We love small-cap stocks here at LikeFolio.

Their businesses are usually at an earlier stage of growth, making them more agile – with more room for expansion and innovation.

Their shares can trade for just a few bucks apiece, which means they can rocket higher and faster than your average “Blue Chip.”

And best of all? The LikeFolio Data Engine is particularly adept at spotting these kinds of small-cap, big-profit winners.

Think Celsius Holdings (CELH) or Hims & Hers Health (HIMS), both of which we spotted under $7, and have gone on to produce triple-digit gains.

But as a whole, small caps have some catching up to do.

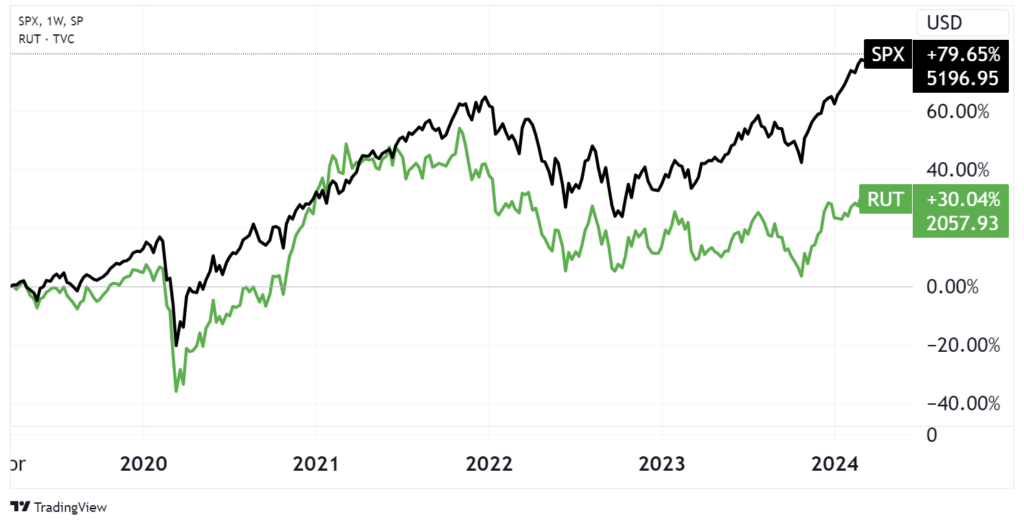

The large-cap S&P 500 Index (SPX) has historically crushed its small-cap equivalent, the Russell 2000 Index (RUT). Over the last five years, SPX has turned in a solid +80% while RUT trails with +30%:

Even more striking is how narrow the SPX gains are. For example, in February, four stocks – Nvidia (NVDA), Meta Platforms (META), Amazon.com (AMZN), and Microsoft (MSFT) – accounted for nearly half of the S&P 500 gains.

So we’re not just talking about large caps beating up on small caps… we’re talking about mega caps carrying everyone along.

But small caps’ time to shine may be just around the corner.

Here are three big reasons we expect to see a small-cap revival in 2024 – and three ways you can play along…

3 Signs Small Caps Are Due for a Resurgence

No. 1: Valuations

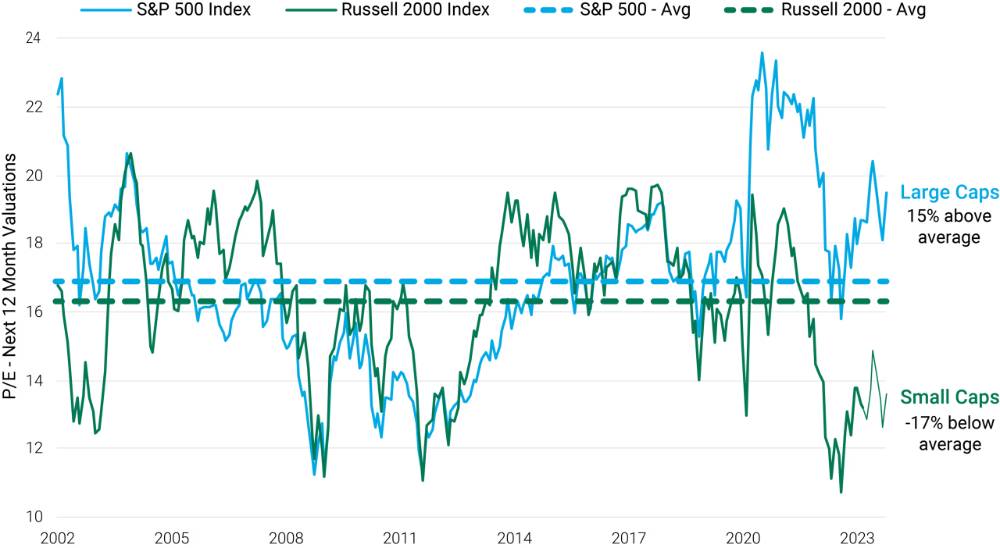

Small-cap valuations, measured by price-to-earnings (P/E) ratios, are currently about 17% below average, while large-cap stocks are currently 15% above average. This is one of the widest disparities we’ve seen in many years:

At the end of the day, investors need returns, and earnings reports matter more than anything. If P/E ratios are too extended on large caps and too small on small caps, there will be a natural sector rotation.

No. 2: Under-Owned

Small caps currently make up only 4% of the market. Compare that to the long-term average of 8%.

You can’t blame investors for piling into the mega caps when the returns have been great. But once this rotation begins, you want to be ahead of it, rather than reacting to it.

Imagine if 2x the money flowed out of mega caps and into small caps over the next couple years… The upside is tremendous.

No. 3: Acquisition Targets

Growing is difficult, especially when you command massive market share. Mega caps can’t continue to grow at breakneck speeds forever. And with extended P/E ratios, if revenue ever slips, the snapback could be fierce.

One way for larger companies to mitigate this is by buying revenue, and what better target than an undervalued small competitor?

Example: Viking Therapeutics (VKTX) crashed up in February on the mere suggestion it could be a takeover target after announcing positive trial data for its weight-loss drug.

We expect to see significant merger and acquisition (M&A) activity in the future as long as small-cap valuations are low – which will only push them higher.

How to Play It: 3 Top Picks

There are so many small-cap stocks out there that selecting a few winners out of thousands of possibilities can be a daunting task. MegaTrends members have a leg up here, with access to the best and brightest small-cap opportunities in real time, backed by LikeFolio’s predictive insights.

But look, exchange-traded funds (ETFs) are a fantastic option for most investors, giving you exposure to hundreds of stocks without having to sift through thousands.

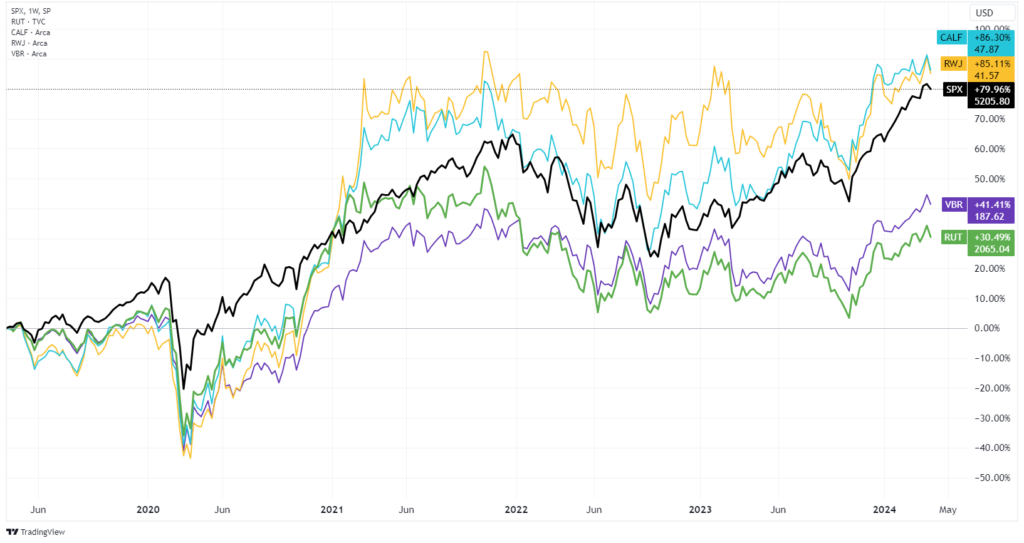

For our money, there are three small-cap ETFs worth mentioning here – each with potentially significant upside:

- Pacer US Small Cap Cash Cows 100 ETF (CALF), which has performed fairly well and focuses on free cash flow yield – aka winners.

- Invesco S&P SmallCap 600 Revenue ETF (RWJ), which uses a revenue weighting index and again, has performed fairly well in tough market conditions.

- Vanguard Small-Cap Value Index Fund ETF Shares (VBR), which is more of value play, and may participate more in the M&A activity mentioned above.

If you take a look at the chart below, you’ll immediately notice that both CALF (blue line) and RWJ (orange line) have outperformed the industry-standard SPX (black line) over the last five years, showing their ability to select/weight great small-cap stocks.

The value play, VBR (purple line), has performed the worst of this bunch, but all three small-cap ETFs have outperformed the Russel 2000 Index.

Moving forward, we believe CALF, RWJ, and VBR are top picks to play a small-cap rotation – in that order.

We’re excited for what’s to come. MegaTrends members, look out for your next big small-cap opportunity.

Until next time,

Andy Swan

Founder, LikeFolio

The Latest Free Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s hot this week…

Airline Loyalty Shift: See Who’s on Top Now

Two airlines look primed for a comeback amid a massive industry shift…

AI, Ad Spend, and Streaming: TTD Is Still a Top Pick

We’re more bullish than ever on this name. Here’s why…