Amazon.com (AMZN) sits on a three-legged stool, driving the bulk of its revenue from e-commerce, cloud computing, and digital advertising.

By tracking consumer mentions across the web and social media, LikeFolio has special insights into two of its main segments:

- E-commerce via its Amazon Prime service

- And cloud computing via Amazon Web Services (AWS).

Amazon Prime, its flagship membership service with over 200 million members worldwide, offers perks like free two-day shipping and Prime Video (streaming) for $139 a year. It’s estimated that more than half of American adults have a Prime membership.

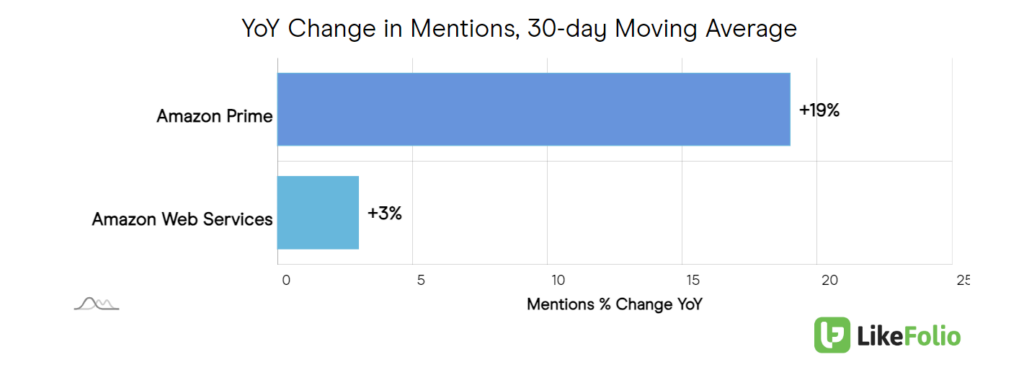

And we can tell you that Amazon Prime interest is rising, logging double-digit, year-over-year growth (+19%).

We’re also seeing AWS, Amazon’s cloud computing service used by millions of businesses, make strides – mentions are up by 3% over the same period:

But that’s not the full story.

Amazon might be a $1.9 trillion mega cap but that doesn’t mean it’s immune to competition. And a deeper dive into our data reveals that three names are nipping at Amazon’s heels.

Take a look at the market share steal underway – and be sure to add these names to your watchlist…

Two Names Winning Retail Shoppers

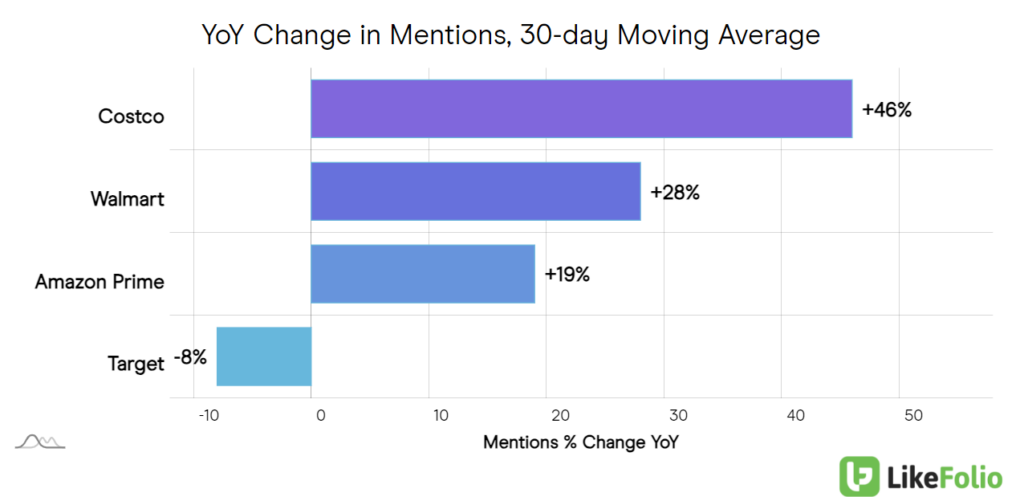

As the U.S. inflation rate edges higher in 2024, consumers are hunting for savings and value – wherever they can get it. And according to our data, this could be giving Costco (COST) and Walmart (WMT) an edge over Amazon Prime.

These two superstores now dominate in mention growth…

Walmart, with +28%, and Costco, with +46%, handily beat Amazon Prime’s +19%. while Target (TGT) lags behind.

Keep a close eye on COST and WMT as they win over retail shoppers.

One Name Stealing Market Share from AWS

We also see market share gain on the cloud front – specifically by Google’s (GOOGL) Cloud Platform…

Google Cloud Platform mentions are up 66% year over year compared to AWS’s +3%. And Microsoft’s (MSFT) Azure? It’s barely in the running, with mentions declining as much as 18% over the same period.

Amazon exceeded expectations in its last earnings report, significantly outperforming analyst predictions with a 14% increase in revenue to $170 billion and earnings of $1.00 per share, surpassing the expected 80 cents. The company provided an optimistic outlook for the first quarter of 2024, projecting revenues between $138 billion and $143.5 billion, which indicates 8% to 13% growth.

Amazon Web Services (AWS) results were strong but slowing: AWS revenue of $24.2 billion matched forecasts, ticking 13% higher year over year. However, that growth decelerated from 20% a year earlier.

This matches what we are tracking on the mention front right now… and could be a sign of what’s to come, when Amazon reports its first-quarter earnings in a few weeks.

So… Where Does This Leave Amazon?

Two additional areas are showing strength for Amazon:

- Advertising: Amazon’s advertising business grew by 27% year over year to $14.7 billion. The introduction of ads on Prime Video is expected to further boost this revenue stream. If Netflix (NFLX) is any predictor of success, ad revenue still has plenty of room to ramp up.

- Operational Efficiency: Under CEO Andy Jassy’s leadership, the company has focused on cost control, leading to a significant increase in net income in the fourth quarter: $10.6 billion compared to $278 million a year earlier. Amazon reduced its workforce by 27,000 employees and cut back on less successful projects, aiming to streamline operations.

Looking ahead, Amazon continues to invest in new areas, especially those that resonate with customers, such as generative artificial intelligence (AI) technologies and new shopping features like its AI shopping assistant, Rufus, which it’s rolling out to U.S. customers as we speak.

The Bottom Line

Amazon is growing – and cutting costs – where it counts. And investors have taken notice: AMZN shares are trading nearly 80% higher year over year.

But LikeFolio data suggests some consumers may be looking elsewhere for services – notably those hunting deals in a persistent inflationary environment.

We’re not betting against Amazon. We’re preparing for conservative spending. And we’ve got these three overachievers on our watchlist: GOOGL, COST, and WMT.

Macro trends appear to be shifting in their favor…

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Results Are in: Here’s How We Did on 578 Earnings Trades

You have to see these numbers for yourself…

March Madness Report: DraftKings, FanDuel, Caitlin Clark, and Your Money

These sports betting stocks were the real winners of the March Madness betting spree…