No social media platform exploded onto the scene quite like TikTok.

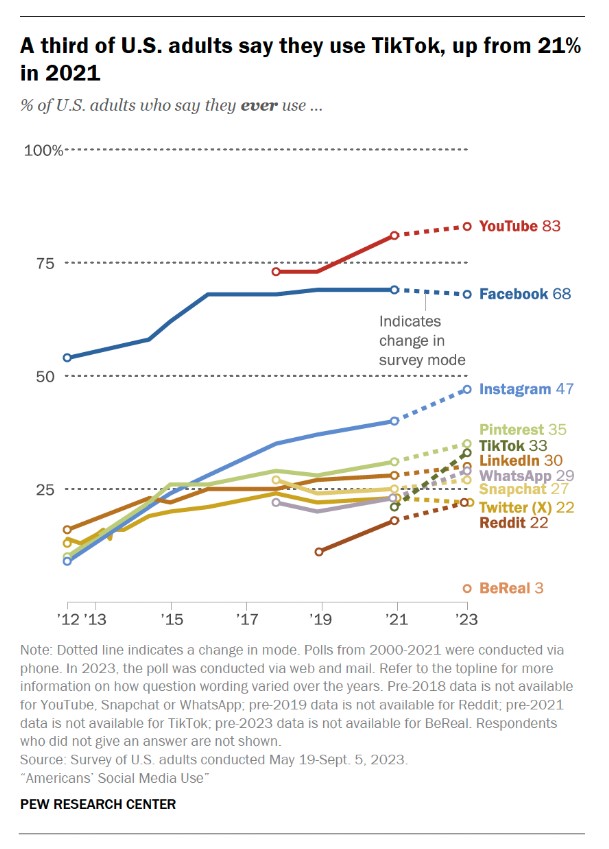

Between 2021 and 2023, the number of Americans using the addictive short-form video platform surged by 12%, more than any other site, according to Pew Research Center.

One-third of U.S. adults reported using TikTok in 2023; that usage nearly doubles to 62% among the younger 18 to 29 crowd.

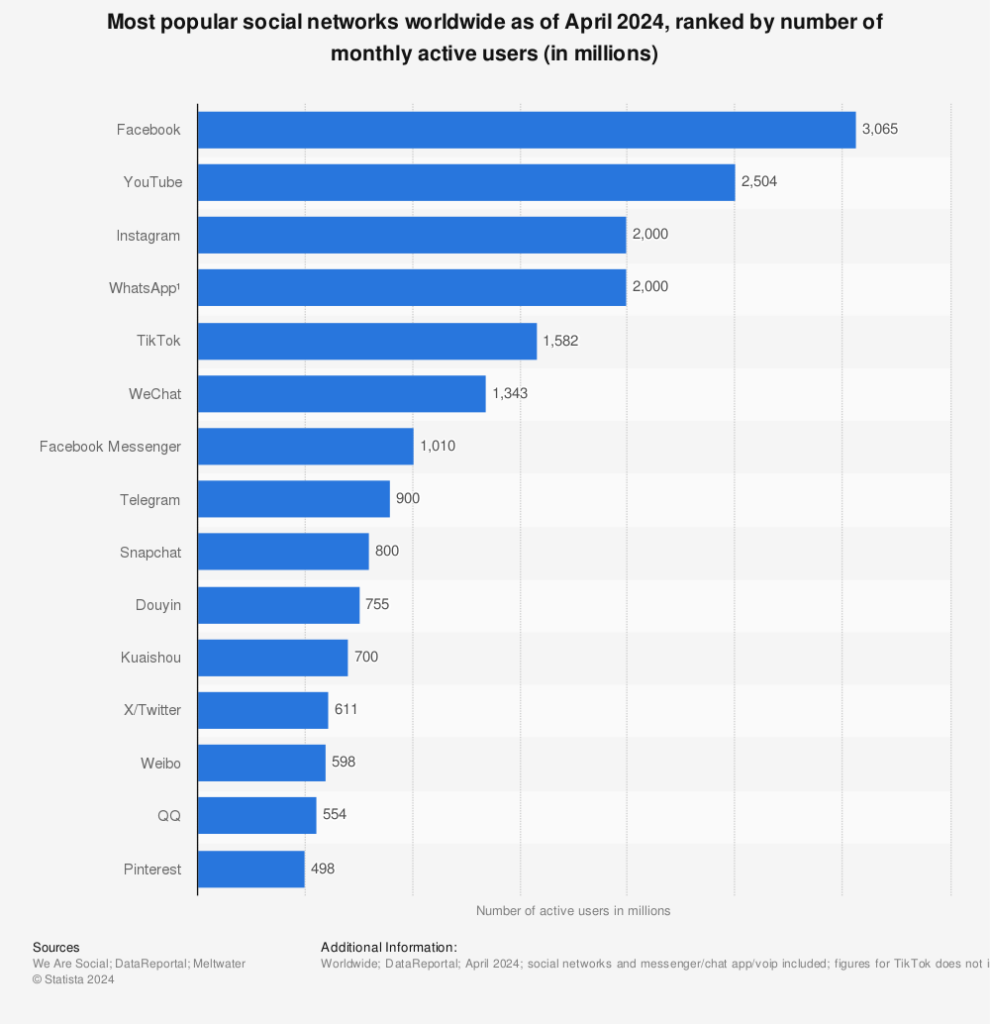

The social app claims 170 million users in the U.S. On a global scale, more than 1 billion folks frequent TikTok monthly to scroll through an endless stream of quick-hit videos, from dances to pranks to makeup tutorials and product recommendations.

TikTok unlocked a winning formula. But its overseas origins pose a problem – and another social media star is reaping the benefits.

The Trouble with TikTok

In April 2024, officials from China-based ByteDance, TikTok’s parent company, faced a congressional panel to answer allegations that TikTok threatened national security. The U.S. government alleges that TikTok could be used to spy on Americans or access their data, and its solution is a law that requires ByteDance to divest its TikTok assets or be removed from the Apple (AAPL) and Google (GOOGL) stores.

It’s not a ban on TikTok… yet. It’s simply eliminating Chinese-based ownership of the app. ByteDance, along with content creators, have filed appeals that will be heard in the fall, so the situation is ongoing.

It’s too early to count out TikTok, but it is facing some serious international headwinds.

And at the end of the day, it might not matter. Because while the rest of us watched TikTok experience meteoric growth, Silicon Valley’s social media leaders got to work building its competition.

Alphabet-owned YouTube launched YouTube Shorts, its version of short-form videos that reached 70 billion daily views in 2023. Meta Platforms (META) came out with Reels, a short, TikTok-esque video feed built straight into its already-popular suite of apps.

We believe META could be the biggest winner of all.

How Video Saved This Social Media Star

Instead of developing a standalone app to compete directly with TikTok, Meta incorporated Reels into its established channels – leveraging Facebook and Instagram’s already vast user bases.

Facebook enjoys more than 3 billion users worldwide, with nearly 52% of U.S. citizens having an account, and Instagram is right up there with it.

By integrating Reels seamlessly into their Explore and Feed sections, Meta made it easy for users to create, share, and discover short-form videos without switching apps. And it’s working.

Overall, video comprises 60% of the time consumers spend on Instagram and Facebook, with Reels being the primary growth driver.

On Instagram, Reels accounts for 50% of the time spent within the app.

And on Facebook, Meta is working to integrate Reels, longer-form video, and live video into one seamless experience. Upgraded controls allow users a more consistent design for videos, with capabilities like fullscreen mode and improved recommendations.

That’s good news for those TikTok creators whose revenue depends on viewers and ad sales, should a ban take effect. Meta released guidelines for creators in April to help them monetize the new format – and bring them under its umbrella for good.

Reels Is a Winner with Consumers

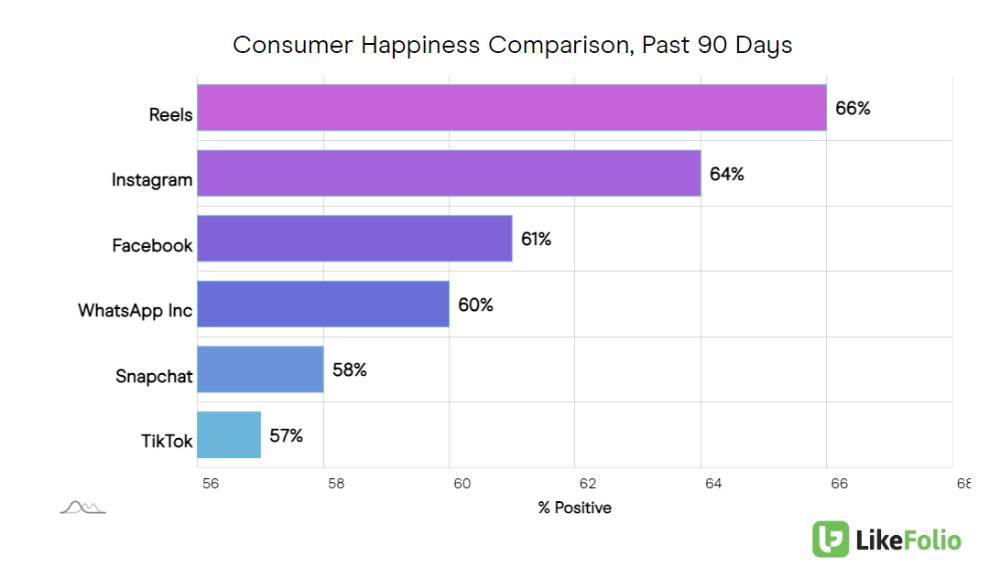

Consumers prefer Reels over other social content, according to LikeFolio data. At 66% positive, Reels’ Consumer Happiness is the highest among similar social sites – and well above TikTok’s 57%.

This engagement translates to real dollars for META. The company generates 98% of its revenue from digital advertising, and Reels outperforms in ad dollar generation – commanding higher rates and comprising a larger portion of META’s ad budgets compared to its other apps.

As Meta figures out how to make money on its other segments, including the metaverse, artificial intelligence (AI), and augmented reality (AR) glasses, Reels on Facebook and Instagram is keeping its growth on course.

Shares have surged nearly 450% from October 2022 lows. If the company can keep focused on its successes – like Reels – rather than its challenges, we believe increased ad spend in the back half of 2024 could provide an unexpected boost.

Bottom line: Meta beat TikTok at its own game with Reels. And TikTok’s uncertain future only leaves more room for this stock to run.

Social media is a powerful moneymaking tool, and at LikeFolio, we’ve made it our business to master it. From Instagram to TikTok to Reddit (RDDT)… and let’s not forget Elon Musk’s 𝕏: These platforms provide critical insights from the group whose spending drives 70% of what happens in our economy. Our Data Engine captures those insights on a massive scale and turns them into actionable trades that can make you money.

Take a look at what our social media machine is tracking now.

It’s a stranger-than-fiction election story you have to see to believe – and it comes with five massive ways to play it for your own profits. Check this out.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Uncle Sam Wants a Piece of DraftKings’ Billion-Dollar Pie

Tax hikes threaten to thwart online sports betting growth – but it won’t be the death of DKNG…

Will AI Boost Apple’s Bottom Line – or Bust It?

Apple’s AI Play: Everything you need to know about Apple Intelligence and what we’re watching now…