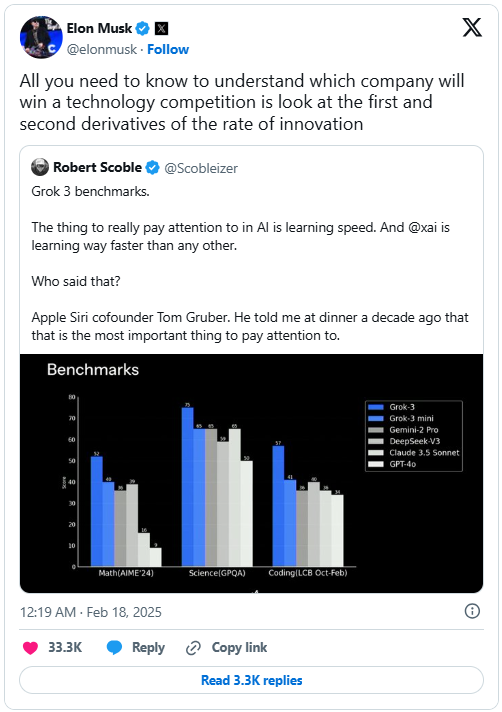

DeepSeek who? The brand-new release of xAI’s most powerful AI engine yet – Grok 3 – just changed everything.

The latest artificial intelligence (AI) model from Elon Musk’s xAI marks a significant leap in AI capabilities, leveraging 10x more computing power than its predecessor through xAI’s Colossus supercluster.

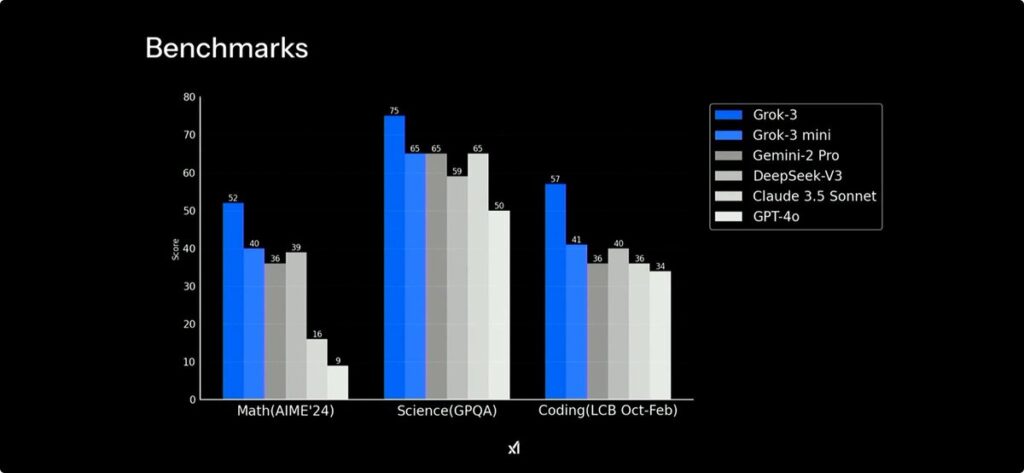

Early benchmarks suggest superior performance in reasoning, mathematics, and coding compared to competitors like OpenAI’s GPT-4o and DeepSeek V3.

The innovations and breakthroughs in AI technology are happening at such a breakneck pace that we wanted to bring you the latest on Grok 3 – and its competition.

Grok’s new features include “Think” mode, which provides step-by-step logical reasoning, and “Big Brain” mode, designed for complex tasks requiring additional computation. To drive adoption, xAI has temporarily made Grok 3 free for all users, expanding beyond its initial X Premium+ ($40 per month) exclusivity.

In addition to Grok 3, xAI introduced Deep Search, an AI-powered tool for enhanced query understanding and summarization, directly competing with existing research AI tools.

Musk’s aggressive iteration and real-time data integration via X (formerly Twitter) positions xAI as a high-velocity competitor against OpenAI, Google DeepMind (GOOGL), and Anthropic.

With Grok 3’s release, Musk is sending a clear message to competitors:

Going forward, AI dominance will be determined not by static performance, but by the speed at which models improve.

xAI’s Competitive Strategy vs. OpenAI, Google, and Others

xAI differentiates itself through integration with X (formerly Twitter), open-source AI development, and a focus on improving learning speed over static benchmarks.

Unlike OpenAI and Google, which operate as standalone AI platforms, Grok is embedded into X, providing real-time access to social media data and securing a built-in distribution channel through X Premium subscribers.

By making Grok’s models publicly available, Musk is embracing an open-source philosophy. This mirrors Meta Platforms’ (META) LLaMA and contrasts with OpenAI’s closed system, allowing for rapid iteration and improvements.

For Musk, the most important factor in AI competition is how fast models improve over time rather than how they perform today. And that focus on acceleration over absolute benchmarks is key to xAI’s positioning.

Competitive Positioning Against Rivals

Here’s a breakdown of how the current competition stacks up:

| Competitor | Strengths | Weaknesses Relative to xAI | xAI’s Advantage |

|---|---|---|---|

| OpenAI (GPT-4o) | Leading general intelligence, enterprise adoption, Microsoft partnership | Closed ecosystem, slower iteration cycles | Open-source approach, faster iteration |

| Google DeepMind (Gemini) | Integration with Google Search, YouTube; strong multimodal capabilities | Slower releases, Gemini underperformance | Real-time data access from X |

| Anthropic (Claude) | Focus on alignment and safety; strong enterprise appeal | Slower innovation pace, limited consumer focus | Emphasis on rapid AI improvement |

| Meta (LLaMA) | Open-source model adoption, AI-driven ad targeting | Competing directly with Grok, enterprise AI focus | Potential synergies in open-source AI |

Grok 3 is a powerful step forward in the global race to deliver the most intelligent computing that history has ever seen. But this race could have several winners.

Consumers are first in line to benefit – we get to use these platforms, after all.

But given xAI’s focus on scaling AI capabilities, open-source development, and real-time social media integration, several public companies could see direct and indirect benefits as well.

At LikeFolio, we look for the smaller outliers that have a chance to change the world by using these technologies in innovative ways.

We’re keeping an eye on a few AI stocks in line to benefit from this rapidly accelerating technology – and some high-risk, high-reward speculative bets, too…

The Best-Positioned AI Stocks

No. 1: Nvidia (NVDA)

xAI relies on Nvidia’s H100 GPUs to train its AI models, with a cluster of 200,000 chips powering its Colossus supercomputer in Memphis. Nvidia is a safe play here – demand will only accelerate as AI models scale.

No. 2: Tesla (TSLA)

Look, xAI and Tesla are both led by Elon Musk. That means Tesla could license xAI’s 200,000 GPU facility to train its Full Self-Driving (FSD) models extraordinarily quickly. Musk has already hinted that xAI will contribute to Tesla’s FSD and Optimus robot development.

No. 3: Super Micro Computer (SMCI)

AI models, particularly deep learning models like Grok 3, require large datasets for training – and those datasets require powerful hardware infrastructures. Super Micro Computer’s AI-optimized servers and data centers are tailor-made for this use case, and could see increased adoption.

High-Risk, High-Reward Speculative Bets

No. 1: X Holdings

Talk about speculative – Musk’s social media empire is privately held. But if it were to go public in the future, it could directly monetize AI-powered social media through X Premium subscriptions and ad tools.

No. 2: Palantir Technologies (PLTR)

If xAI pivots to enterprise applications, Palantir’s enterprise-level AI stack could serve as a complementary tool to help train and build its AI models at scale. Palantir’s AI systems are battle-tested, employed by heavyweights like the U.S. Department of Defense and U.S. Intelligence Community. But it also serves corporations and privately held companies.

No. 3: Advanced Micro Devices (AMD)

Right now, xAI relies on Nvidia GPUs. But if it diversifies its AI chip suppliers, AMD’s MI300 chips could gain traction. AMD’s MI300X chip has already attracted big-ticket clients like Microsoft (MSFT), Meta, and Oracle. And its MI325X and MI350X chips promise major performance gains – up to 35 times that of its previous models.

No. 4: SoundHound AI (SOUN)

If xAI expands into voice AI, SoundHound’s expertise in conversational AI could be a natural fit. SoundHound’s voice AI software can process speech like the human brain, giving brands their own voice and new revenue opportunities. Its early adopters include call centers, automakers, and restaurants – but partnerships with AI leaders could be a game-changer.

The Bottom Line

With Grok 3, Musk is – yet again – upping the ante in AI and creating investment opportunities for those who can spot next-level implications:

- AI hardware and infrastructure providers like Nvidia will see increased demand.

- AI-powered applications and platforms, from tiny players like SoundHound to behemoths like Tesla, could benefit from Grok’s expansion.

- And long-term speculative plays in enterprise AI (Palantir), social AI (X Holdings), and alternative computing (AMD) are well positioned to reap the rewards.

As xAI positions itself as a leader in the AI race, backed by Musk’s connections to the White House and the promise of fewer regulatory barriers under President Trump, there’s a “backdoor” way to play this, too, that you can learn about here.

The opportunities are vast. But rest assured, we’ll continue to keep you updated on xAI’s next major AI model updates, X monetization strategies, Musk’s long-term vision for AI integration across industries, and any other opportunities we spot along the way.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Carvana’s Powerful Lesson: Don’t Bet Against the Consumer

We bet against this company too soon – and it taught us a powerful lesson that every investor should keep in mind…

These Luxury Retail Trends Bode Well for ONON and LULU

Despite concerns about a slowing consumer, the latest earnings reports show high-end shoppers are still spending…