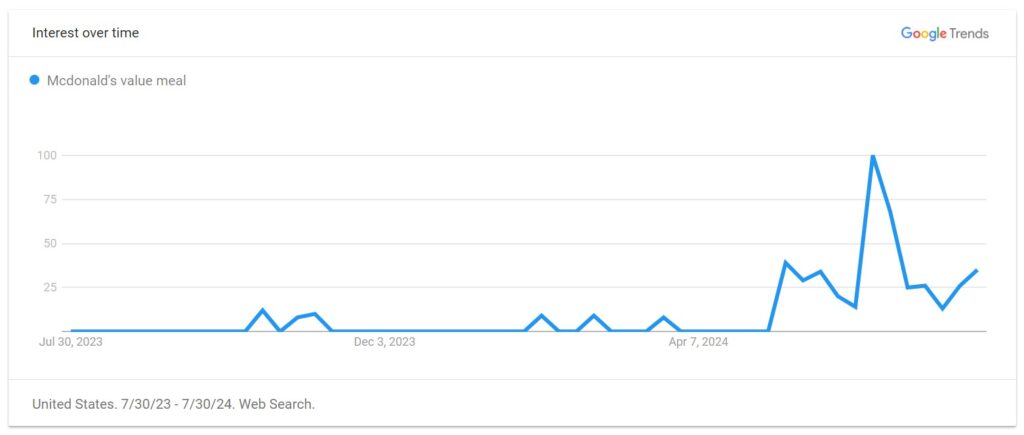

Consumer searches for McDonald’s value meals hit a new high this summer as the deal rolled out:

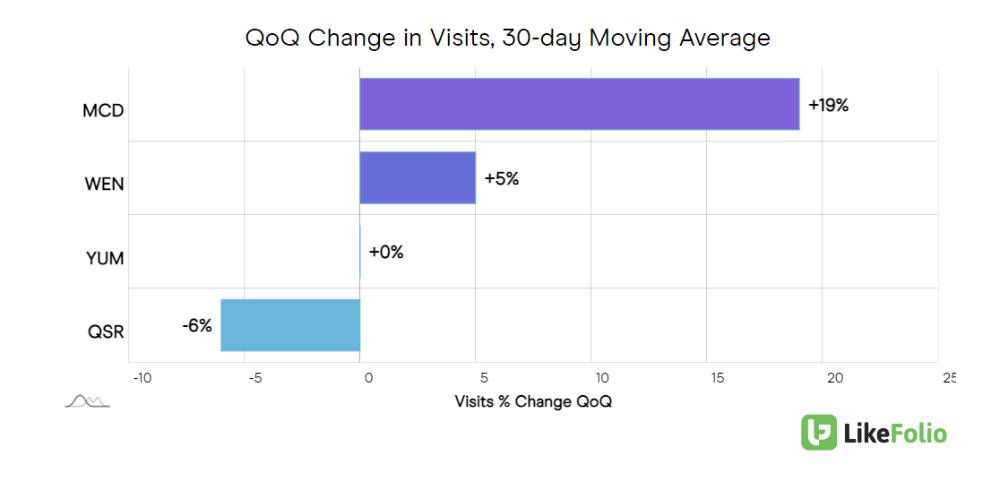

Web visits have jumped 19% quarter over quarter, putting MCD in the lead against comparable fast-food peers like The Wendy’s Company (WEN), KFC and Taco Bell parent company Yum! Brands (YUM), and Burger King’s Restaurant Brands International (QSR):

It’s worth noting that each of those competitors have added value deals to their menus in recent months – yet McDonald’s is still gaining the most traction of the group. And that bodes well for the stock.

Bottom line: Consumers are lovin’ it.

With the $5 Meal Deal giving McDonald’s a much-needed boost in consumer sentiment and foot traffic, we see a potential opportunity brewing for long-term investors.

For another fast-food pick with potential, check out this pizza joint rolling out AI and automation tech. Both of these names deserve a place on your moneymaking watchlist.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

A Tempting Pick-and-Shovel Play for the AI Gold Rush

If you missed out on NVDA’s rise, keep a close eye on this budding software supplier…

AI and Automation Could Mean Big Dough for Domino’s

Turns out, Domino’s is a tech company, and here’s how you can get a piece of the pie…