When Bitcoin (BTC) burst past the $60,000 mark this week, we weren’t as surprised as the rest of the market seemed to be.

My brother Landon recommended Bitcoin as a “must-own” asset for 2023 – right here in our very first issue of Derby City Daily, saying at the time:

“I think that 2023 could be a really big year for Bitcoin – from 20 up to maybe 50-60.”

It took a couple of extra months, but here we are, one year later…

Thanks to our powerful consumer insights machine, we could see crypto and DeFi adoption accelerating on Main Street well before the Wall Street “pros.”

And we believe this rally is only just getting started.

Let me show you how we predicted the rise of DeFi and how you can ride the wave from here – without ever even having to buy Bitcoin yourself…

The Rise of DeFi

During the banking sector collapse in March 2023, folks rushed into decentralized assets like Bitcoin as the flaws of the traditional banking sector became too clear to ignore.

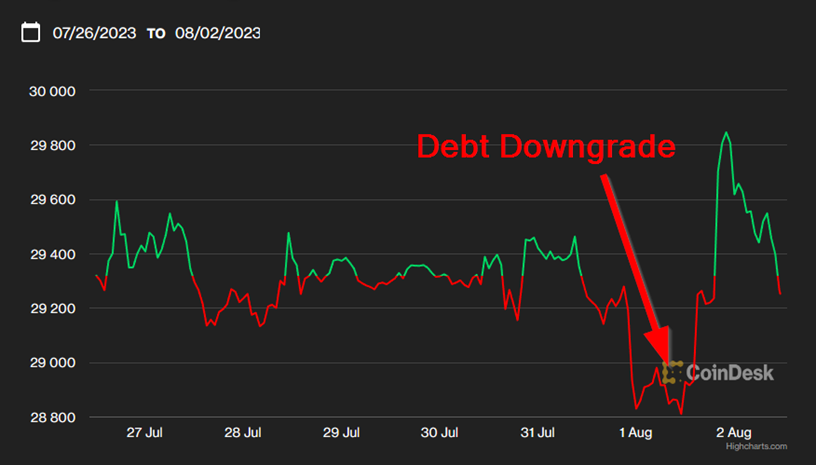

Then there was the summer’s U.S. debt downgrade – the next domino to fall – leading us to issue what many considered a “hot take” at the time:

“Bitcoin (BTC) could be the biggest winner of the debt downgrade.”

And facing fresh economic uncertainty, investors once again flooded into DeFi assets…

Just like we predicted.

We’ve been hitting this DeFi “mega” trend hard in our MegaTrends service, especially since we detected a tipping point for Bitcoin and DeFi at large early in 2023.

In our May 2023 “Power of Blockchain” report, we named three massive stock picks that led those MegaTrends subscribers to double- and triple-digit gains in a matter of months.

We doubled down on “The Rise of DeFi” in our September 2023 MegaTrends report, this time, exploring small-caps with the potential to ride DeFi’s tailwinds to extraordinary gains. Yet again, all three of those stocks went on to produce profits – with one up nearly 200% as I write this.

And in December 2023, we tripled down on the DeFi “mega” trend, going so far as to name 2024 “The Year of DeFi,” taking our subscribers deeper down the rabbit hole with opportunities that – you guessed it – have each raced higher in the months since.

(You’re free to learn more about these MegaTrends-exclusive opportunities, and how to access them, right here.)

Our Secret to Spotting the DeFi Winners

At LikeFolio, we’re not just tracking companies. We’re tracking consumer behavior and sentiment in real-time, which allows us to see the real-world impact of DeFi, rather than the theoretical musings of Wall Street analysts.

We know the DeFi movement is only gaining steam: Mentions remain elevated by as much as 324% year over year. Blockchain technology and trading crypto buzz are trending higher, too.

There’s plenty of untapped profit potential here. And you don’t have to invest in Bitcoin directly – or even in one of the newly approved Bitcoin ETFs – to ride this wave.

Our Social Heat Score tool has identified what we believe could be the biggest winner of “The Year of DeFi.”

This powerful stock-picking device boils down millions of data points on macro trends, demand, social media buzz, consumer sentiment, web traffic, stock performance, and more, and distills it all into a simple 0 to 100 score telling us how bullish (or bearish) the opportunity is for a given company.

And right now, it’s sending a powerful bullish signal on the publicly traded crypto exchange, Coinbase (COIN).

The No. 1 Stock to Own in the Year of DeFi

If DeFi is the future of finance, then Coinbase is the gateway drug that’s making it irresistibly accessible.

As one of the most reliable and user-friendly platforms in the crypto space, Coinbase is often the first stop for newbies venturing into digital assets.

It provides the “infrastructure” that makes global cryptocurrency trading possible, including:

- Cryptocurrency accounts, digital tools, and educational resources for individual investors

- A crypto transaction marketplace for institutions

- And technology that helps developers build crypto-based apps that can accept crypto as payment.

But its role doesn’t stop at mere introduction.

The platform is increasingly supportive of a range of DeFi tokens and services, making it easier for users to dive deeper into the decentralized financial ecosystem.

In essence, Coinbase is not just an entry point; it’s becoming a comprehensive hub for DeFi engagement.

And because the exchange collects a percentage on each transaction, when interest in crypto goes up, Coinbase reaps the benefits.

Interest in Bitcoin is ticking higher right now…

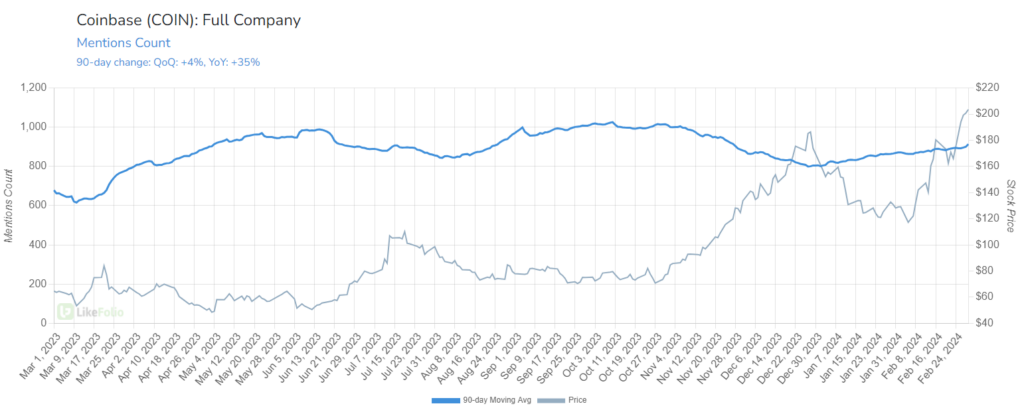

And LikeFolio metrics confirm growing demand for Coinbase’s services. Web traffic is up by 29% year over year, while buzz around using Coinbase has gained 35% over the same period:

Bottom line: When Bitcoin does well, Coinbase does well – and that makes it a great stock to have in your portfolio in 2024.

Just ask our MegaTrends subscribers, who’ve already made 250% from COIN since May.

This was just a taste of the opportunities we’re tracking in the Year of DeFi. To learn how you can gain full access to the opportunities we mentioned here, including the small-cap DeFi picks with explosive profit potential, go here now.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Is This the AI-Fueled Comeback Zoom Needs?

Here’s why we’re not betting on Zoom’s AI comeback just yet…