It’s hard to imagine an investing trend rivaling artificial intelligence (AI) here in 2023.

So instead, let me show you one – because it allowed us to cash in on 174% gains this week…

And the profits look poised to continue.

This trend stems from the basic human tendency to find the easiest way out of a problem.

Obesity is a big problem – affecting 42% of adults in America, according to the National Institutes of Health (NIH).

And a “magic pill” is a whole lot more alluring than diet and exercise.

So when folks found out type 2 diabetes treatments could help them shed weight in record time, social media was quick to catch on.

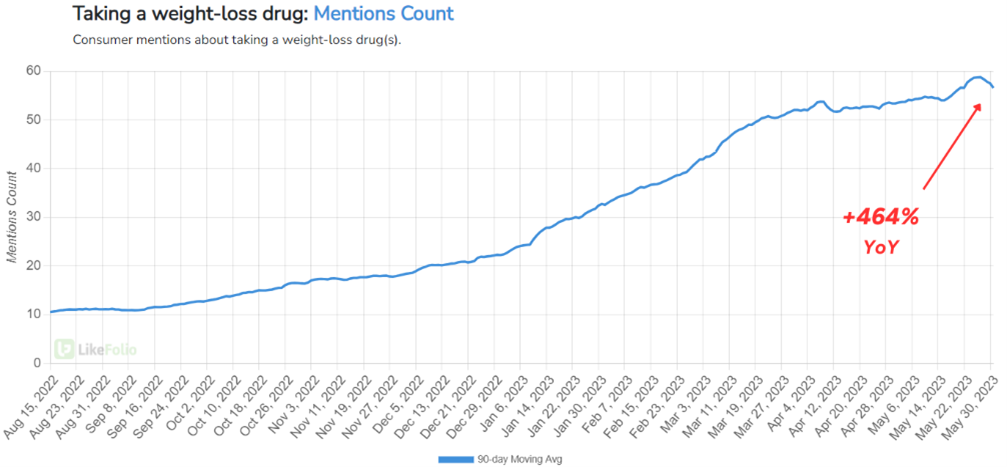

Our proprietary system detected the skyrocketing interest as consumer mentions of taking a weight-loss drug zoomed 464% year-over-year, rivaling AI as one of LikeFolio’s top “investable” trends for 2023:

These “magic pills” for weight loss go by a few different names: Semaglutide, Wegovy, Ozempic, Mounjaro… and they’re actually injections (though pill versions are in the works, stimulating consumer interest even further).

💊 Wegovy and Ozempic are brand names for the same generic GLP-1 drug, semaglutide. The difference: Wegovy is specifically approved as a weight-loss treatment while Ozempic is approved for type 2 diabetes. Both are sold by Novo Nordisk (NVO). Mounjaro (tirzepatide) is Eli Lilly’s (LLY) version, developed as a GLP-1 and GIP agonist for type 2 diabetes. Mounjaro is currently being reviewed by the FDA for weight loss.

But the fact is that each of these drugs has proven to be remarkably effective in treating obesity… even if they’re not approved for that use (yet).

And demand has exploded over the past year. Just take a look at the surge in social media buzz LikeFolio is recording for these drugs on a year-over-year basis:

- Semaglutide: +1,047%

- Wegovy: +1,345%

- Ozempic: +2,826%

- Mounjaro: +12,060%

That’s translated into surging sales in 2023: For the second quarter, revenue from Novo’s GLP-1 diabetes segment grew 50%, while obesity care soared 157%. Wegovy sales alone accounted for $1.1 billion, its highest quarter on record.

Influential celebrities from NBA great Charles Barkley to Tesla (TSLA) CEO Elon Musk touting their success stories have only added fuel to the fire.

WW International (WW), better known as WeightWatchers, wanted a piece of that pie.

So earlier this year, WW acquired telehealth provider Sequence – giving it the ability to connect its users via medical doctors to those trendy weight-loss drugs.

The deal caused WW shares to jump 80% in 24 hours – from a closing price of $3.87 on March 6, the day of the announcement, to a closing price of $6.93 on March 7.

We were early to the opportunity, recommending our paid-up LikeFolio Investor subscribers buy WW shares back in December when our social media machine tipped us off that the company was gaining momentum with consumers.

Under new leadership, we saw WW outperforming other weight management services and home fitness companies in demand while maintaining high levels of Consumer Happiness.

That forward-looking call paid off massively for LikeFolio Investor subscribers this week when we alerted them it was time to cash out.

The result: a 174.73% return.

If you missed out on those profits, don’t worry.

We’re not resting on our laurels. We’re looking toward that next big play.

And we already found our next weight-loss winner.

Check out this next company entering the weight-loss drug arena that has us even more excited than WW…

Meet Our Next Big Weight Loss Winner

During its recent earnings call, along with impressive 83% year-over-year revenue growth and a 74% increase in subscribers, Hims & Hers (HIMS) announced its plan to launch prescription weight-loss treatments by the end of 2023.

You’ll recognize Hims & Hers as one of our favorite stocks to follow: Landon named it a top pick in our “3 Stocks That Could Triple This Year” special report.

Its impeccably-branded over-the-counter (OTC) products are available at CVS, Target, Walmart, Walgreens, Bed Bath and Beyond… through Amazon.com…

Heck, you can order them through Grubhub while you’re getting dinner delivered.

But Hims & Hers is also a telehealth provider – offering online consultations with its vast network of physicians for as little as $39, where patients can get prescriptions for notoriously “stigmatized” ailments like hair loss, erectile dysfunction, and acne.

Meaning that – unlike WW, which had to acquire a telehealth provider to gain access to prescribing – Hims & Hers’ entire business is built for this.

And with a “No stigma, just treatment” mantra, obesity care is a perfect fit for its brand.

It was always Hims & Hers intention to enter the space. But rather than jump in with both feet, Hims & Hers took a more thoughtful approach.

The company has been diligently researching over the last year, adding weight-loss experts to its medical advisory board, and building a way to affordably give patients access to costly GLP-1 treatments.

“Our weight management category will leverage all of the strengths of our platform. This means access to personalized treatments customized for customers’ clinical needs, powered by our enhanced pharmacy capabilities,” CEO Andrew Dudum confirmed during the most recent earnings call earlier this month.

The brand-name “magic pills” may not be immediately available with the year-end rollout, Dudum said, but Hims & Hers is laser-focused on supporting these medications as soon as possible.

In the meantime, LikeFolio data for HIMS looks strong: Purchase Intent is accelerating 90% higher year-over-year.

And when those “magic pills” inevitably drop, you’ll be glad you scooped up HIMS now at less than $7 a share.

Even before this week’s 174% WW win, LikeFolio Investor subscribers have had one heck of a summer, with profitable trades like:

- 24.02% on Foot Locker (FL)

- 38.38% on Bellring Brands (BRBR)

- 51.69% on Crocs (CROX)

- 73.86% on Carnival (CCL)

With more opportunities ramping up, Landon and I would love you to join us for the next round of profits.

So we’re sweetening the pot for folks who act today with instant access to “The Great $2 AI Moonshot.”

Until next time,

Andy Swan

Founder, LikeFolio