If recent headlines have taught us anything, it’s that top company leadership needs protection.

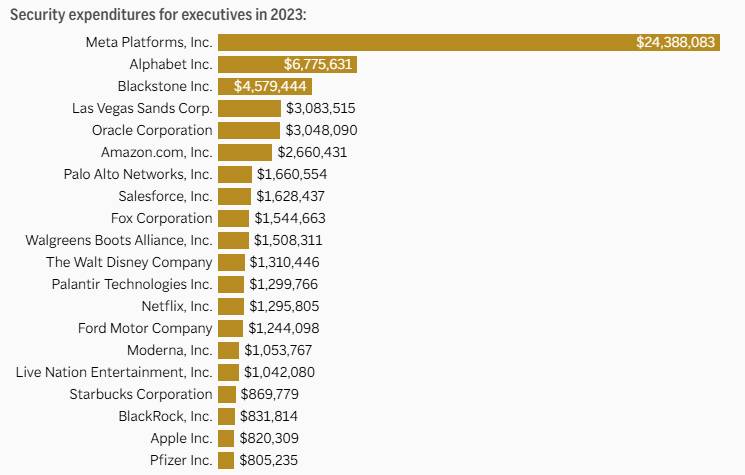

Last year alone, Meta Platforms (META) shelled out $23.4 million for Mark Zuckerberg’s security, the most of any U.S. company.

This kind of spending is partly used for round-the-clock bodyguards and security detail.

Unfortunately, the majority of executive protection (EP) services that offer this kind of focused on-site personnel are privately held, including Allied Universal and Constellis Holdings.

However, executive protection includes more than just bodyguards. That Meta security bill we mentioned also covers a wide variety of security systems like cameras and alarms, as well as cybersecurity measures.

And it’s not just Meta shelling out big money on keeping its leadership safe.

Executive protection spending by S&P 500 companies doubled between 2021 and 2023.

Following the death of UnitedHealthcare (UNH) CEO Brian Thompson, demand for these services could accelerate. And the companies offering the technology and services towards executive protection could be positioned for growth.

Today, we’ll help you prepare for the potential opportunities that could arise from this trend with a high-level overview of the major players in the space.

At the very least, these stocks should be on your watchlist…

Security & Protection Services Watchlist

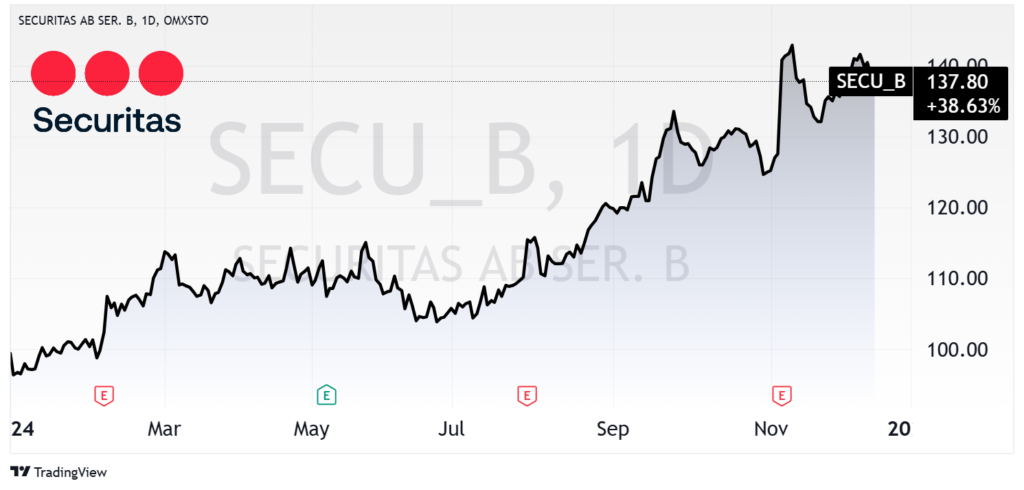

Stock No. 1: Securitas AB (SECU-B.ST)

Traded on the Stockholm stock market, Securitas AB (SECU-B.ST) provides a wide variety of security solutions.

Its executive protection services include security guards, patrols, and monitoring services. Its other services include operation centers, risk management, and security screening, along with technology-driven solutions such as video surveillance.

Securitas also owns Pinkerton, a private investigation company that serves as a security and risk management provider.

Securitas AB maintains a strong client retention rate of 87% in North America, and an even stronger 90% in Europe, reflecting positive experiences from its customers.

Securitas shares are up 38% year-to-date (YTD).

Stock No. 2: ADT Inc. (ADT)

ADT (ADT) will be a familiar name to American consumers. The company focuses on home and business security, providing solutions for the buildings themselves, including alarms, cameras, and hazard detectors.

The company also provides Patrol with onsite guards, patrol cars, and dispatch.

For large enterprise customers, ADT offers its Enterprise Security Risk Group (eSRG), offering business-wide solutions for improving security and safety.

ADT does not provide private executive protection. Rather, it focuses on consumer and business-level security.

For the third quarter of 2024, increasing sales volume led to a 5% year-over-year increase in revenue for ADT and record recurring monthly revenue.

ADT shares are up ~5% YTD.

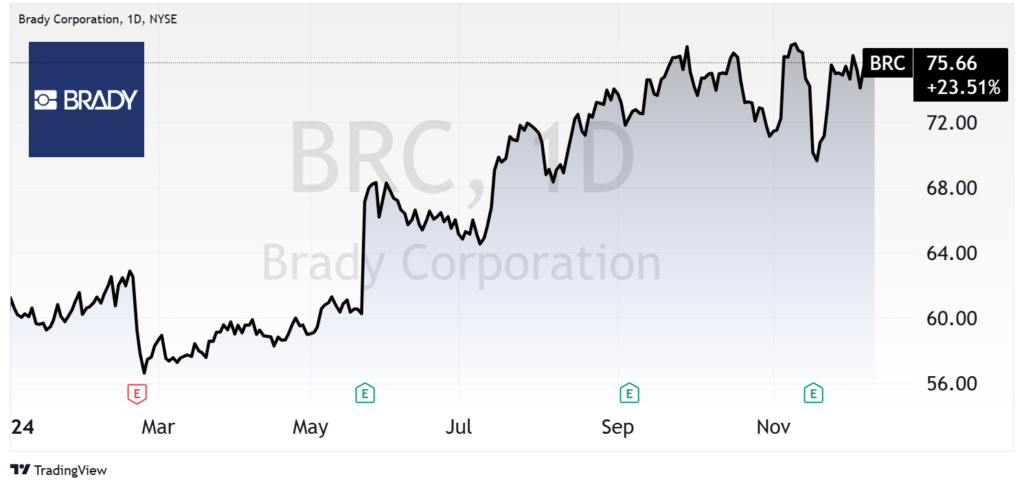

Stock No. 3: Brady Corp. (BRC)

Brady Corp. (BRC) provides workplace safety and identification solutions for a wide variety of sectors – from industrial to government to entertainment.

These include badges, lanyards, ID cards, etc., as well as the infrastructure and software to implement them.

The company does not focus on outright executive protection but provides many services to secure businesses. Its core competency is in industrial solutions that create a safer work environment, such as labels, locks, and signs.

BRC’s earnings report for the quarter ended October 31, 2024, featured a 13.6% year-over-year sales boost and an earnings per share (EPS) beat.

Shares of BRC are up 23% YTD.

Stock No. 4: Napco Security Technologies (NSSC)

Napco Security Technologies (NSSC) develops, manufactures, and sells electronic security systems, including ID readers, door locks, alarm systems, and video surveillance systems.

These products make for ideal security infrastructure of executive personnel and are products that can be installed across company locations.

Net sales gained 6% year over year in its most recent quarter, reaching a record $44 million. The company has greatly improved its profitability with increased efficiency and high-margin products, leading to an 84% increase in net income from FY23 to FY24.

NSSC shares are up 14% YTD.

Stock No. 5: Evolv Technologies (EVLV)

Evolv Technologies (EVLV) manufactures and sells weapons detection security screening solutions designed to detect firearms, explosive devices, and other threatening items.

Evolv’s tech screens roughly 1 million people every day from all of its systems, detecting more than 500 firearms daily, with upwards of 800 customers across its various industries.

Additionally, the company provides an insight service towards visitor flow, alarm activity, detection performance, and more. This data can assist risk management and security planning.

In its most recent quarter, EVLV reported a 29% year-over-year revenue surge due to increasing demand for its products, bringing in $25.5 million. However, due to operating at a loss, this growth is not as influential on its stock performance.

Shares of EVLV are down 18% YTD.

The Bottom Line

Executive security was once seen as an unnecessary “burden” on shareholders. But one high-profile event can change the whole game.

Considering the renewed interest in keeping top company execs safe, companies that provide security and protection services could see an uptick in demand. Savvy investors should keep a close eye on these names:

- SECU-B.ST: Sweden-based Securitas AB provides extensive executive protection services and boasts a strong client retention rate of 87%.

- ADT: This familiar name provides consumer and business-level security rather than private executive protection. You’ll likely find ADT’s protection signs in your own neighborhood (or home).

- BRC: While it does not focus on outright executive protection, Brady’s services are geared toward securing businesses at large, providing workplace safety and ID solutions for a wide variety of sectors.

- NSSC: Napco’s electronic security systems provide an ideal infrastructure for securing executive personnel, and the company is making significant strides to improve profitability.

- EVLV: Evolv specializes in weapons detection security screenings, covering roughly 1 million people daily, and helps businesses in security planning with critical insights into visitor flow, alarm activity, and more.

We’re still in the early innings of this trend, but these names should be on your watchlist for 2025. LikeFolio will be watching the data around these names closely for any emerging winners.

The last stock it picked for our members has already gained 18% in a matter of days.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Digital Wallet Winners and Losers: One Stock to Avoid (And Two Better Bets)

Block shares are up 53% in the last six months, but LikeFolio data suggests SQ may not be the winner Wall Street thinks it is…

Reddit: From Digital Ads to AI Data, This Stock Is Still Heating Up

$315 million in advertising revenue is just the tip of the iceberg for this rising social media star…