You have questions, we have answers: Submit them here by April 11. 📧

Remember when the Lord of the Rings trilogy first came out in the early 2000s, and all of a sudden, it seemed like everyone and their mother was booking a trip to New Zealand?

Even 20 years later, I hear about folks making the 17-hour flight to have their own real-life Hobbiton adventure.

Following those films, New Zealand’s tourism office reported a 50% surge in arrivals. And even though only 1% of visitors said LOTR was their sole reason for traveling (6% listed it as one of the reasons), that 1% translated to $27 million per year being added to New Zealand’s economy.

Now, a similar film-inspired tourism phenomenon is taking hold in 2023 under a flashy new guise: “set-jetting.”

Whether they’re flocking to the Sicily hotel that served as the backdrop for Netflix’s “White Lotus,” heading to Alberta to (literally) follow in the footsteps of the characters on HBO’s “The Last of Us,” or going all-in on an $18,000 luxury James Bond travel experience…

Folks are looking to immerse themselves in the scenery from their favorite streaming shows. And they’re willing to pay big bucks to do it.

According to Expedia’s 2023 Travel Report, 39% of global travelers have booked trips to visit a destination they saw in a TV show or movie.

And our social media machine shows consumers talking about taking trips to set locations at an explosive rate, currently registering 433% above last quarter’s levels:

To be clear: The sample size is still relatively low for this just-coined buzzword, so we’ll be keeping a close eye on the data from here.

But the fact is that when one of the macro trends we track in our database starts gaining by triple-digits like “set-jetting” is, alarm bells go off in our office signaling there could be an opportunity here that warrants a closer look.

And “set-jetting” isn’t the only triple-digit trend hitting our radar this week…

Triple-Digit Trend: Psychedelics 🍄

LikeFolio coverage of psychedelics as an alternative therapy for difficult-to-treat mental health conditions is through the roof right now.

Consumer mentions of microdosing – taking small enough amounts of a psychedelic substance to experience the therapeutic effects without losing your mind – are trending 654% higher this year.

Recreational microdosing is technically illegal under U.S. federal law but that clearly hasn’t stopped folks. Microdosers cite enhanced creativity, boosted mood, increased productivity, and reduced anxiety, among other benefits.

Buzz around psilocybin – the psychoactive (and therefore therapeutic) substance found in “magic mushrooms” – is booming right alongside it, up 424%.

Despite this surge in interest, the psychedelics trend is still in the very early stages of development. Colorado only became the second state (behind Oregon) to legalize access to psilocybin during the last election cycle.

But as an investor, it’s something to watch.

This treatment could serve as a solution for those struggling with their mental health, which has become increasingly common post-pandemic.

According to the National Institute of Mental Health, as many as one in five American adults are living with a mental health disorder. And 1.5 million folks in Colorado alone are in need of treatment.

Nearly a dozen more states are pushing to join Colorado and Oregon this year in legalizing psychedelics in some form – which would serve as one heck of a catalyst for the few publicly-traded companies operating in the space.

We’ll be covering the opportunities in this space in more detail soon, so watch for more psychedelics coverage to hit your inbox over the next few weeks.

Triple-Digit Trend: Decentralized Finance ₿

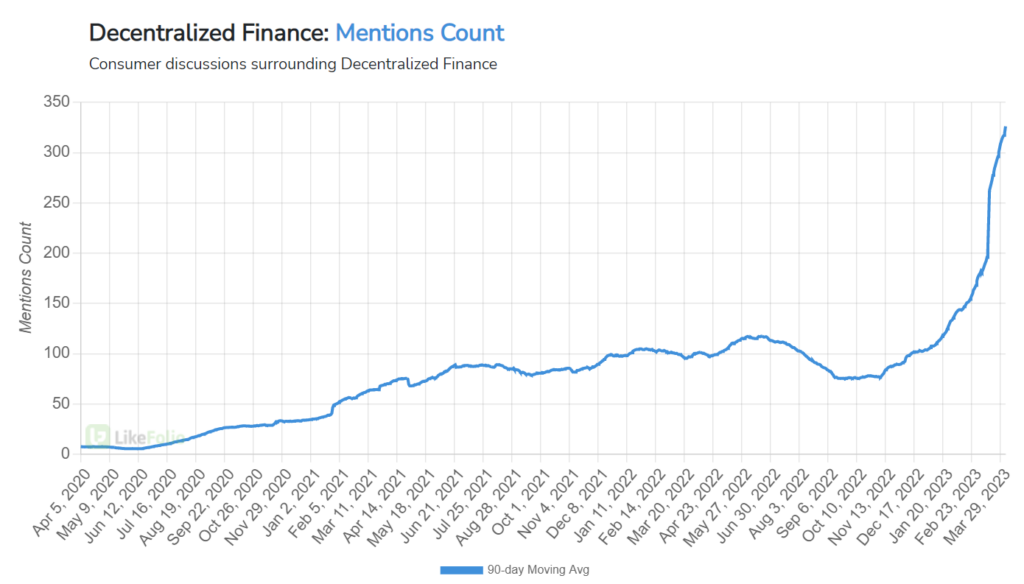

Social media conversations around decentralized finance (DeFi) are surging in 2023:

Compared to the year prior, our data shows this trend is up 224%… And 210% just from last quarter.

This trend gained serious steam as the banking crisis unfolded last month, just as chatter around bank withdrawals started swelling. And that’s no coincidence.

When centralized banking fails, it only makes sense to high-tail it toward a decentralized version – where the transactions are entirely peer-to-peer, removing the need for the very “middle man” that tanked those traditional banking counterparts.

Crypto bellwether Bitcoin (BTC) is up over 70% this year as a result and its second in command, Ethereum (ETH), isn’t far behind at 60%.

Meanwhile, we’re watching consumer mentions of trading cryptocurrency gain traction from last quarter, currently registering 18% higher QoQ.

And that’s great news for one of our favorite stocks.

The Top Consumer Trends to Watch This Earnings Season

Each of the consumer trends we covered today has us excited, and over the coming weeks, you can expect deeper dives into each of the opportunities.

But even more pressing are the hundreds of trading opportunities that are about to unfold over the next 10 weeks of earnings season.

That’s why we recently shared our consumer trends “cheat sheet” for the current earnings season, which gives you a breakdown of where consumers are voting with their wallets right now – and where they’re not.

It’s a great starting point to prepare you for the earnings season profit party.

But for the full earnings season experience, you need to watch this special presentation Andy and Landon put together.

That’s where they detail their strategy for getting in, getting out, and getting paid over… and over… and over again this earnings season…

And then do it all over again when the next earnings season inevitably rolls around, like clockwork, four times per year.

All the best,

Megan Brantley

VP of Research