Carvana (CVNA), the used car dealer known for its rather unique car vending machines, has seen its stock rise by a staggering 1,000% this year.

Just this week, management caught investors by surprise – delivering its second-quarter earnings report a month earlier than expected.

And with what Carvana shared, it was no surprise that they wanted to get the news out early.

It beat revenue estimates, bringing in $2.96 billion for the quarter. It also announced a deal to reduce its costly debt.

Shares burst even higher on the results.

But the stock’s meteoric rise isn’t exactly what we’d call a genuine comeback.

As Benjamin Graham once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

In the high-stakes game of Wall Street, short-term trends often overshadow long-term fundamentals.

And there’s another factor at play here driving shares at a dangerous clip – that could burn unwitting investors.

Call it a “Short Squeeze Mirage.”

A short squeeze occurs when a stock’s price increases sharply, forcing short sellers to buy it in order to forestall even greater losses. Their scramble to buy only adds to the upward pressure on the stock’s price.

Carvana’s short interest is close to 41.5 million shares, representing about half of the company’s total float. This makes it the second most shorted company in the U.S. The stock has risen close to 100% in the last 30 days, likely forcing many short sellers to cover their positions.

Underneath the surface, the company is grappling with a host of issues that are being masked by this short-term rally.

But our data provides a voice of reason amidst the frenzy.

And we’re here to give you the real story…

The Real Story on Carvana

LikeFolio’s data provides a sobering counterpoint to the short-squeeze frenzy.

Consumer mentions of using Carvana are down 30% year-over-year.

And web searches for Carvana have dropped 21% year-over-year.

This suggests that despite the stock’s meteoric rise, consumer interest and engagement with the brand are waning.

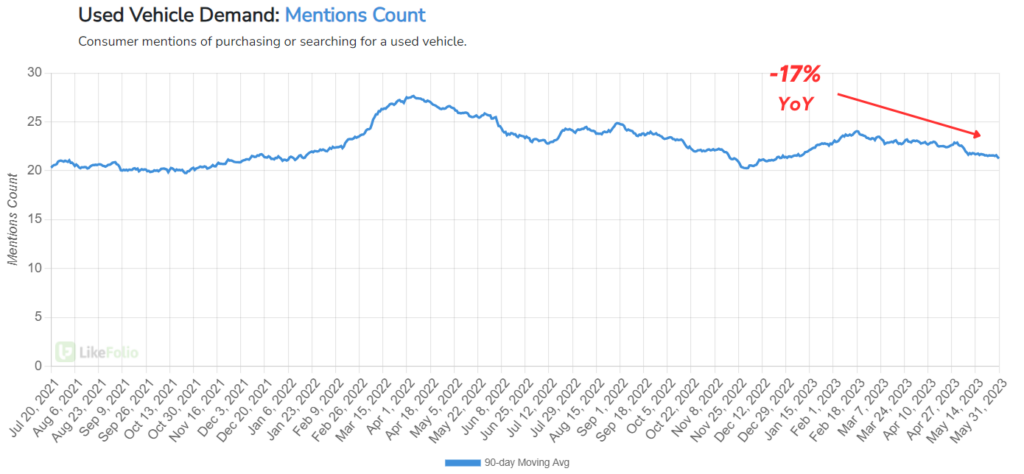

There’s also the matter of the current used car market, which is set to face significant pressure in the remainder of the year.

A sharp decline in used car prices in the U.S. was a major reason behind Carvana’s 90%-plus decline in market value in 2022. Any more pressure would only further compress Carvana’s margins.

LikeFolio data reflects this, with used car demand mentions declining 17% year-over-year.

Oh – and the company has yet to be profitable.

Carvana’s been carrying a massive debt burden that threatened to lead it to bankruptcy: In the first quarter, Carvana’s interest expenses totaled $159 million.

That was a significant increase from just $64 million a year ago, due to a near-doubling of its long-term debt in this period.

With all that financial pressure, Carvana’s focus shifted from growth at any cost to survival.

This might seem like a prudent move, given its situation. But a lack of focus on growth puts it at a disadvantage – and could lead to undesirable outcomes in the future as competitors are aggressively pursuing growth opportunities.

And the debt restructuring deal it announced this week? While it should reduce Carvana’s debt by $1.2 billion, it won’t magically solve all those other issues.

So, while Carvana’s stock might seem like a tempting investment due to its recent rally… it’s simply not worth the risk.

Going back to what Benjamin Graham wisely noted, the market may vote in the short term, but it weighs in the long term.

Take this as a warning – and tread carefully in the desert of the used car market.

We’re here to help you separate the winners from the losers with data, not emotion.

And the same system that warned us about Carvana is signaling a potential breakout ahead for one “undercover” AI player.

It’s a relatively “tiny” company with a market cap under $1 billion… but the profit potential is anything but.

Demand is way up.

And with shares trading under $3… trust me, you’ve gotta check this one out.

Until next time,

Andy Swan

Founder, LikeFolio