In Derby City Daily, we’re tracking a vital investing theme that’s become ever-apparent in LikeFolio’s consumer data: the trade-down effect.

Faced with pesky inflation, growing job cuts, rising debt levels, and eroding savings, consumers across the board are having to “trade down” to more affordable menu items or brands.

Now, with earnings reports for major retailers rolling in over the last month, we’re seeing this trade-down effect play out on a massive scale – and create potential opportunities for investors.

In February, Walmart (WMT) issued a weaker-than-expected financial outlook in its February release, stating: “While the supply-chain issues have largely abated, prices are still high and there is considerable pressure on the consumer… As such, our guidance reflects a cautious outlook on the macro environment…”

But shares popped 4% on the news due to the company’s outperformance in grocery – where it gained significant market share with higher-income shoppers.

The trade-down effect in action.

And Walmart isn’t the only retailer benefitting from a consumer trade-down…

Here’s a look at how another department store name is capitalizing on this trade-down economy – and what it means for investors in 2023…

The Trade-Down Effect in Action

Target (TGT) posted stronger-than-expected results last Tuesday (Mar. 2) with 3% revenue growth in 2022 from the year prior – albeit clearing a very low bar.

How did TGT do it?

Discounts – alongside a robust portfolio of consumer-loved private label brands.

Target’s high (and unchanging) Consumer Happiness levels were a critical clue that consumers had no plans to desert the brand.

A consistently high level of Consumer Happiness is a strong, long-term indicator for Target: 66% positive compared to Walmart’s 53% positive.

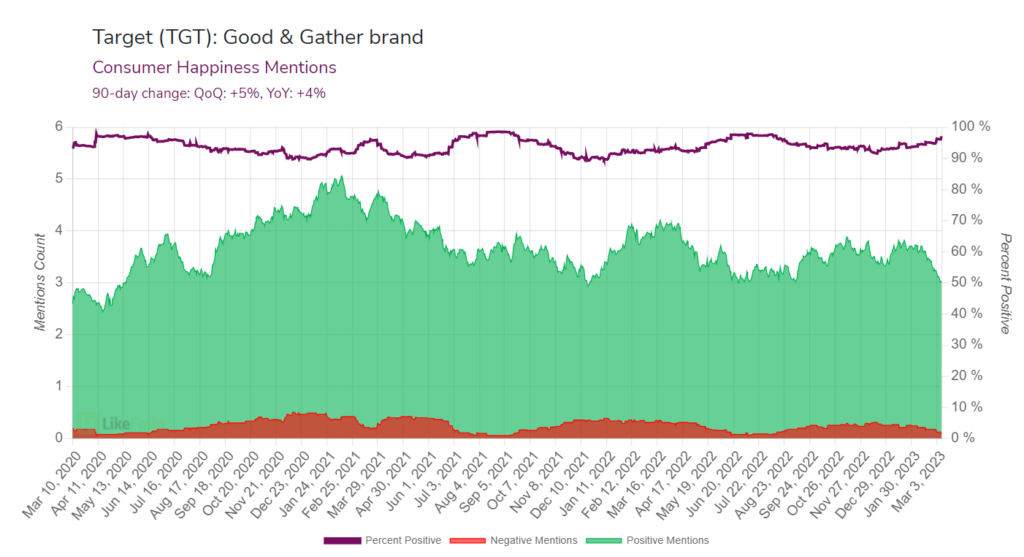

Target has several well-loved private-label brands, many of which serve as a lower-cost alternative for consumers. For example, its Good & Gather branded line of everyday grocery essentials boasts an impressive 97% positive happiness level:

And it was those essentials categories – food and beverage, beauty, and household items – that were a key growth driver for Target in 2022, serving as a trade-down boost and a helpful mechanism to get consumers in the door.

While Wall Street reacted positively to earnings, giving TGT a 3% boost, Target’s overall report echoed a similar sentiment to Walmart’s: shrinking profit margins (even lower than the prior quarter) and a conservative full-year outlook as consumers pull back on discretionary spending.

What Comes Next for Retail Stocks in 2023

LikeFolio data as a whole is shifting into a more conservative range.

Across our coverage universe, more than half of the companies sit in our “neutral” range when it comes to our earnings score, and the bearish lean has become more pronounced.

But as a trader, it’s important to understand the macro environment we’re operating in now.

Where is the bar of expectations?

The answer: Much lower versus last quarter.

This means that many reports, like the ones Target and Walmart issued, will be received as a win, even with conservative guidance.

We’ll be vigilant looking ahead to understand where expectations lie, and which consumer metrics will be most critical to analyze.

For now, we know:

- Inflation continues to weigh on discretionary spending…

- Consumers are making strategic purchasing decisions, including trading down for lower-cost brands/products…

- And happiness is an extremely useful indicator to understand if consumers are deserting a brand, or if loyalty is high enough to stick around.

Until next time,

Andy Swan

Co-Founder

Up Next: Stock Showdown: The Winners and Losers in Today’s “Trade-Down Economy”

In this installment of Derby City Stock Showdown, we’re showing you a company that’s winning big from the “trade-down” effect – and one that’s losing. Click here for the full story.