SoFi Technologies (SOFI) is off to the races.

Finally.

The debt ceiling deal in Washington has ended the three-years-and-counting freeze on student loan payments – an embargo that was gutting a key segment of SoFi’s business.

Last quarter, SoFi’s student loan unit counted $525 million in revenue – more than 75% less than the $2.4 billion recorded pre-pandemic.

Investors immediately understood what this news means: The San Francisco-based SoFi can ramp up its top line – even as the tech-focused financial services firm capitalizes on the other hefty opportunities it sees.

SoFi shares jumped 11% the day the agreement was announced.

But we saw this coming.

We “saw” this rebound long before the debt-ceiling agreement was reached. In fact, even before the debt-ceiling “crisis” began.

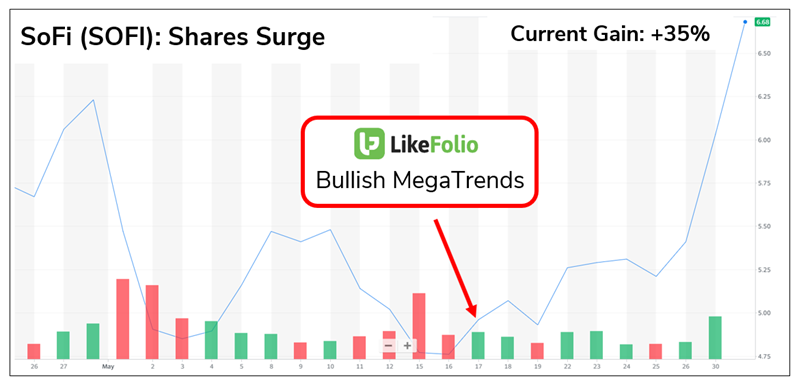

Early in May, our data led to a “double-down” call on our existing bullish SOFI “buy” call.

You can see the whole story in this chart… and what SoFi shares have done since then.

Let me tell you more about SoFi today.

What the company does, why we like it, and the powerful signals that told us a rally was coming…

The SoFi Story

Like so many ventures in today’s high-tech space, SoFi bills itself as a “platform” player – with a focus on financial services. It offers a lot of the usual services like savings-and-checking banking, investing, credit cards, student and personal loans, and mortgages.

But it uses its proprietary technology to let folks do all those things with a single company along with offering “value added” services like financial planning,

SoFi “missionizes” those offerings by telling customers that it can help them achieve financial independence – using the tagline “SoFi helps people get their money right” to drive that vision home.

SoFi isn’t the only company that’s trying to pull this off.

But it’s one of the leaders when it comes to execution.

And two big “triggers” told us that a rally in the stock was coming.

Trigger No. 1: When Big Consumer Trends Collide, Big Things Happen

The fact was that SoFi was surfing some pretty important trends.

One of the biggest was a surge in consumer preference for, and adoption of, digital wallets.

Mentions of using a digital wallet have increased by 14% from last year to this one.

SoFi lets customers add credit and debit cards to its digital wallet. And it’s possible to upload its own virtual debit card to such third-party wallets as the Apple Wallet, Samsung Wallet, and Google Pay.

That growing usefulness of digital wallets gets even bigger when you consider that we’re right now looking at a surge in crypto trading (as we detailed in yesterday’s story).

SoFi’s app lets users Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) alongside stocks and ETFs on the same platform.

Trigger No. 2: Main Street Was Smarter Than Wall Street (Once Again)

Mentions of consumers using one of SoFi’s banking services were rising – a lot – even as the company’s stock price was falling.

That’s big.

Not only was mention buzz growing on a quarter-over-quarter basis, but web visits were zooming – accelerating 59% from last year.

That told us that SoFi is improving user engagement, service adoption, and audience expansion.

Better still? SoFi’s product buzz continues to improve, currently pacing 27% higher quarter-over-quarter:

The Takeaway

SoFi is an innovator, and a leader – one that’s really providing value to, and connecting with, its customers.

That will lead to top-line growth in its own right.

And with the student loan shackles off, revenue from that source will grow, too.

It’s an exciting company – and on a $7 stock, we’re talking about an opportunity that continues to grow for investors taking the long view.

Until next time,

Andy Swan

Co-Founder