The universe of investable opportunities we cover here at LikeFolio is enormous: At any given time, we’re tracking consumer sentiment for nearly 500 companies – mostly public, some private, and even a few cryptocurrencies – and within those companies, thousands of brands.

That coverage is constantly expanding, too. Because the more data our system analyzes, the stronger its predictive power becomes – and the better it gets at spotting stocks ready for liftoff.

Yet even after a decade of honing this social media-driven investing edge, we still find the sweetest victories often come from placing bets on proven winners.

I’m talking about stocks our data engine flagged when they were just starting to show signs of explosive growth, yet were still flying under the radar for most investors.

This select group of “LikeFolio All Stars” includes names like:

And let’s not forget this $3 “undercover” AI winner that’s more than doubled since May.

But today, Celsius Holdings (CELH) is reminding us why it may just be the best example of a LikeFolio All Star to date.

We first initiated coverage on CELH in 2020 as a sub-$7 contender, holding strong in our bullish stance as its “better-for-you” energy drinks gained footing in a market filled with sugary competition.

Since then, LikeFolio Investor subscribers have racked up more than 300% gains from our early 2022 buy recommendation.

And the bullish call we made in February of this year? It’s nearly doubled, delivering a 94% profit to our followers in less than nine months. (Here’s how you can get in on those real-time trade alerts.)

Now, Celsius shares are riding a fresh surge – popping more than 6% today, as of this writing.

But our consumer insights suggest there’s plenty more upside to come for this moneymaking machine.

Here’s why we’re still thirsty for Celsius – and how we’re playing this 300%-plus winner from here…

🚀 This 300% Winner Is Still Surging

First, a look at the data: Celsius mentions have skyrocketed by 134% year-over-year, a pace that leaves even the stock’s gains in the dust.

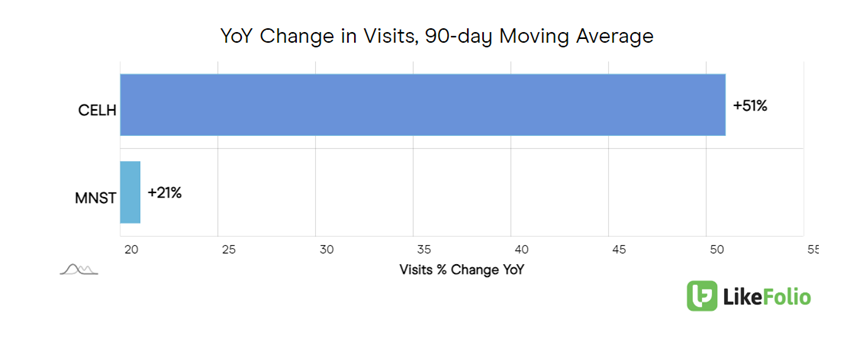

Meanwhile, web visits have jumped by 51% year-over-year, well outpacing the growth of the formidable market share leader, Monster Energy (MNST).

It’s clear that the fitness community’s thirst for Celsius’s “better-for-you” energy drinks is far from quenched.

What is helping to drive CELH gains of late?

Nearly a year ago, the company strategically aligned with PepsiCo (PEP) in a $550 million deal that not only injected capital, but also put a distribution powerhouse in Celsius’s corner.

This partnership has proven to be a massive growth catalyst for Celsius, driving it past the $300 million sales mark in a single quarter for the first time in Q2 (a 112% increase from the previous year).

This morning’s earnings results proved Celsius’s staying power with another record quarter.

Revenue in the third quarter more than doubled year over year yet again, coming in at $385 million.

North America has been the star of the show, delivering a 107% surge in revenue to $371 million for this most recent quarter.

Internationally, sales swelled by 56%. And with plans to further leverage the PepsiCo partnership, Celsius is eyeing additional gains here.

Celsius maintained its position as the third-largest energy drink brand in the U.S. while more than doubling its market share to 10.5% as it made significant inroads in convenience stores and foodservice channels.

If all that wasn’t impressive enough: This quarter, Celsius secured the top-selling energy drink spot on Amazon.com (AMZN), putting it ahead of Monster and Red Bull for the first time ever.

The brand’s innovation isn’t slowing down, either…

Playing Celsius from Here

Celsius launched its brand-new CELSIUS ESSENTIALS line at the Mr. Olympia 2023 competition this past weekend, reaffirming its dedication to a community that values wellness as much as a good workout.

This new 16-ounce offering is tailored for the fitness elite, promising to bolster both physical and cognitive performance with added aminos like leucine, isoleucine, and theanine.

While Celsius may cater to the fitness community, its appeal has officially gone mainstream.

Bottom line: LikeFolio data supports a continued bullish outlook for Celsius, driven by product innovation and expansion into new markets domestically and internationally. We’ll keep playing this one to the upside and view any pullbacks as accumulation opportunities.

But look, if you missed out on buying CELH when it was still trading under $50, don’t worry – we’ve already identified the next big 300%-plus winner that you can get in on right here.

Until next time,

Andy Swan

Founder, LikeFolio

More Big Winners to Explore from Derby City Daily

We’ve delivered more than a few double- and triple-digit profit opportunities with our predictive consumer insights…

How We Nailed This 135% Crocs Win (And the Next Big Play)

Here’s how we called this massive CROX win – and the next “ugly” shoe winner it helped uncover…

Pinterest Zooms 20%: This Long-Term Bet Is Paying Off

We saw this PINS rebound coming. But what comes next is even bigger…

Stock Picks: Your Next Triple-Digit Winner Is Here

With 337% and 50% wins in the bank from ETSY, here’s how to make this next round of profits yours…