If you want to see where the 2024 election outcome odds really stand, just follow the money.

Keen observers may have noticed a trend with many of the stocks featured in Wednesday’s issue of Derby City Daily – Trump vs. Harris: 8 Stocks to Watch for the 2024 Presidential Election.

Conservative energy stocks like Exxon Mobil (XON), large banks like JPMorgan Chase (JPM), and defense services providers like Palantir Technologies (PLTR) – aka our top “Trump Stocks to Watch” – are all trending higher in 2024.

It seems the stock market is already pricing in a potential Trump victory, with key sectors experiencing upward momentum based on expectations of a return to his first-term policies.

We’re not mistaking the stock market for a crystal ball, of course.

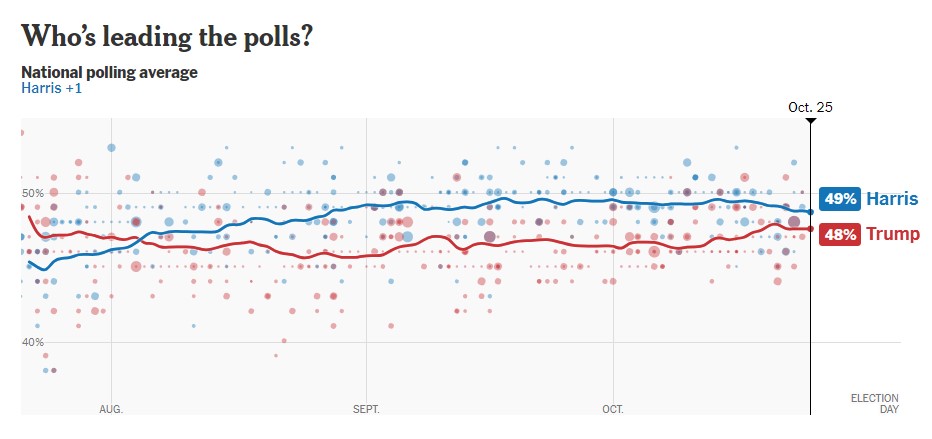

The latest polling from The New York Times shows America is very much split on the vote, putting Donald Trump (R) and Kamala Harris (D) in a dead heat with just 10 days to go until Election Day.

It’s still anyone’s game. And the clock is ticking.

With stocks expected to make outsized moves in the weeks and months ahead, we’re here to help you turn election-year volatility into profits.

You already have our Election-Year Watchlist in hand, highlighting the stocks that could benefit from a Trump or Harris victory.

Today, we’ll expand on our election game plan with three sectors that are ripe for growth, regardless of who ends up in office.

The macroeconomic tailwinds brewing in these sectors are undeniable. So, let’s get to it…

Sector No. 1: Nuclear Energy

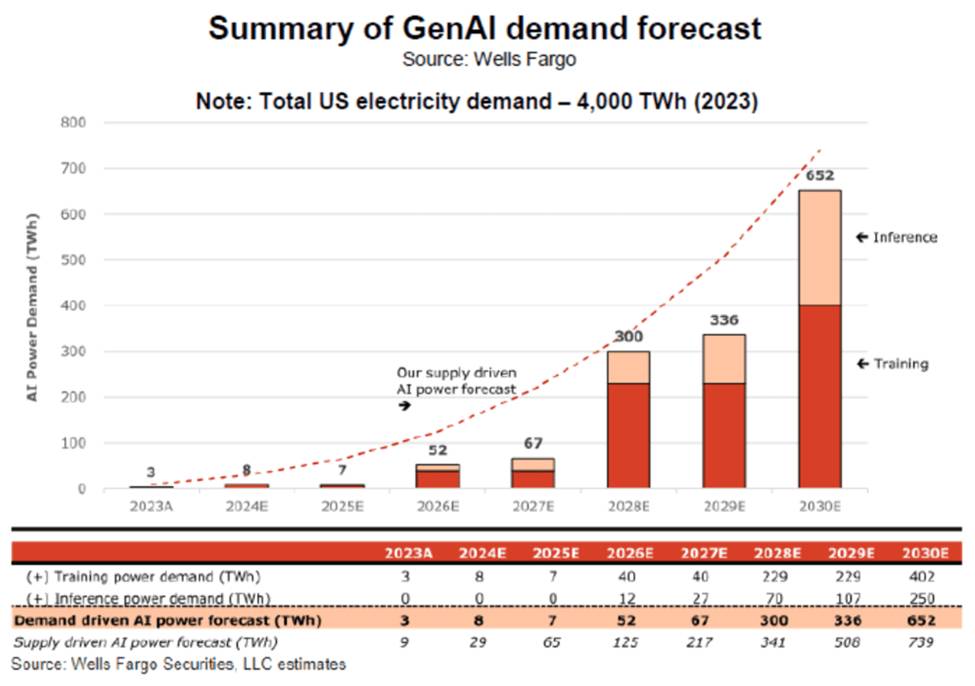

With rising energy demands fueled by artificial intelligence (AI) and data centers, nuclear power is becoming increasingly important.

These technologies already require vast amounts of energy. In fact, Wells Fargo estimates that AI’s power demand, driven by both training and inference, will grow dramatically from 3 TWh (terawatt-hours) in 2023 to 652 TWh by 2030. This translates to ~74,452 MW (megawatt).

To put this into context, 1 MW of power is enough to supply energy to about 200 American homes.

Companies that supply the infrastructure for increased electricity usage will become crucial to keeping up with this demand.

BWX Technologies (BWXT), for example, focuses on nuclear components and reactors – and could easily benefit from increased nuclear infrastructure spending.

A leading provider of carbon-free energy and nuclear power generation in the U.S., such as Constellation Energy (CEG), could push even higher, too.

Constellation operates one of the largest fleets of nuclear power plants, with more than 20 nuclear reactors, contributing nearly 10,000 megawatts of zero-carbon electricity.

The company is well-positioned to play a key role in the country’s transition to clean energy, especially as the push for carbon-neutral power sources accelerates.

Sector No. 2: Cryptocurrency

Another sector set to burst higher under either administration? Cryptocurrency.

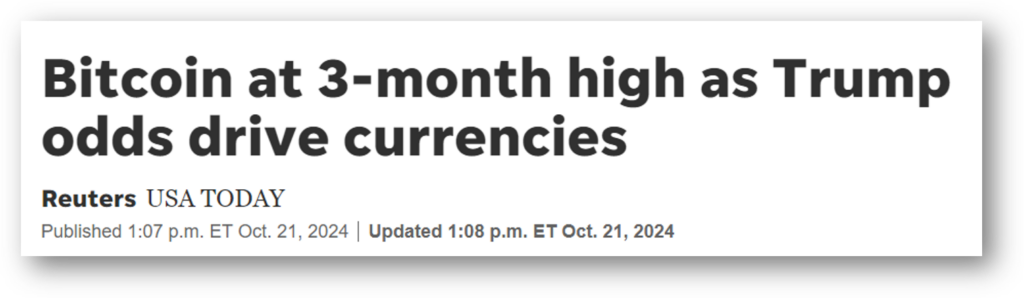

A Trump win could lead to more lax regulation in the cryptocurrency sector, benefiting companies like Coinbase Global (COIN) and Marathon Digital Holdings (MARA), both of which are heavily involved in Bitcoin (BTC) trading and mining.

This would likely encourage further investments in Bitcoin, as reduced regulatory scrutiny might promote greater adoption and market activity.

Bitcoin itself could experience massively increased demand as a store of value and as a speculative asset under a less regulated environment.

Under a Harris administration, stricter regulations might be imposed on cryptocurrency exchanges and mining operations. Companies focusing on ESG-friendly blockchain solutions, such as HIVE Digital Technologies (HIVE), could find a favorable niche as Harris places more emphasis on sustainability and responsible energy use.

Despite increased regulatory scrutiny under a potential Harris administration, many analysts believe Bitcoin and other cryptocurrencies are primed for continued growth.

The primary driver isn’t tied to political leadership but to broader macroeconomic factors that favor crypto’s rise.

The Federal Reserve is expected to cut interest rates in 2024 and 2025, injecting more liquidity into the market, which could drive demand for cryptocurrencies.

Bitcoin, often viewed as a hedge against inflation and financial instability, stands to gain further appeal if the U.S. faces a debt downgrade or fiscal tightening.

These factors strengthen Bitcoin’s position as a safeguard in uncertain times, making its upward trajectory likely, regardless of political developments.

Sector No. 3: Small-Cap Stocks

And last but certainly not least is one of our favorite sectors to scour for opportunities: Small-caps.

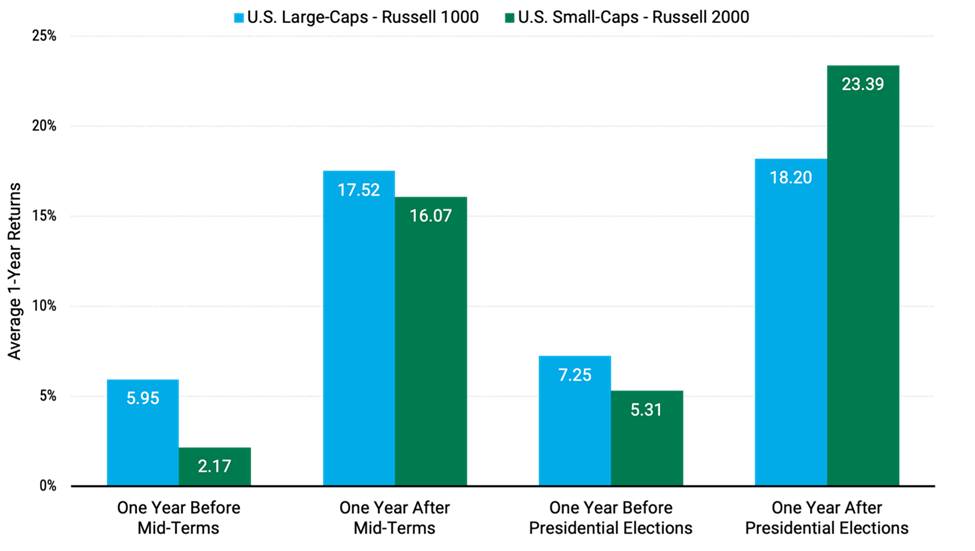

Historically, small-cap stocks have tended to outperform following presidential elections.

The Russell 2000 Index (RUT), which tracks small-cap companies, has consistently outpaced its large-cap counterpart, the Russell 1000 (RUI), in the year following an election in seven out of the last 10 cycles.

This pattern suggests that small-cap stocks benefit from the resolution of political uncertainty, which often drives increased investor confidence in these more volatile but potentially high-reward stocks.

Our MegaTrends service specializes in those small-cap plays, leveraging a powerful stock-picking device called the “Social Heat Score” to find names on the verge of a breakout.

Just this week, one of our small-cap MegaTrends trades rocketed 43% higher in a matter of six days – proving the massive profits these tiny stocks can deliver when you have a system for identifying the winners. (See for yourself how the Social Heat Score works here.)

The Bottom Line

Regardless of the 2024 election outcome, nuclear energy, cryptocurrency, and small-cap stocks stand out as sectors with strong growth potential in 2025.

We’ll be monitoring on the consumer front to identify names with extremely high levels of consumer enthusiasm that stand to benefit from these “mega” trend tailwinds heading into and after Election Day.

MegaTrends members, keep an eye on your inbox for the next big trade – we’re finalizing the details as we speak.

Until next time,

Andy Swan

Founder, LikeFolio

You’re Invited: Learn How to Turn Election Chaos into Outsized Profits

We don’t know who will win come Election Day – nobody can predict the future. However, we do know that the days and weeks following the vote will be a volatile time for America and the markets.

That means huge moves in stock prices are coming. And what you do now could determine whether that volatility is your best friend… or worst enemy.

The great news for you is that our colleagues developed a strategy to help you profit from the post-election chaos – and they’ve invited all our Derby City Daily readers to get the details during a special event this coming Tuesday, October 29.

➡️ You can access that invitation and reserve your seat here. ⬅️

To be clear, their strategy doesn’t rely on feelings, hunches, or forecasts about stocks that are set to soar. Rather, it’s a proven, quantitative system that tracks massive money flows into stocks from deep-pocketed Wall Street investors. The bigger the money flows into a stock, the more confidence they have that a stock is about to move higher.

And look, this thing works. Over the past three decades, it’s flagged more than 3,500 stocks that have gone on to soar 1,000% or higher. Impressive, right?

So, here’s your chance to learn more: On Tuesday, October 29, they’ll let you in on their post-election profit plan during an urgent briefing called The Day After Summit.

The event is free – just make sure you add your name to the list here.

Once you’re registered, be sure to tune in Tuesday at 7:00 p.m.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Trump vs. Harris: 8 Stocks to Watch for the 2024 Presidential Election

Whether Trump or Harris wins the White House, these are the stocks to know before Election Day…

It’s GM Versus Ford in the EV Race for Second Place

Traditional automakers are playing catchup to Tesla – and one is in prime position…